AI: AI Chips, going Fast & Furious

...the top bid now is $7 trillion

The Bigger Picture, Sunday, February 11, 2024

The most jarring headline this week for this AI industry watcher was the WSJ’s “Sam Altman Seeks ‘up to $7 trillion Dollars to Reshape Business of Chips and AI”.

It’s like we’re watching the highest stakes auction in the world, with bidders topping each other at every query by the Auctioneer: “The Top Bid is $7 Trillion, Do I see $8T?”

This Sunday’s Bigger Picture is to take a wider look at the high-stakes investment auction for the global AI Chip Infrastructure and related capital expenditures (capex). To put it in a context vs tech infrastructure booms of cycles past. And perhaps understand the financial and other drivers. Let me explain.

The WSJ reference above of course is to OpenAI founder/CEO Sam Altman, who’s made an iconic career of executing against over the top long-term AI fears and aspirations.

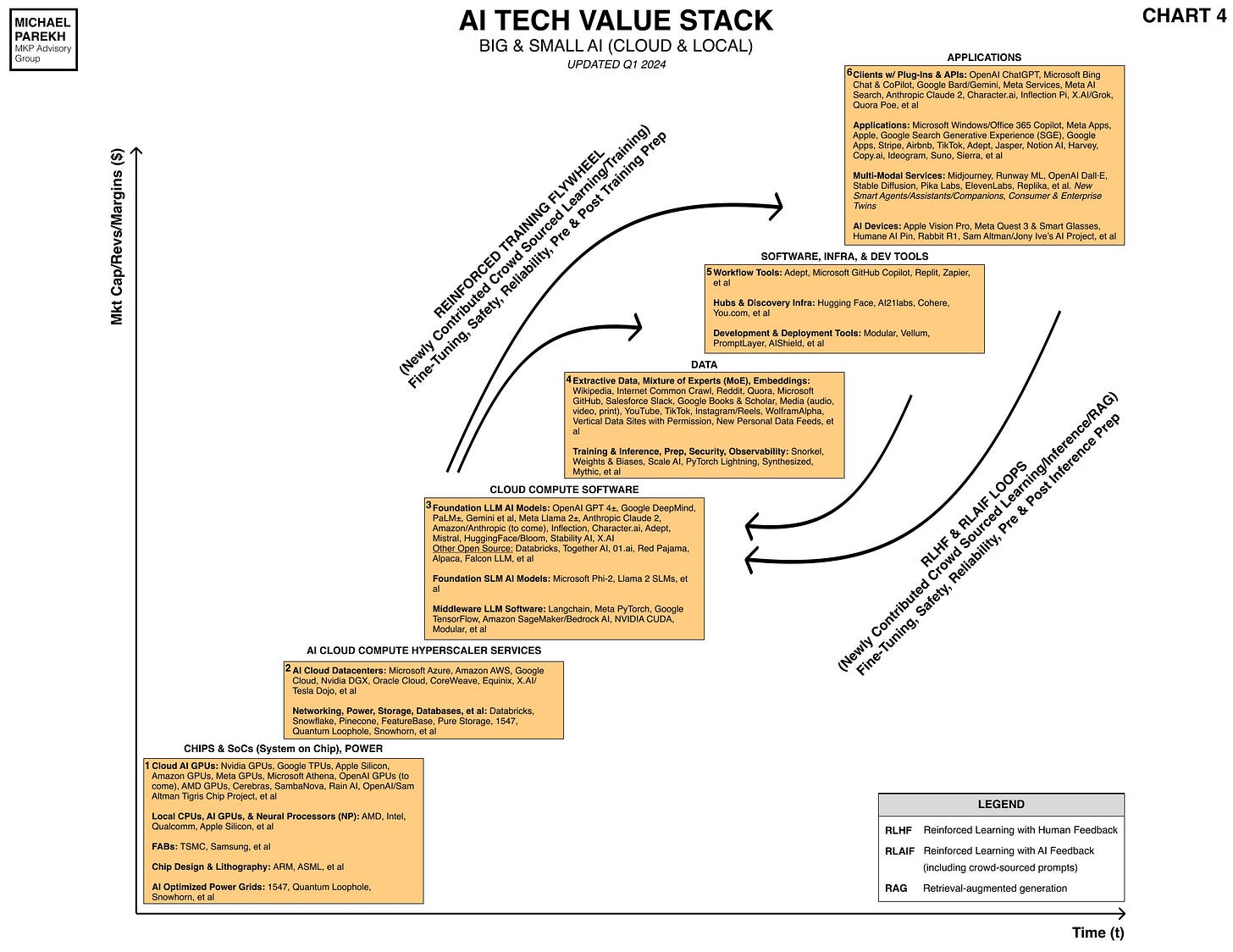

As I’ve long maintained, it’s really early in this AI Tech Wave, and its hyper competition in the AI Hyperscaler Infrastructure Boxes between 1 and 5 below.

These boxes start with AI Chips and Power, with TSMC as the key global Chip fab company, and go onto AI Cloud Hyperscalers, AI LLM AI model Compute software for Inference and Training, and of course AI Extractive Data, which power the incredible utility of Generative AI models in the first place. These four boxes, along with Box 5, AI Software Infrastructure & Tools, comprise the bulk of the $200+ billion AI gold rush we’ve seen since OpenAI’s ‘ChatGPT moment’ back only fifteen months ago in November 2022.

As I articulated in the third bullet of yesterday’s AI Weekly Summary:

“New WSJ reports on OpenAI’s Sam Altman now talking about AI Chip efforts that could potentially raise up to $7 trillion in coming years. For context, the telecom companies in the nineties raised and expended almost a trillion dollars in fiber backbone capacity to power the first Internet boom. Over 98% of that capacity went under utilized after 2002, taking a decade for applications and services to catch up.”

So the $7 trillion above for Sam Altman’s aspiration for AI chips and fab infrastructure is truly startling in context. That trillion dollars in internet backbone bandwidth made possible much of the internet broadband and streaming infrastructure that took over a decade to get utilized through tumultous public market cycles. As I went onto explain yesterday:

“An example of scaled services back then in the Internet investment boom that finally started to soak up that backbone bandwidth, include Netflix transitioning from DVDs to Streaming, and eventually using up almost half the internet backbone over a decade. And of course the general transition of the internet from dial-up internet access (narrowband of AOL era), to the broadband wired and wireless connections for the internet and mobile in the late 2000s, going into the second decade of the 21st century”.

“AI infrastructure builds and utilization in this AI Tech Wave, may see smaller or similar gaps in timing, both in the training and inference of models large and small, Unknown for now in a ‘Build and they will come” environment. Separately, Reuters reported Nvidia’s plans to focus on new custom chips for AI and other applications, focusing on the cloud/data center market for custom chips of over $30 billion. Again, general signs of a global enthusiasm for AI chip infrastructure and fabs.”

If one looks at the expected supply/demand curves of the coming decade, one can certainly see an adoption curve for AI not dissimilar to the one for the Internet from the mid 1990s to the 2020s, a twenty five year span. Semiconductor watcher Fabricated Knowledge has some useful projections in this context:

“What inning is AI in? If history is a guide, it’s hard to predict the twists and turns of a new market growing from nothing. Here’s my humble attempt at estimating AI penetration and my thoughts on the run-rate business of AI models and industry structure.”

“Internet Adoption vs. AI”

“The internet remains the best case study to anticipate the implications of Generative AI and its ripple effects.”

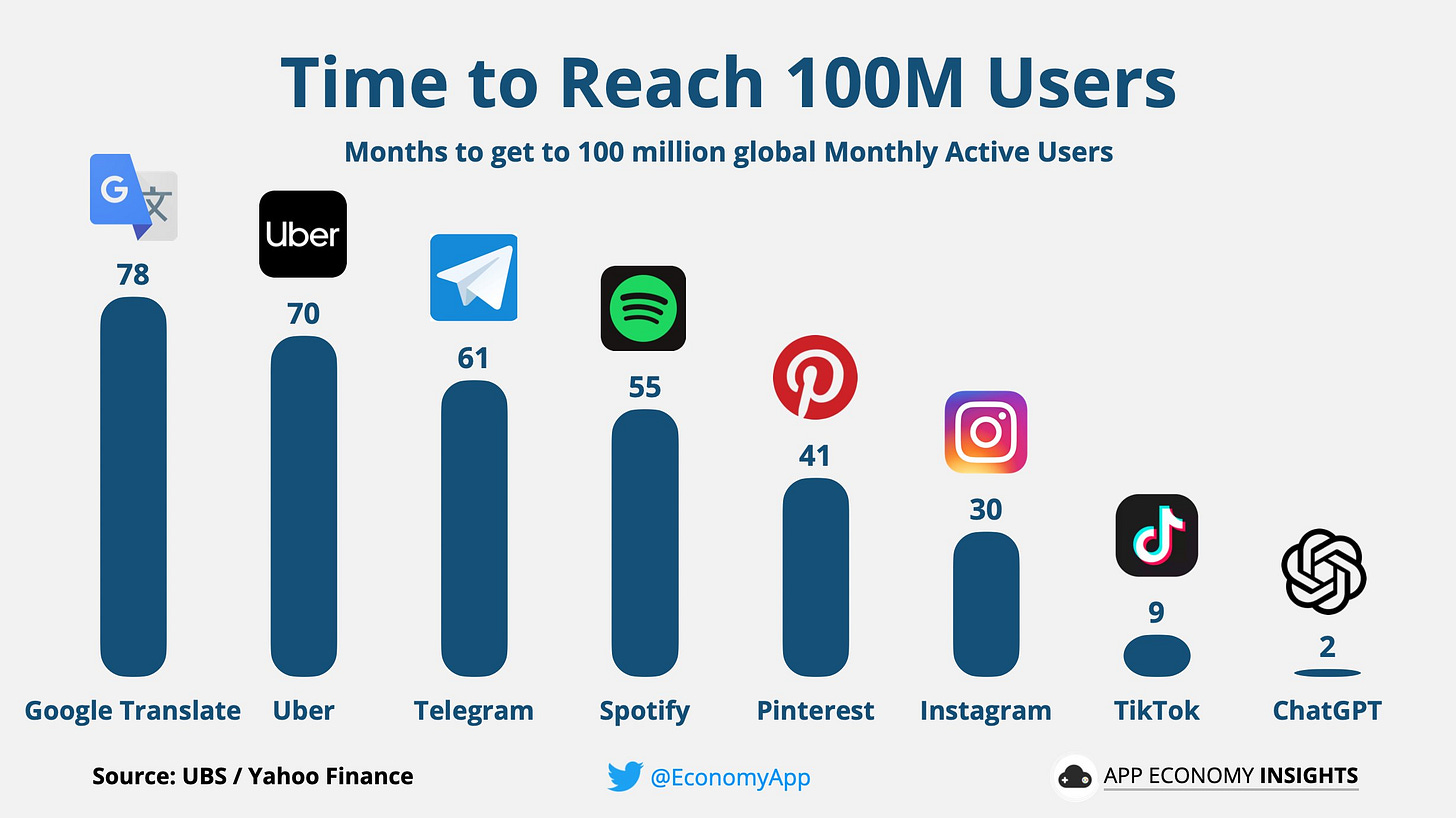

“It took 27 years to go from 0% to ~70% global penetration. If we take the estimates of paid users today, we can approximate a penetration rate for paying users of ChatGPT or LLM services. I will create a bottom-up estimate of paying users using Copilot and OpenAI estimates. Then, I’ll try to parse what the profitability of just those two units would look like and compare it to top-down penetration estimates.”

The numbers above are consistent with the rates of growth we’re seeing thus far for OpenAI, ‘Magnificent 7’ led by Microsoft and Google in particular, Nvidia, Amazon, and the other leading public/private LLM AI companies. But the projections beyond have various possible outcomes in a very complex calculus. More unknowables than even the Internet and other tech cycles I’ve professionally analyzed before. We can go through longer term supply/demand curves and industry competitive dynamics at length in future posts. Especially in the context of the unique differentiators of the AI Tech Wave vs past secular tech waves.

As I’ve articulated before, with both ‘Big and Small AI’ adoption potentially happening in more compressed cycles than the decades of prior computing and internet tech waves, we’re seeing both the ‘Mainframe’ and ‘PC/Smartphone’ tech eras happening in years rather than decades.

So one could potentially see the need for trillions in AI Chip and Computing Infrastructure. But it’s not just Business priorities of specific companies that’s driving the AI infrastructure race.

Especially since the AI Boom also fueled this time by Geopolitical concerns against China for countries to build their own Chip Infrastructure. As Foreign Policy noted this week, “Everyone wants a Chip Factory”:

“Several times in the past two years, U.S. Secretary of Commerce Gina Raimondo has cited a version of the same statistic, almost like a mantra.

“Decades ago, the United States produced nearly 40% of the world’s chips. Now, we produce just 12%,” she wrote in a post last month on X (formerly Twitter), echoing similar posts from July 2023, May 2023, and November 2022. “We’re changing that with the CHIPS and Science Act.”

“Passed in August 2022, the act is one of the Biden administration’s signature pieces of legislation, earmarking nearly $53 billion in subsidies and investment to convince semiconductor chip companies to move their factories—colloquially known as fabs—back to the United States. It’s a carrot for the industry’s biggest companies, meant to counterbalance the stick of ever-stricter export controls that prevent many of them from selling their products to China.”

“Indeed, U.S.-China competition is driving much of this. Containing China’s technological advance—particularly in semiconductors and the artificial intelligence applications they power—has been one of the Biden administration’s biggest policy priorities.”

This is a topic I’ve written about at length, under the heading of the ongoing need for the US and China to ‘thread the needle’ between their geopolitical security goals, and trade/technology interdependence. Goldman Sachs recently did a piece on this topic titled “The generative world order: AI, geopolitics, and power” worth reading as well. Entire countries like India and many others are putting their hat in to fund AI Chip infrastructure going forward.

To put further context around a $7 trillion AI Chips investment number, Goldman Sachs in a separate forecast estimated a $7+ trillion positive impact from Generative AI on the global $112+ trillion Economy, over a ten plus year period:

“Breakthroughs in generative artificial intelligence have the potential to bring about sweeping changes to the global economy, according to Goldman Sachs Research. As tools using advances in natural language processing work their way into businesses and society, they could drive a 7% (or almost $7 trillion) increase in global GDP and lift productivity growth by 1.5 percentage points over a 10-year period.”

But trillions in AI Chips alone is likely a reach, especially in the context of investor return expectations in a realistic investment horizon. Even measured in terms of a decade or more. We ‘only’ saw tens and hundreds of billions invested in each of the previous tech booms in areas ranging from self-driving electric cars, to 5G, to of course crypto and other aspirations in the ‘Metaverse’. Not trillions in any one area of tech over a compressed period of time. Even physical transportation infrastructure are measured in trillions only in the context of entire countries and regions of the globe.

More likely in the AI Chips context, Sam Altman’s ‘Bid’ is potentially a directional marker by a leading and very competitive bidder, aimed at scaring away potential rivals, more than an actual realistic capital expenditure. Competitors roaring at each other to mark their territories. Or bidders at a global auction glaring down each other. In the meantime, it remains to be seen if other bidders come forth to go above $7 trillion. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)