AI: Building Value over Time

... via Tech Stacks, Staircases, & Loops

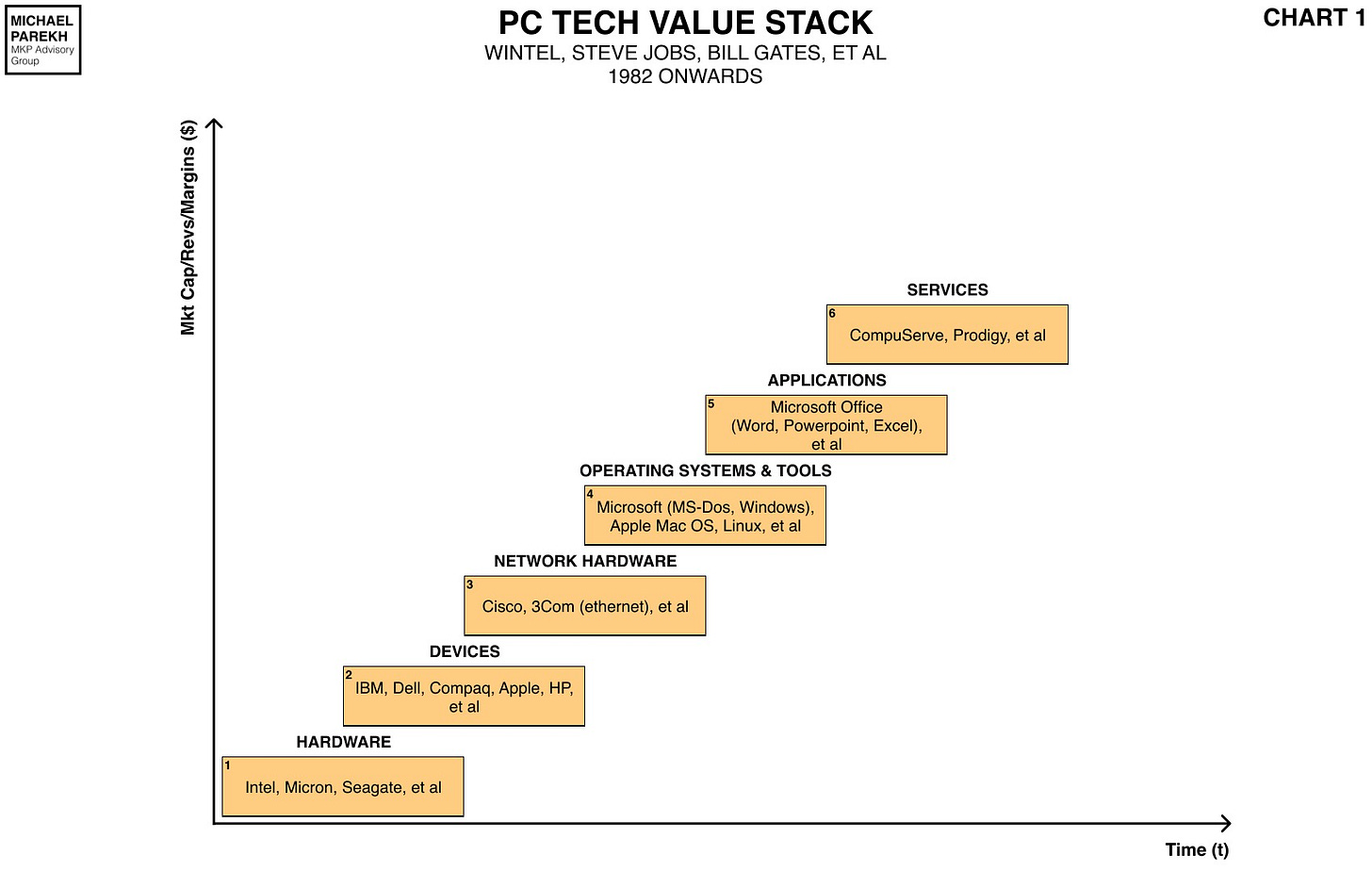

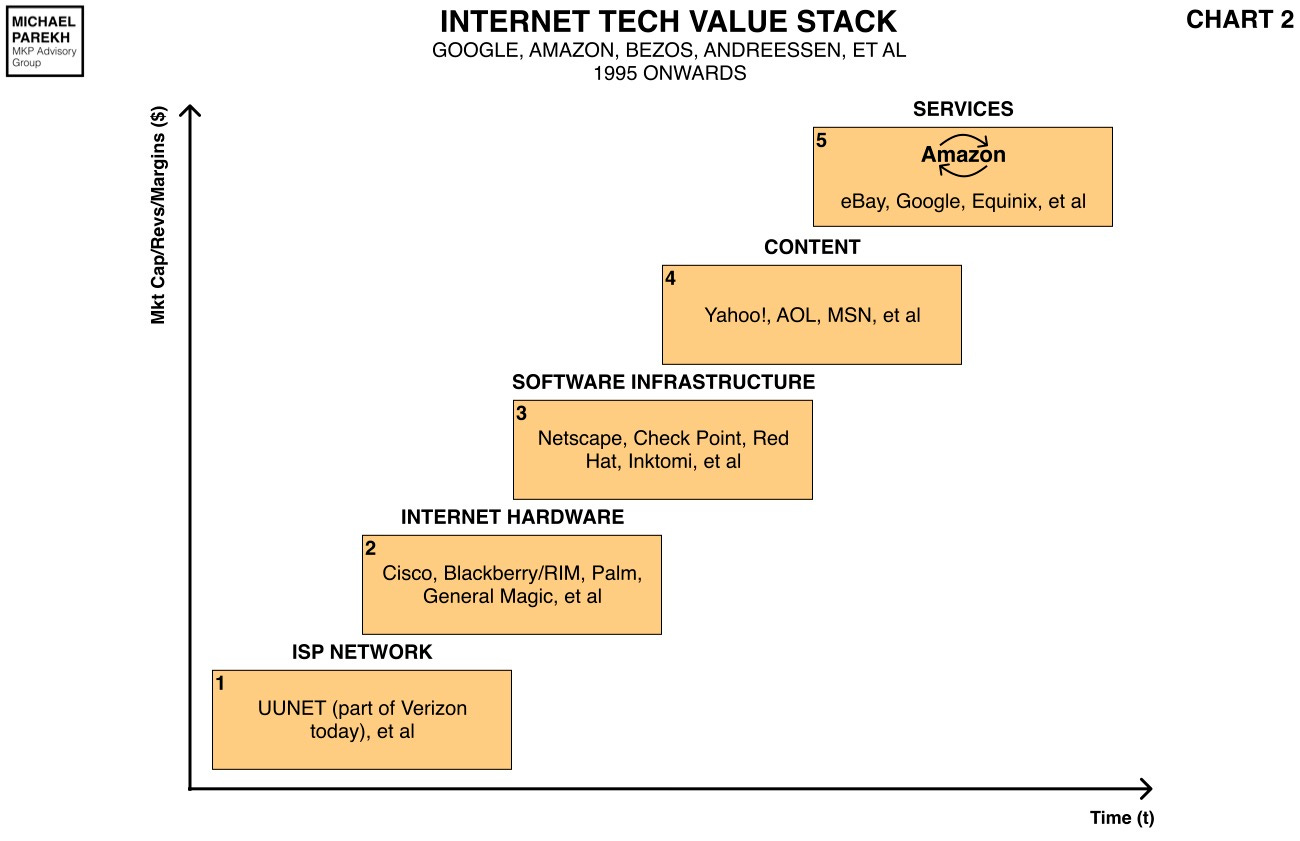

Over the last thirty plus years, each major technology wave, like the PC and then the Internet, evolved as a series of technologies in a tech value stack that came to define the full ecosystem with huge collective value over time. They then went on to create the winning companies in each stack worth billions, and some now in the trillions.

This piece aims to sharpen the key points that will help us understand the current AI wave. I’m leveraging a lifetime of professional tech investing analysis here, starting in the 1980s at Goldman Sachs, when the Firm took Microsoft public in 1986. Let’s dig in.

Each wave of Tech Value stacks typically started with hardware and software standards (open and closed), that defined the underlying hardware and software Infrastructure, provided by a growing set of specialized companies providing applications and services to businesses and consumers in the millions and billions.

These were typically the first three layers of the tech value stack. They were then followed by sets of companies over time that then provided applications, content and services to consumers and businesses on top of the stacks.

The accompanying charts describe this evolution for each wave, with examples of companies that eventually became the leading examples of each layer in the tech value stack. Typically the financial values, measured in margins, revenues, profits, and market cap growth, were relatively higher, as one went up the stack. First up, the PC Tech Value stack.

“Wintel”, represented by Microsoft and Intel, along with many others, were examples of the biggest winners in the PC wave.

Next up, in the equivalent Internet Tech Value stack below, Amazon, Google and others, were the winners in the Internet wave over a quarter of a century.

They were all powered by Moore’s Law and others (Metcalfe’s Law etc.), to provide the exponential, compounding growth drivers, at various points in the stacks. (Disclosure: I ran Goldman Sachs’ Internet Research team starting in 1994, and developed these frameworks to help understand the PC and Internet waves).

I have extended this analytical approach to AI using this Framework, and the chart below shows how that looks in these earliest days of AI Commercialization. Will be changing this chart a lot, and building around it.

The resulting “Staircase” AI Tech Value stack, is developing along similar lines today, starting with hardware and software infrastructure like the underlying Chip and chip making companies like TSMC, ASML and of course Nvidia of late delivering the critical GPUs (Graphical Processing Units). (Box 1 in the chart).

The data centers that host the ‘Compute’ at scale (Box 2), are followed by the companies that provide the foundational large language models like ‘AI Native’ companies like OpenAI (Box 3). Those define the boxes leading to the middle of the “Staircase” stack.

These are then followed by additional layers in the stack that provide the massive amounts of Data and the constant processing and reprocessing of that data (Box 4). Followed then by software infrastructure and middleware (Box 5), to allow the building of applications and services at the top of the stack (Box 6).

In the case of the AI Tech Stack, unlike the earlier PC and Internet stacks, it’s uniquely turning out that the usage of the underlying large language models and data is providing critical loops of data that reinforce the learning in the underlying models. We discussed these at length in this post yesterday. That fundamentally changes the Tech value stack in the AI wave vs the earlier PC and Internet Waves.

These reinforcement feedback loops, driven by users and businesses USING the underlying Models, are shown in detail in the chart below, along with examples of currently leading AI companies in each of the AI Tech Value stack boxes.

These usage loops can be both reinforcing human and machine learning and training mechanisms that are then turning out to create the “flywheel loops” that create new Value from Box 3 to Boxes 4,5 and 6, and then back. Again, this is a key differentiator vs earlier tech waves, and I will go through how and why in detail in future posts.

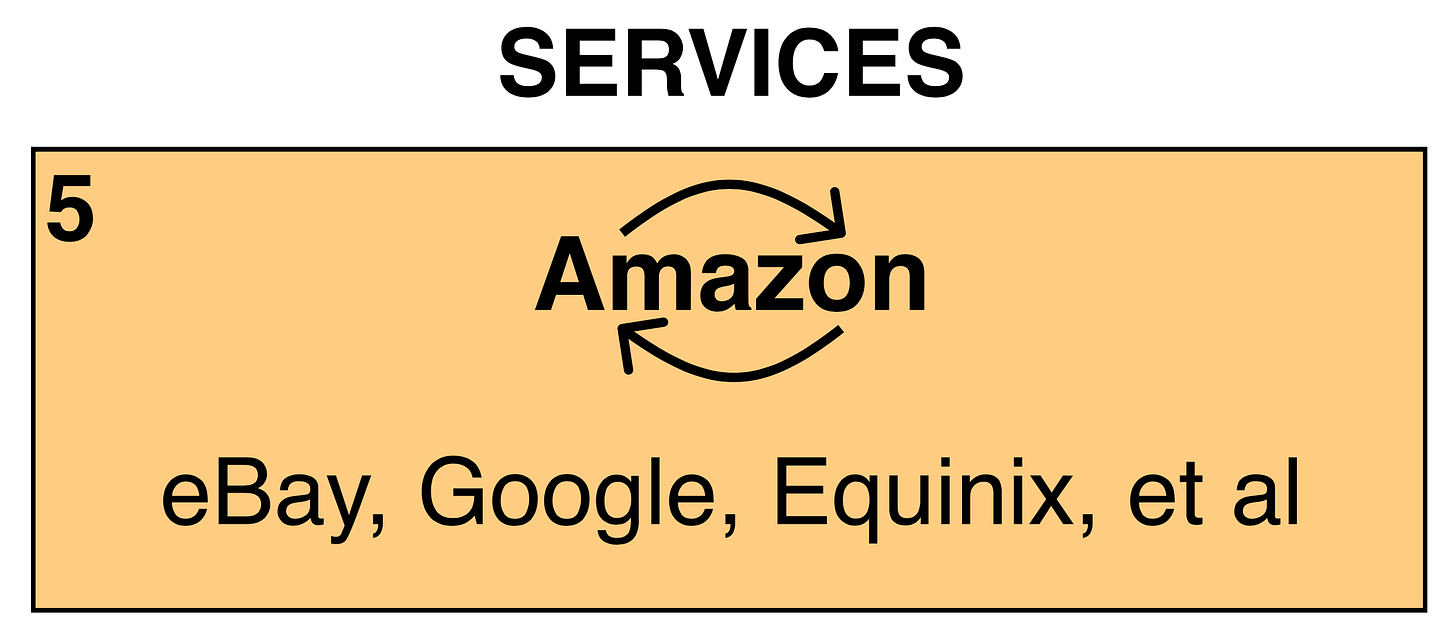

As demonstrated earlier by Amazon in the Internet cycle), these massive new feedback loops are providing the ability to dramatically increase the reliability and results of the underlying LLM AI models.

OpenAI’s ChatGPT, introduced just six months ago, is the iconic example of this “flywheel loop”. There will be many, many more creating similar value across the “Staircase” AI Tech Value Stack. Will have a lot more to say about them in coming posts.

Amazon showed the way with their Flywheel loops starting in 2001 in the Internet wave as again the chart below shows. Creating massive value for investors over the last two plus decades. And this was years after the company had already gone public in 1997.

Note how their logo turns into the Flywheel loop if one tries in the Internet Tech Value Stack in Box 5 below.

Want to see that up close?

We are just at the beginning stages of starting to build the value in these AI data models, and across the entire AI Tech Value stack layers. Here is that chart again with the User-driven Feedback Loops, and some leading company names as of today, in each of the six boxes. Lots here. Take a minute. We will be coming back to this chart again in future posts.

Just like the PC and Internet waves before, the AI value creation in each of the boxes in the chart above, will play out over the next decade and more. And likely create a lot of value for investors private and public again. Much, much, more to come. Stay tuned.

(NOTE: The discussion in this and other posts on this site is for informational purposes only. No Investment advice is intended).