In the ten months since the OpenAI ‘ChatGPT Moment’, we’ve seen a FOMO (‘Fear of Missing Out’) driven AI infrastructure ‘Gold Rush’, unprecedented in scope in this AI Tech Wave vs the PC and Internet waves. Hundreds of billions in private and public dollars are being deployed worldwide, in infrastructure, new companies, and initiatives by companies large and small:

Much of it is in the spirit of ‘Build it and Hope they will Come’. Meaning customers both consumers and business. That can then be monetized on a sustained basis for long-term growth in revenue and profitability, especially after all the new mouths at the Data table. Be it with transactions, subscriptions, or ad revenues, the three-legged stool of online monetization. Meshing of course the secular tech cycles with the financial ones. It’s always more difficult than it looks in the beginning, when there’s general euphoria over the possibilities

But almost a year in, it’s time to re-consider that aspect, as I highlighted in my ‘Yellow Flag’ piece a few days ago. Specifically, it’s important to separate the ‘gold rush’ growth in the industry’s early metrics from what may be sustainable in the long-term as customers really use these technologies in their products and services. It’s what I did professionally for a long time in earlier cycles. It’s both an art and a science. And it’s far more complicated in the AI tech stack than all earlier tech stacks in their various waves and cycles.

It will likely take at least a few years until we’ve figured out the true ‘product-market-fit’ of AI technologies. As I’ve pointed out before, even though the Internet commercialization boom kicked off with the ‘Netscape moment’ in 1995, one of the key blockbuster long-term winners, Google, wasn’t event founded until 1998, and didn’t go public until 2004. These things take time, and tech always takes longer to do what we think it will do, and then do it faster than we think when it’s time.

What brings this up right now are recent market and media discussions focusing on long-term growth, costs of AI, and valuations. As the Information notes about the post-child of this AI gold rush OpenAI this week:

“There’s no doubt large language model leader OpenAI and rivals like Anthropic are quickly expanding revenue, judging from reports in The Information in the past few weeks. (The latest data point from my colleague Amir today reveals that OpenAI is generating revenue at a pace of $1.3 billion a year, up 30% from the $1 billion-a-year pace we reported this summer.)”

“But new data from Kruze Consulting, a finance and HR consulting firm, points to at least one challenge these companies will face: getting their customers to stick around.”

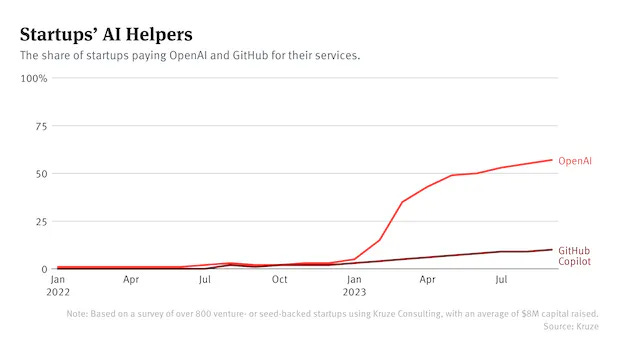

“Kruze’s analysis of expenditures by more than 800 venture-backed startups found, perhaps unsurprisingly, that the percentage of companies using OpenAI products has risen to 57% in September from 3% in November last year, when ChatGPT launched. But when you dig a bit deeper, you see a different picture.”

“While the 800 companies spent an average of $2,600 on OpenAI each month, the median spend was just $80, enough for a few ChatGPT+ subscriptions. That difference suggests a few power users skewed the average figure, and that most are just experimenting or don’t need much from OpenAI. (Startups in the analysis have raised $8 million in capital on average.)”

“That brings up the question of how many startups want to rely on OpenAI’s software and will become big customers. Startups represent a customer base that’s usually quick to adopt new technologies, but this group is under more pressure than ever to rein in costs.”

It’s the proverbial $64,000 question. In this case with a lot more zeroes, especially given recent strategic investor driven valuations. And it’s a mix of both quantitative and qualitative answers to get at the true picture. To figure out the long term sustainable growth for these companies that late stage private and eventually public investors, can count on to evaluate these AI companies and markets. It wasn’t easy in the PC and Internet cycles. It’s far more complex this time especially given the regulatory and geopolitical overlays (headwinds).

It’s going to be even tougher this time around due to many reasons, but two in particular:

Everyone is pre-trained by prior waves: By this I mean that users and investors worldwide know that there are huge reasons to be on top of this tech wave given the spectacular success eventually of the earlier PC, Internet, Cloud and Mobile waves, despite their turbulent market cycles. So companies and individuals are more informed on the possibilities and probabilities of future opportunities emerging over the horizon, and invest aggressively early on. Fear of missing out (FOMO) battling simple Fear of the markets not emerging in the size, shape and times anticipated. And the markets today are measured in billions of people worldwide vs hundreds and tens of millions in the internet and PC cycles before.

AI Software costs grow with customer usage, at least for now: As I discussed earlier, this is not like selling traditional software through sales and subscriptions where the ongoing costs once developed go down over time. This will likely be so at least for the next couple of years, due to the high current cost of AI Compute GPU infrastructure, the costs go up with usage driven by the need for ‘reinforced learning loops’ for training and inference on the LLM AI models. At least for now. This issue will be addressed with lower compute costs over time, but it’s an important difference relative to earlier tech waves.

There’s a lot more to watch and track on this question of separating the initial gold rush spending and investing from sustainable growth that investors should understand. There is a LOT we don’t know about how LLM AI technologies work, and a fair bit of faith in ‘AI Alchemy’ for ‘magical’ results. All also being uniquely batted around by regulators here and abroad.

But these are early days in the secular innovation cycle. So a lot more qualitative analysis has to make do with the nominal quantitative data available for now. But it’s an effort that will be likely worth it in the long run as we accelerate ahead. Even if it takes a bit longer than expected. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)