We’ve covered in detail the intense efforts by big tech companies placing big, bold bets in this new AI Tech Wave. But it’s important to also note their increasingly big, appetite for investments in budding AI companies as well.

Just the last few days saw some notable corporate strategic investments in recently minted ‘unicorn’ AI startups, at increasingly higher valuations from a financial investor perspective.

“More than 1 in 4 dollars invested in American startups this year has gone to an artificial intelligence-related company, Crunchbase data shows.”

The point was augmented by Stephanie Palazzola of The Information:

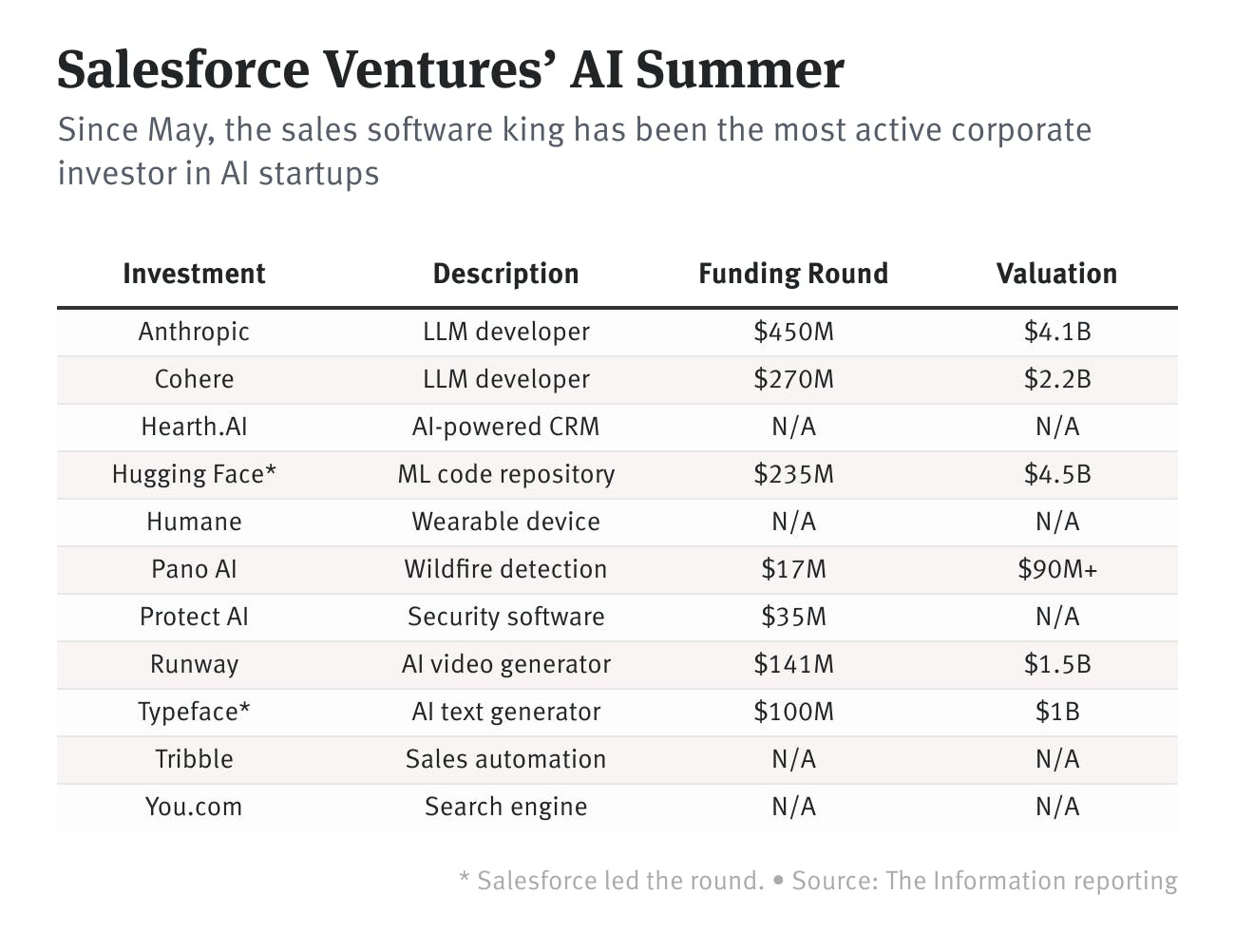

“And not just the tech behemoths. It’s no secret that Microsoft, Google, Nvidia and Oracle have collectively invested billions of dollars into AI startups that turn around and spend the capital on the investors’ cloud services or chips. But it turns out that enterprise software firm Salesforce has been the most active corporate investor of all in terms of the number of deals, if not in dollar volume: Since May, the company has backed 11 AI startups, including two of the best known large-language model developers, Anthropic and Cohere.”

Salesforce, the one big tech company that has been as much in the business of tech acquisitions over its history as enterprise software, has been busy in AI investments, as the above chart illustrates. The trend has meant financial investors have been adding supply this summer, as this other piece by The Information notes.

As I’ve pointed out in an earlier post, in many cases, these corporate strategics’ investments also foster adjacent business deals that ‘boomerang’ to buttress an existing business of the investing company.

Exhibit A in this context of course is the seminal Microsoft $13 plus billion investment in OpenAI. Much of that has then been invested back by OpenAI in Microsoft Azure Cloud data center ‘Compute’ services in the billions. Synergy indeed.

And it’s been a ‘club sport’, as one can see the range of corporate strategics that invested in the just announced $235 million funding round for the ‘Github of AI’ hub platform company Hugging Face, at a $4.5 billion valuation (BOLDING MINE):

“AI startup Hugging Face has raised $235 million in a Series D funding round, as first reported by The Information, then seemingly verified by Salesforce CEO Marc Benioff on X (formerly known as Twitter).”

“The tranche, which had participation from Google, Amazon, Nvidia, Intel, AMD, Qualcomm, IBM, Salesforce and Sound Ventures, values Hugging Face at $4.5 billion. That’s double the startup’s valuation from May 2022 and reportedly more than 100 times Hugging Face’s annualized revenue, reflecting the enormous appetite for AI and platforms to support its development.”

Not many big tech companies were left out in that round. Most of them of course are active across the spectrum of the tech stack building blocks in the AI Tech Wave chart I’ve discussed in earlier pieces. Especially the ones in on the ‘picks and shovels’ phase of the current AI ‘gold rush’.

Corporate Strategic investment alongside traditional venture investing by financial investors has been a part of the landscape for decades. It’s just that this segment has grown quite a bit across the various big tech waves, from the PC to the Internet, to now AI. As this piece on VC investment trends explains:

“Over the last decade, corporate venture capital has exploded in both its size and significance. According to Bain, corporate venture capital (CVC) has doubled from 11% of all venture capital investing in 2010 to over 20% in 2021 with a compound annual growth rate of 31% during the same period:

The numbers are startling if one is not regularly tracking these things:

“Corporate venture capital deal value has increased by more than tenfold over the last decade. By the third quarter of 2021, corporate venture capital investments in startups amounted to over $105 billion. Moreover, these investments are quite broad-based spanning many different industries but with the largest segments consistently being health and information technology which corresponds to their attendant relevance to the economy as a whole.“

The piece is worth reading in its entirety as it goes into some detail about the imperatives of corporate venture investors vs financial venture investors. It’s useful to understand the differing motivations and incentives for the two groups of investors.

And see why it’s generally a synergistic relationship for the most part over time. Indeed, corporate buyers are often the key outlet for financial venture investors to exit investments at times when the public IPO markets maybe in a cynical lull of late, which may be about to turn.

Of course, another headwind for corporate investors if they end up moving into acquisition mode, are regulatory authorities. Given that most acquisitions have to go through antitrust and other regulatory approval processes. This area has also been busy for regulators, as the WSJ noted recently:

“The FTC and the Justice Department challenged 10 mergers in court last year, up from six in 2021 and eight in 2020, according to data compiled by law firm Dechert. This year, the agencies have sued to block or undo four deals.”

The most recent tussle of course has been the near $70 plus billion acquisition of video game giant Activision by Microsoft, which saw a setback for the FTC trying to block the transaction:

“Federal Trade Commission Chair Lina Khan is taking on the world’s biggest technology companies—and losing.”

“Khan failed Tuesday in her latest effort to block a big-tech deal when a federal judge denied her agency’s bid to block Microsoft. The FTC, which is appealing, suffered a similar setback earlier this year when it tried to thwart Meta’s purchase of a virtual-reality gaming company. “

The regulatory environment has not slowed big tech’s appetite for big AI investments. And we’re in a positive momentum phase, however long it lasts. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)