AI: Big Tech tailwinds

..Meta, Microsoft & Google market optimism

It’s quarterly earnings time, and three of the top US AI focused tech mega caps Meta, Microsoft, and Google, worth almost $5 trillion in market cap, all reported their results this week. Amazon and Apple don't report until August 3 next week.

Spoiler alert: they’re all doing well with their core businesses, and AI remains a strong positive driver from an investor perspective, and thus a tailwind for all. Their stocks are up this year, and Meta and Google up 5% plus after their reports. The AI driven tech wave remains well in place.

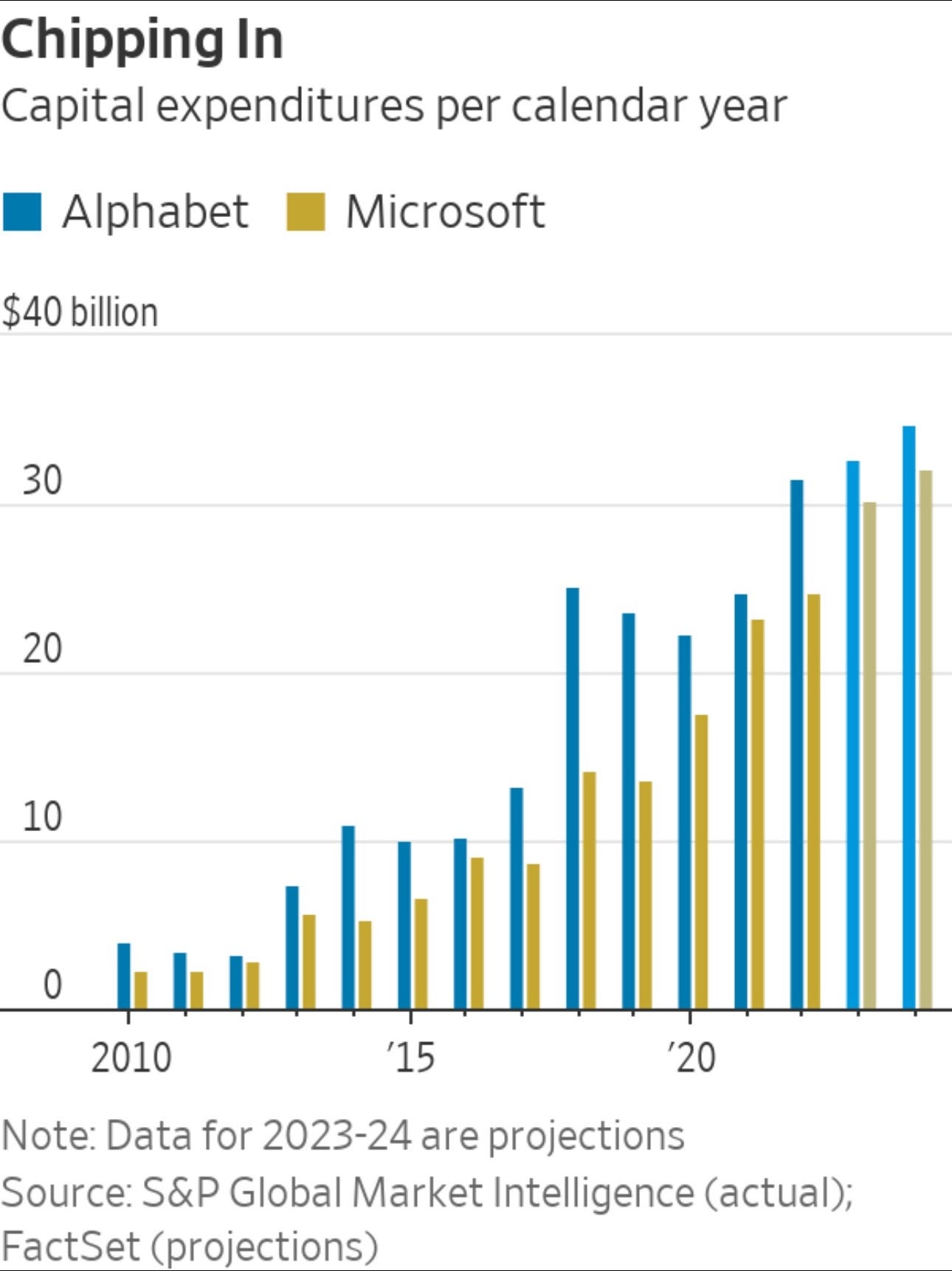

This despite each company investing billions this year and next in capex (capital expenditures), for AI and other technology parts of their businesses. A lot of that AI spend is going to Cloud supply constrained, GPU driven infrastructure, which I’ve discussed at length.

Let’s look at some highlights on the earnings reports and calls, starting with Meta today (links in quotes below are mine):

“Meta’s shares surged by more than 7% in after-hours trading, a sign that investors are encouraged by improvements in digital advertising even as concerns about the meta-verse remain. The company reported second-quarter revenue of $32 billion, up 11% compared with a year ago, and the largest quarterly growth since the final quarter of 2021.”

“Thus far in 2023, Meta has seen its shares more than double as [Founder CEO] Zuckerberg has focused on cost-cutting, developing new generative AI technology and the launch of Threads, a microblogging app the company launched to compete with the business formerly known as Twitter, which billionaire owner Elon Musk rebranded as X. “

“The company said it expects its 2023 expenses to be between $88 billion and $91 billion, higher than its previous outlook of between $86 billion and $90 billion. In the past year, Meta has had multiple rounds of layoffs impacting about 21,000 jobs, or nearly a quarter of the company’s workforce.”

“Meta reported that Facebook’s daily active user base increased to 2.06 billion users, up from 2.04 billion the previous quarter. The increase defied expectations of analysts surveyed by FactSet who thought user numbers would remain flat.”

As I’ve written extensively, Meta CEO Zuckerberg is laser focused on AI opportunities, both driving its efforts around AI open source infrastructure support (Llama 2 driven and more), and rapidly developing AI enabled products, services, and advertising for its 2 billion plus global users and advertisers.

Zuckerberg’s plans for Threads for example, are just getting started despite the media focus on weekly ebbs and flows vs Twitter/X.com. And Llama 2 driven efforts have both defensive and offensive business opportunities for Meta. Will have a lot more on all this in the months to come, including Meta’s ambitions for smart AI agents, as I update the three year AI road map in future posts.

Microsoft and Google also had similarly positive earnings reports, and AI tailwinds to discuss:

“Google and Microsoft are two very different businesses chasing the same Next Big Thing. Fortunately, both are doing well enough to provide the sizable funds needed for that effort.”

“The two reported relatively strong results for the June-ended quarter late Tuesday, featuring improved revenue growth and profitability as a result of cost reductions. Google’s core advertising business returned to growth following two straight quarters of declines, while Microsoft’s cloud and enterprise software businesses beat Wall Street’s projections for the final quarter in its fiscal year, despite slowing corporate spending on technology across the globe.”

“But the duo’s core businesses have nearly taken a back seat to the escalating hype over generative artificial intelligence—the technology behind chatbots such as ChatGPT.”

“That colored their respective reports very differently on Tuesday. Microsoft, whose share price has surged 46% since the start of the year thanks to the company’s aggressive adoption of genAI technology in its products, saw its stock slip more than 3% after hours. The company projected revenue for the September quarter that was slightly below Wall Street’s projections.”

“Google-parent Alphabet, whose stock price has risen a more moderate 39% this year, jumped 6% following its own report, which didn’t include any official financial projections.”

“Neither earnings release suggests any change in the two companies’ pursuit of AI. In fact, both showed why the two are the best suited to build on a technology that requires massive computing resources—and equally massive pocketbooks. Microsoft now generates nearly $60 billion in annual free cash flow, while Alphabet produces $71 billion. Both have had a little over $28 billion in capital expenditures over the past four quarters—more than the annual revenue of three-quarters of the companies in the S&P 500.”

“And both sent clear signals Tuesday that they would take those numbers even higher. Alphabet’s $6.9 billion in capex for the recent quarter came in well below the $8 billion Wall Street had anticipated, but Chief Financial Officer Ruth Porattold analysts on the company’s earnings call that it will keep increasing for the rest of this year and into next “to support the opportunities we see in AI” across the company.”

“Microsoft is leaning in even more aggressively, with capex for the June quarter jumping 30% year over year to a record $8.9 billion. CFO Amy Hood said the company will increase that amount sequentially each quarter through its new fiscal year.”

Even though Wall Street had initial concerns about Google's core Search empire being threatened by AI driven search, it’s becoming increasingly clear that Google has formidable AI resources to bring to the table, even if they sometimes seem to go at it at their own pace. And that pace, as I've said before, is a feature and not a bug, given the global scale and complexity of Google’s business, and the intense regulatory concerns around AI.

On a separate note, it’s useful to read this detailed piece by David Pierce of The Verge on how even the best funded and executed startups, to reinvent AI driven Search, face formidable challenges against Google. It talks about an admirable effort by a company by ex-Googlers called Neeva, to go up against Google, with every advantage imaginable, and the difficulties it faced mounting a serious, sustained challenge at scale.

Replace ‘Neeva’ with ‘OpenAI’ or any other ‘AI Native’ startup today, and one sees how difficult it’s going to be to scale a successful AI challenge against Google. Doesn’t mean it can’t be done.

Just that the execution path is as daunting as Luke Skywalker flying down the Death Star trench to hit the smallest of vents open to Space, with swarms of X-fighters and laser cannons in the chase.

They’re going to need the Force alright. Even perhaps Elon with xAI Force. Stay tuned.

(Note: Discussions on this site are for information purposes only. No investment advice is intended at any time).