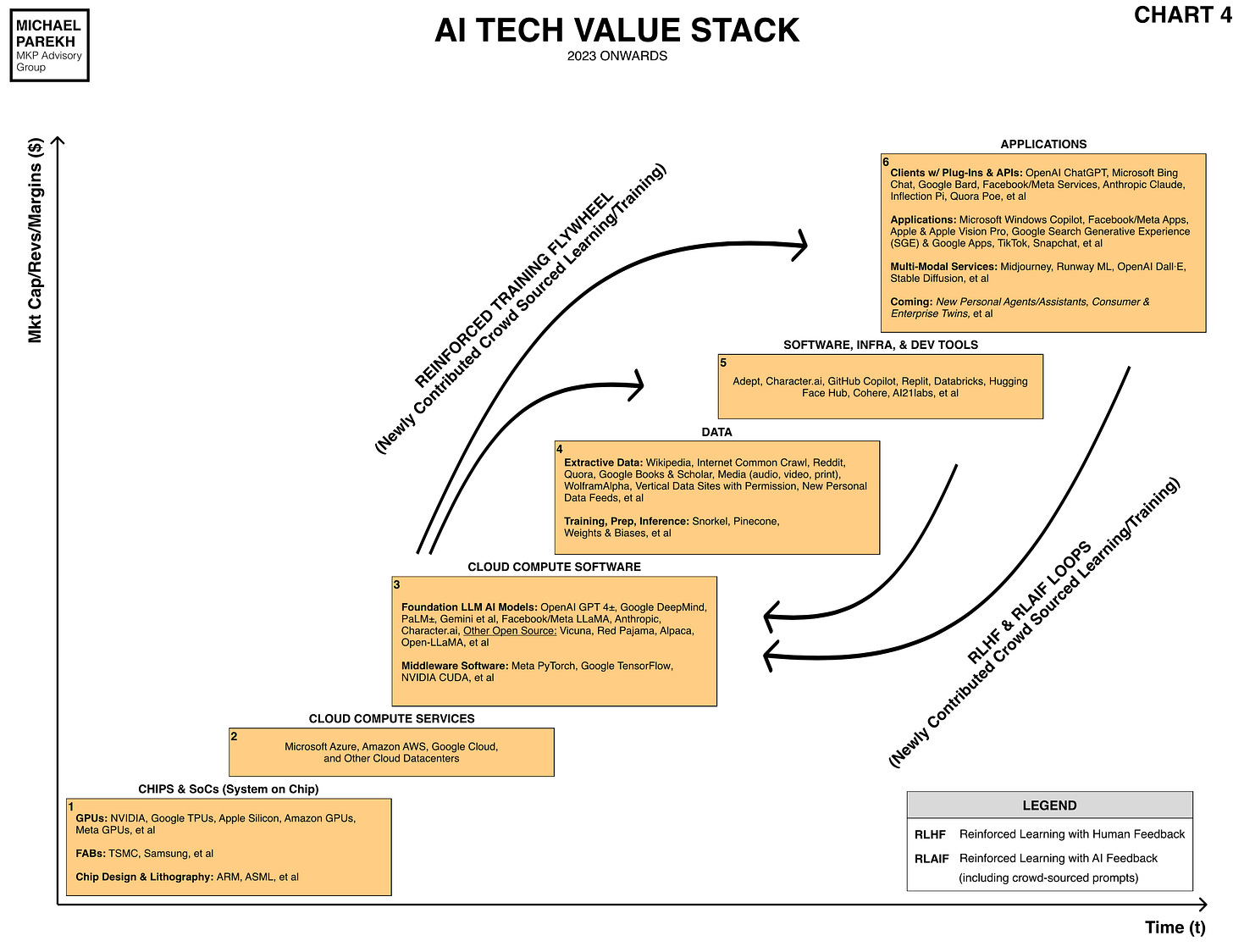

The quarters are done for all five Big Tech companies, with Apple and Amazon being the last to report their results yesterday. I’d already discussed Meta, Microsoft and Google results earlier, and the AI driven investor tailwinds that are carrying all of them to strong stock performance year to date, with a cumulative market cap approaching $10 trillion.

That despite the multi-billion quarterly capital expenditure commitments by them all ahead of incremental revenues from AI and other products and services. Let’s focus a bit on Apple and Amazon highlights this quarter (via the Information) (My comments in Bold caps below):

“Even though Apple's revenue fell, its profit edged higher, thanks to high margins on its services product. Amazon's efforts to clamp down on costs are paying off.”

“Apple’s revenues fell 1%, but growth in its high-margin internet services business lifted the company’s profit 2%.”

“In the fiscal third quarter ended July 1, Apple said its revenue fell to $81.8 billion from $82.96 billion in the same period a year ago as sales of its largest hardware products—iPhones, iPads and Macs—slowed across the board. (AHEAD OF NEW PRODUCT UPGRADES IN SEPTEMBER). The only exception was the product category that includes its Apple Watch and AirPod products, which grew 2% to $8.28 billion.”

“Meanwhile, Apple said its net income rose 2% to $19.88 billion, or $1.26 a share, from $19.44 billion, or $1.20 a share, a year earlier. That was due in large part to record revenue in Apple’s services unit, a business that includes its App Store and various subscription internet services. Revenue from services rose 8% to $21.21 billion.”

Here is the bit that needs attention and highlighting:

“While services represent only about a quarter of Apple’s total revenue, Apple’s gross profit margin from the business was about 71% in the quarter compared to roughly 35% for its hardware products.”

Services revenues have been a multi-year ‘holy grail’ focus for Apple, and the efforts are bearing fruit. This is a meaningful, higher margin revenue stream for Apple. Over the coming years, this likely is an area of further opportunity, especially with their new AI driven computing platform, the Vision Pro next year, which I’ve discussed here and here. Am very optimistic about the uniquely Apple Vision Pro platform over a three plus year perspective.

We are also going into the annual hardware upgrade period for Apple in September, with new iPhone, iPad and other product updates from Apple, so there is much to look forward to next quarter and beyond, on both the hardware and software fronts.

Turning to Amazon’s quarter, they had a good results indeed, with the stock up nicely post the results:

“Amazon Operating Income Jumps.

Amazon posted operating income of $7.7 billion in the second quarter, up from $3.3 billion the same period a year earlier and its highest in two years, as it managed to keep costs under control in its retail and subscriptions businesses in North America.”

“Amazon Web Services had $22.1 billion in revenue during the April through June quarter, a 12% increase and its slowest ever year-on-year growth since at least 2014. Revenue from advertising was up 22% at $10.7 billion. The company reported $134.4 billion in overall revenue during the second quarter, a 11% year-over-year increase.”

Amazon projected that revenue would rise between 9% and 13% in the third quarter versus the same period a year earlier, and that operating income would come in between $5.5 billion and $8.5 billion. Amazon shares jumped 7.5% in after-hours trading.”

As I highlighted just yesterday, I view Amazon as the relatively under-appreciated big tech company as far as the AI Tech wave opportunity is concerned, and this quarter, especially in the AWS results, shows their methodical progress continues.

I also view Google as having the opportunity to proactively address the ‘ChatGPT’ challenge from OpenAI and Microsoft on the LLM AI front, as outlined here. My second half 2023, and three year AI outlook are also available for further background reading. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here).

I'm excited to see how big tech will shape the next five quarters with their advancements. Looking forward to more insightful articles from you. Cheers!