AI: Nvidia keeps striking

...staying in front of a gold rush

In a piece a few weeks ago, I highlighted how strong the current appetite has been for ‘corporate strategic’ VC investing, especially by big tech companies like SAP and others. Another company striking while the ‘iron is hot’ so to speak is Nvidia. As the Information notes in “Nvidia and the Corporate VC Boom Ahead”:

“Nvidia’s corporate development team must be exhausted. They’ve inked roughly 20 deals this year, according to financial data firm PitchBook and The Information’s reporting. For comparison, once-prolific VC investor Tiger Global Management has done about 30 startup deals this year.”

“Nvidia’s revenue reached $13.5 billion in the second quarter, double that for the same period last year, and it has forecast a 170% surge in third-quarter revenue. Put simply: It has more money than it knows what to do with, so it’s trying to invest in every conceivable customer, partner and acquisition target—or “anything that smells like AI,” as one tech investor put it—before it loses momentum. And that will happen. Eventually, the supply of its chips will balance out with demand and Nvidia’s explosive growth will slow.”

“In the meantime, it has backed some of the most promising AI companies. On Thursday, software startup Databricks announced a $500 million funding at a $43 billion valuation with participation from Nvidia. (Read more on the Databricks round).“

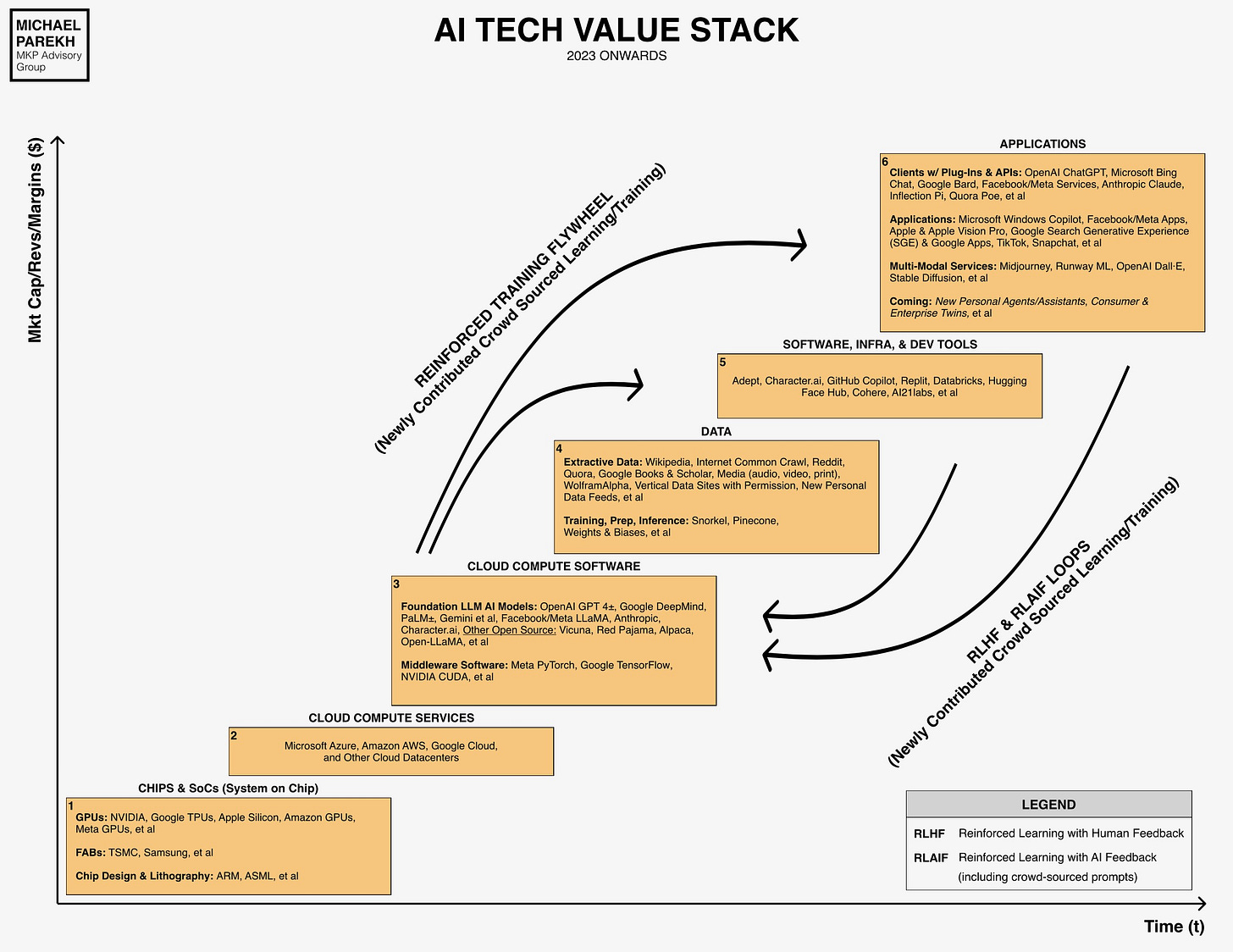

As has been recounted a fair bit now, at this early stage of the AI Tech Wave, and infrastructure gold rush, Nvidia has been the clearest beneficiary. Especially in the public markets, with the company crossing a trillion dollar market cap on strong growth in its core GPU chip business.

For now it is a ‘win-win’ environment for what I’ve called ‘Boomerang deals’ for all parties involved. As the Information goes on to explain:

“Other recent Nvidia investments include OpenAI rivals Cohere and Adept, as well as Hugging Face, which makes open-source tools for developing AI software.”

“These deals help Nvidia earn loyalty from leading AI companies, and, because most of them are Nvidia customers, the company stands to earn back the capital. Critics have described the way firms like Nvidia account for revenue from these startups as “round tripping.”

“Startups don’t mind. They need the cash—and even more, they need the chips. And there’s a bonus: The halo effect around Nvidia helps them capture other investors’ interest because everyone in AI wants to play nice with Nvidia.”

Nvidia is also of course aggressively executing on its core business as I’ve outlined on its ‘Nike’ strategy with the top cloud data center companies like Amazon AWS, Microsoft Azure, Google Cloud, Oracle Cloud and other ‘Cloud Service Providers’, or CSPs.

Using its strong public market currency and balance sheet to bolster its strategic position up and down the AI Tech value stack is also smart execution while the ‘iron is hot’. And while staying on top of Geopolitical challenges and opportunities in China, India and beyond. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)