AI: How two top VCs can disagree and both be right

...Sequoia and a16z take positions

We have a public disagreement between the two top gunfighters at high noon. And potentially need to agree to disagree. Let me explain.

There’s growing consensus that this coming AI Tech wave is potentially bigger than tech waves past, and that a ‘gold rush’ for AI infrastructure makes sense to build ahead of the coming crushing demand for all things AI. Especially since this AI stuff uses more ‘Compute’ in terms of hardware and software, and a commensurate amount energy to make it all go. As a result, both private and public investors are committing tens of billions and more globally to get into a better position than their peers.

Sequoia, one of the top private investors a post discussing current AI infrastructure spend on LLM AI compute vs the eventual enterprise and consumer markets. What was unusual is a relatively immediate public response by another top private VC investor A16z, who had a counter-view to that via Twitter/X, on that compute cost and market assessment, with a decidedly more bullish take.

In my view, both are pointing to key trends, topics, and data that we all need to be paying attention to, and in many ways both are right. The AI Tech Wave I’ve discussed is just getting started, and there are marked differences vs the prior PC and Internet cycles that created trillions in value, and had a lot of losers and winners.

The difference lies in my view they're being right in different cycles potentially concurrently, one financial and the other secular. It’s a topic I’ve addressed recently. Let’s unpack it all a bit.

First, Sequoia post “AI’s $200 billion Question”, by David Cahn, makes the headline point that:

“GPU capacity is getting overbuilt. Long-term this is good. Short-term, things could get messy.”

From my perspective, he’s highlighting that long-term, this is a good thing in terms of the secular tech cycle, but things could get messy potentially, in terms of the financial cycle, for some or many players.

A16z (or Andreessen Horowitz to spell out the firm’s full name), has a response by partner Guido Appenzeller, summarized on Twitter/X as follows:

“In a recent post Sequoia's @DavidCahn6 argues AI infra is overbuilt: - NVIDIA GPU revenue is $50b/y - This requires $200b in "AI revenue" - There is only $75b in "AI revenue" Thus there is a $125b hole I strongly disagree. AI Infra will be huge. Grab popcorn and read on.”

He goes on to make his counter-case in seven crisp bullets.

Both of their missives are worth full reads.

Sequoia’s David Cahn ends his post with some key questions:

“The AI infrastructure build out is happening. Infrastructure is not the problem anymore. Many foundation models are being developed—this is not the problem anymore, either. And the tooling in AI is pretty good today. So the $200B question is: What are you going to use all this infrastructure to do? How is it going to change people’s lives?”

And A16z's Appenzeller has one key reply in his point 5 of 7, complete with illustration:

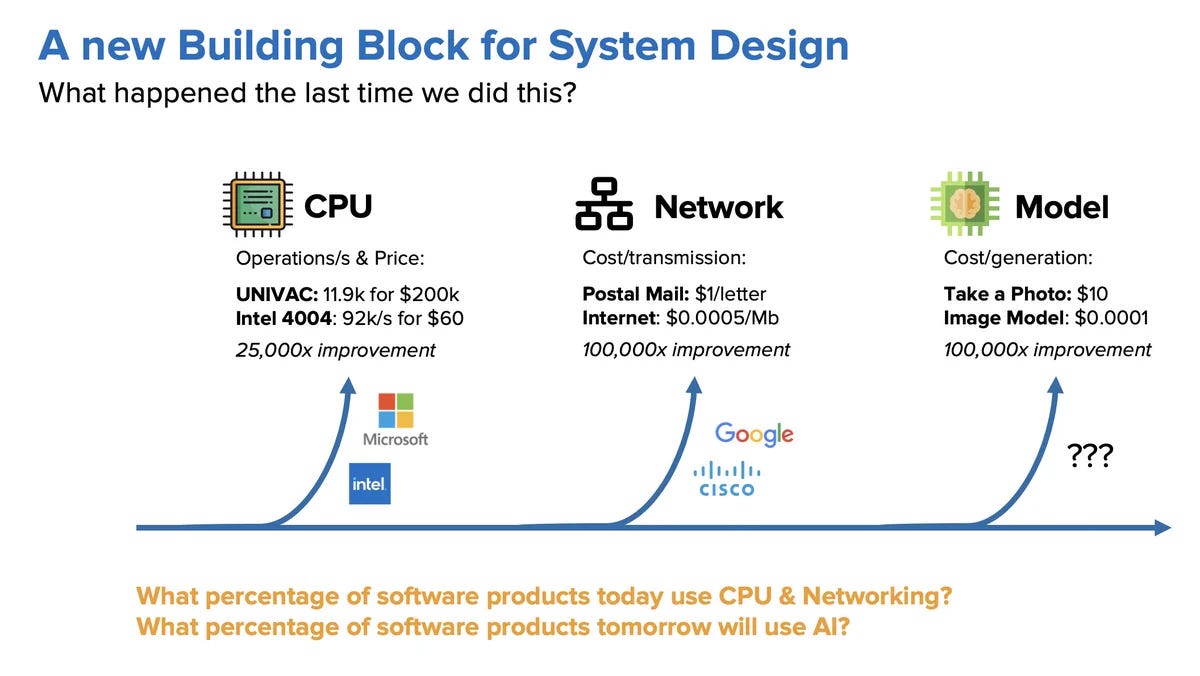

“But most importantly, it misses the magnitude of the AI revolution. AI Models are an infra component like CPUs, databases & networks. - Today almost all software uses CPU/DB/Network - In the future the same will be true for models. So all software will be powered by AI infra.”

“7/7: In summary, there is no hole. AI will be a ubiquitous component in any product that contains software. A $50b spend on GPUs infra can easily be amortized over a $5T worldwide IT spend. And I am super excited to invest in AI infra and the applications that are powered by it!”

As I’ve described before, ironically using prior work by a16z’s Marc Andreessen, AI software is beginning to be used to redo almost 75 years of traditional software. And this will take at least a decade or two to truly take shape, even with Developers getting ‘augmented’ by AI. This technology deep down is hard to understand even for its inventors, and much of the really powerful LLM AI software and the hardware to run them has barely been built much less deployed.

So yes, we will need hundreds of billions in investment, and it’s going to be financially messy in terms of who comes out on top vs whom. That’s going to be the job of the entrepreneurs and investors to sort out, hopefully with minimal speed bumps by regulators. We need to accelerate on towards figuring it out.

Both authors above have sound points on the Cambrian explosion that is driving this major technology innovation cycle. It needs to be paid attention to regardless of one’s industry and life priorities. This thing is going to nudge and perhaps dent it all, and we’re going to have to reprogram ourselves with new habits to cope with it all. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)