AI: 2023 Half-Time

... a preview ahead

Besides summer breaks, hot dogs, and fireworks, this July 4th weekend also reminds us all that half of 2023 is behind us. In AI land, it’s easy to forget that OpenAI’s ‘ChatGPT’ moment was only last November.

The world has reacted with more fear than prior tech waves, but also a good amount of greed. The AI gold rush is off, and it’s a good time to be in the picks and shovels business, with Nvidia at the head of the line.

Public investors have been bidding up everything with an AI sheen, and like earlier cycles, momentum and hype will again get ahead of near-term AI realities. Private investors too have jumped in with gusto, seeding four month old companies with a $100 million and more. Not to mention billion dollar AI acquisitions picking up pace.

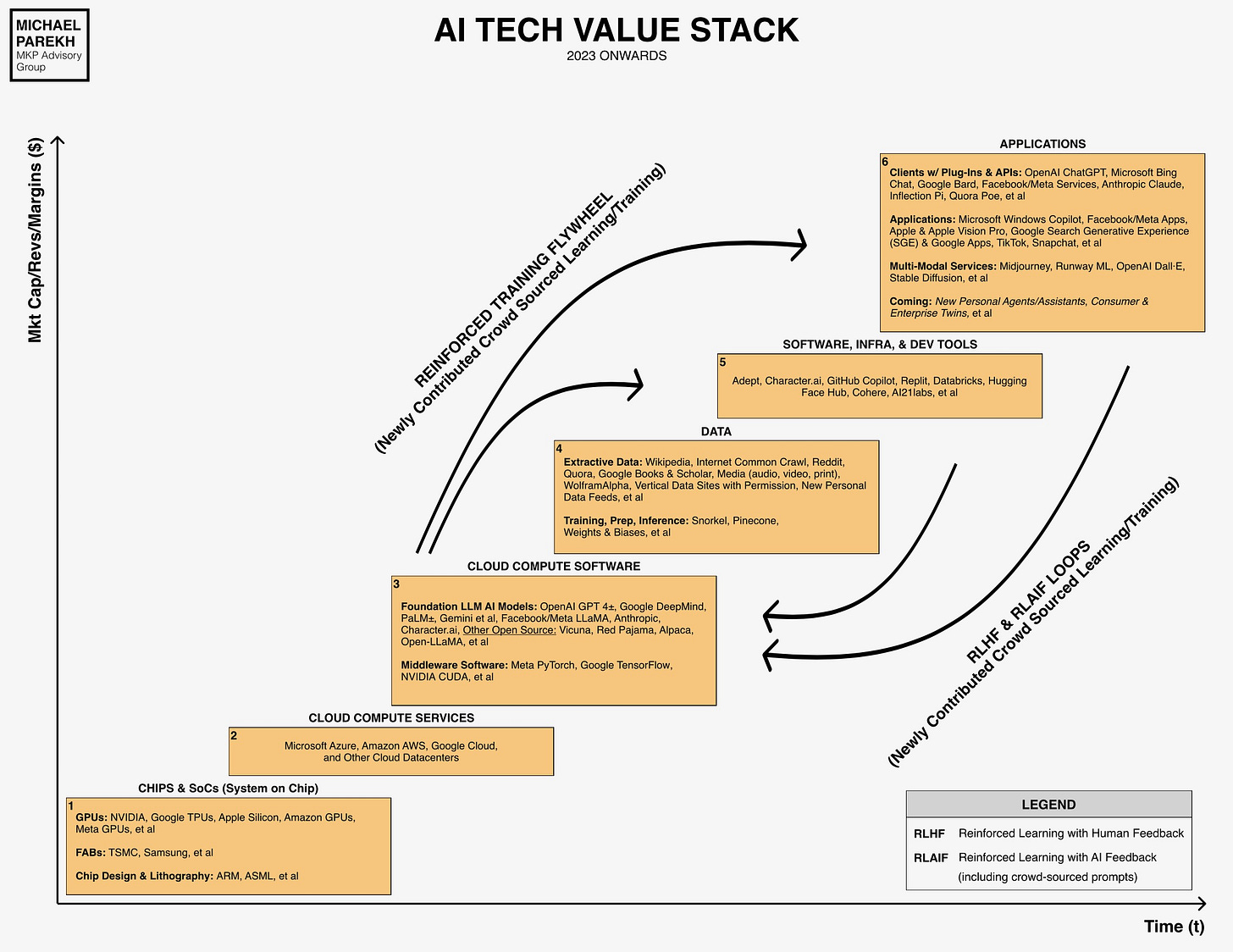

But realities in tech ALWAYS take longer to realize. Just remember how long we’ve been waiting just this decade on technologies like Blockchain/Crypto, Self Driving cars/taxis (Tesla FSD inclusive), VR/AR/MR smart glasses, smart Voice assistants, smart homes, and come to think of it, anything with the word ‘Smart’ before it. So let’s temper our timing expectations for ‘smart’ AI assistants (Box 6 in chart below) in particular (Full disclosure: I was lead analyst for the General Magic IPO in 1995, the original ‘smart agents’ company by ex-Apple rockstar engineers).

AI, including the current LLM and Generative iterations, will likely prove slower to impress mainstream global users, despite the ‘Wow’ factor of ChatGPT to date. And financial cycles around AI as before, will always flow and ebb ahead of the secular tech cycles.

All that being said, this AI tech wave is more real than what’s come before. My source of conviction is the rule that has guided me in tech, since the dawn of the Apple II in 1977, and the IBM PC In 1981. “Follow the Tech”. Understand it deeply, vertically and horizontally across the tech stacks. As close to what the core developers and builders are seeing and doing, as possible. Then of course wait for truly mainstream examples of what is possible.

I’ve closely tracked ‘AI Tech’ for a very long time (in its many early incarnations), from the Chip level up.

And we finally, finally, have both these conditions with AI. First, the way Software has been done for over half a century is shifting from the deterministic to the probabilistic. I explain it in easier terms here. As importantly, the hardware at the chip level up, can finally do exponentially more in parallel and at accelerating scale, with these new software approaches, after years of hard evolution.

On the second one of course, OpenAI’s GPT and ChatGPT is as strong a beacon to what’s possible for the mainstream as anything we’ve seen in decades. And it’s amazing the engineers who build this stuff. It may take longer, and there will be hype, boom and bust cycles financially, but the underlying tech drivers are real in this one.

I’ve laid out the possible road map relative to previous cycles with the AI Tech Value stack, and discussed how it compares and differs from the PC and Internet cycles (e.g., Data and Reinforcement Learning Loops). The charts are built off over three decades of analyzing this stuff.

Will be talking a lot more in future posts on what’s likely in store for AI in all the six boxes above. Over time frames that should be thought of in years, learning from past waves. Mindful of course of the new opportunities, and special headwinds this time around.

So with all that said, I thought it might be useful to think about just the next six months ahead of us this year as a half-time preview.

Let’s start with the high level items as guideposts:

AI still being invented and re-invented: Core AI innovation at the deep technical level is at the ‘beginning of the beginning’ phase. The best technical innovations are still emerging every week out of academic research labs, in the form of AI papers, along with open source efforts by developers worldwide, then being flooded with venture dollars to create a Cambrian explosion of new ‘AI Native’ startups. Assumptions on AI capabilities and ‘Compute Costs’ in particular, are likely to change meaningfully just this year alone. Expect this to continue into next year and accelerate.

Early days in Horse race: Expect most current assumptions ‘Where the Moats are’, who the ‘obvious’ winners and losers are to be undone, and related timelines to shift. Remember Google wasn’t even founded until three years after the ‘Netscape moment’ in 1995.

Chip Constraints Continue: GPU shortage issues will continue to daunt companies trying to build LLM AI applications and services this year, despite the Herculean efforts by folks like Nvidia, TSMC (who makes the actual chips), and other associated chip makers around Memory, Networking, and related areas (Boxes 1 and 2 above). These shortages will continue well into 2024.

Beware AI Veneers: Most incumbent Tech companies in every box above will talk up their ‘AI Add-on’ products and services to every investor in earshot. Bring extra grains of salt every day. Look for the ‘AI Native’ products and services wherever possible.

Rising Regulatory Drumbeats: The regulatory headwinds will continue in every global jurisdiction through the year. The EU ‘AI Act’ is potentially up for finalization later this year but likely to spill into 2024. US is developing its own responses here. The temptations to ‘preserve jobs’ and address ‘AI Safety’ ahead will AI innovation and building, will be too tempting for politicians everywhere.

Geopolitics trump globalized tech supply chains: Let’s just call this the “China issue”. Politicians of all stripes are convinced and united in their belief that China can’t be trusted for national security and other economic/geopolitical reasons. Ergo the global tech supply chains that were a tail wind to earlier Tech Waves, are distinct headwinds this time, with possibly SERIOUS negative implications for the US Tech industry (and possibly the US economy at large), over the next few years. Today alone saw reports of more curbs on chips to China. I will have a LOT more on this front in posts to come.

The items above just begin to set the stage for what to expect over the next six months and beyond. These general areas are important guideposts to keep in mind as we step into the second half of 2023. On to the third quarter. Stay tuned.

(NOTE: The discussion in this and other posts on this site is for informational purposes only. No Investment advice is intended).