AI: Tracking Consumer AI Applications

...Eleven months post ‘ChatGPT Moment’

We’re approaching the annual anniversary of OpenAI’s ‘ChatGPT Moment’ last November that kicked off the multi-hundred billion dollar AI Gold Rush documented on these pages. The Holy Grail of course is what end-users, both consumers and businesses ultimately do with all this LLM and Generative AI infrastructure being laid on lavishly for them.

And as I outlined just a few days ago, even the top VCs funding these efforts disagree on the timing differences between the investments and the ultimate returns for users, and of course investors. Both private and public eventually. And as I’ve said many times before, we’re in the beginning of the beginning phase, with much of the AI technologies being invented and reinvented at a breakneck pace.

Still, it’s useful to take measure of where we are on the holy grail of all these efforts, the actual Applications that are available for users at this point in time. Andreessen Horowitz (aka a16z) published a deeper look at the top 50 Consumer AI apps being used to date, and provide some useful takeaways at this early juncture. In their report titled “How are consumers using Generative AI?”, they highlight a list of 50 Gen AI Web Products, by monthly visits. The data is as of the middle of this year.

No surprise, three of the top apps are around accessing the big Foundation LLM AI models by various companies, led of course by OpenAI’s ChatGPT, which runs on the company’s GPT 4 and 3/3.5 models. Followed by Character.ai, a popular AI unicorn that provides ‘smart AI’ chatbots for millions of users. They’re likely to see increased competition in an early market from Meta’s recently announced celebrity powered ‘smart’ AI chatbots, not to mention offerings by Snap and others. And of course Meta is also rolling out their own LLM AI product dubbed Meta AI, based on its Llama 2 open source LLM AI technologies, also available to other companies.

Google’s Bard brings up number three, and it likely doesn’t include the extensive rollout by the company of AI assisted Google Search across its billions of daily users. Those products are likely to see an upgrade soon with Google’s next gen Foundation LLM AI technology Gemini, which will go even more head to head against OpenAI/Microsoft’s GPT-4 shortly.

The a16z report has six takeaways that are useful to go through, but I’d highlight the following items:

“The top 50 list is an almost even 3-way split between companies that (1) trained their own proprietary model, (2) fine-tuned an existing model, and (3) built a consumer UI on top of an existing model (e.g., “GPT wrappers”). However, it’s worth noting that of the top 10 products, half are built on their own model, while 4 are fine tunes—only one falls in the “wrapper” category.”

“Excluding ChatGPT (which skews the data given OpenAI’s $11.3 billion raised), companies with a proprietary model have raised an average of $98 million. This compares to $20 million for companies that have fine-tuned an open-source model, and $9 million for “wrapper” companies.”

As expected, ChatGPT has a ‘massive lead’ for now, representing 60% of monthly traffic to the entire top 50 list (1.6 billion monthly visits and 200 million monthly users as of June 2023). Makes ChatGPT 24 of the top 25 most visited websites globally. Not bad after 11 months.

And ChatGPT is just getting ready to go ‘multimodal’, going beyond text into images, video, voice, code, and beyond from a single interface. The race is on amongst OpenAI/Microsoft (with its CoPilot and Bing products), Google, Meta, Amazon/Anthropic and others to bring multimodality to the masses as soon as they can get enough GPU hardware capacity online from Nvidia and others.

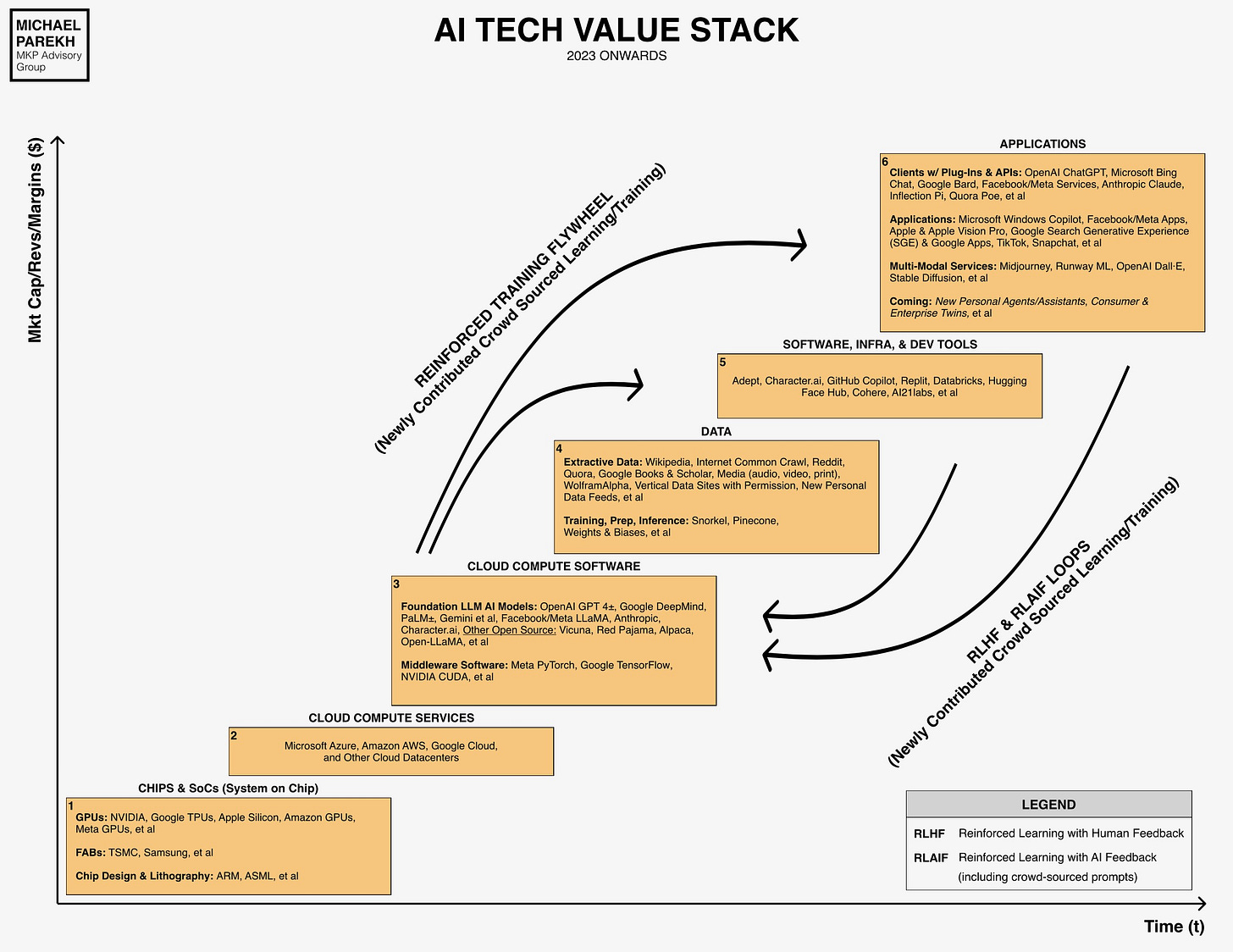

Taking a step back, as I highlighted In the AI Tech Wave chart a few months ago, the long-term holy grail for the higher relative growth, margin and eventual market caps is in the box furthest up and to the right. It’s Box no. 6.

And a close-up of the Applications Box no. 6 shows the current landscape as we know it today, complete with ‘Smart Agents’, ‘Digital Twins’, Voice translators and so much more.

Not surprisingly, the a16z report shows that the top consumer AI are on track as expected with the Big Tech represented first given the relatively enormous Capex (capital expenditures) required to launch and ramp these services, especially given the AI ‘gold rush’ and GPU infrastructure shortages.

This will be the case at least Ito 2025. But over that time and more we’re going to see a lot more innovations to come in Gen AI consumer apps and services. Not to mention business apps and services to be discussed in a separate post. It’s also an area with substantial investment and building. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)