AI: Microsoft 'eyes wide open' in AI race

...better positioned than previous tech waves

The Bigger Picture, Sunday 1/28/24

Microsoft made the cover of Barron’s this weekend, with the headline:

“Microsoft is the World’s most Valuable Company. Now it has to prove it can stay there”.

The media and Wall Street love races, and even races of seeming Tortoises vs the Hare. With the company now going neck and neck with its other ‘Magnificent 7’ big tech peer Apple in the $3 trillion market cap race, there now even more focus on CEO Satya Nadella, who’s been ‘All-in’ on AI early, with eyes wide open.

Of course, his seminal, early partnership and investment in OpenAI helped drive a trillion dollars in market cap in 2023 this early in AI Tech Wave.

There are many implications of this current crowning of Microsoft, especially in terms of both what I’ve called ‘Big and Small AI’. That is this weekend’s Bigger Picture I’d like to unpack.

First, a bit more context from Barron’s cover story, posing two pointed questions:

“The company is in the early stages of infusing OpenAI’s technology into all of its offerings. That raises some important questions: How much will it make from AI, and how long will it take to do so?”

Of course the two questions on the minds of every Wall Street analyst and investor. Framed against Apple of course, a topic I’ve already discussed at length in the context of AI.

“The rise of the cloud and artificial intelligence has given Microsoft an edge over rival Apple. Earlier this year, Microsoft briefly took Apple’s crown as the world’s most valuable company.”

And then of course the contrast today vs a quarter century ago:

“The stock certainly isn’t in the bargain basement. According to Jefferies’ Thill, who has Microsoft as his top pick for 2024 with a $450 price target, the company’s forward price/earnings ratio now stands at 32.6, versus 27.1 for the Nasdaq Composite, historically high for the stock. (The company will announce its fiscal 2024 second-quarter earnings this coming Tuesday.)”

“Microsoft investors with long memories may remember facing an eerily similar dilemma 25 years ago, after the stock climbed dramatically during the internet bubble—should they sell their position? Back then, they would have been wise to do so. After peaking in December 1999 at a split-adjusted $59.96, the stock bottomed out in March 2009 at $15.15, losing nearly 75% of its value. Shares wouldn’t close above that 1999 peak until October 2016—truly a lost epoch for MSFT shareholders.”

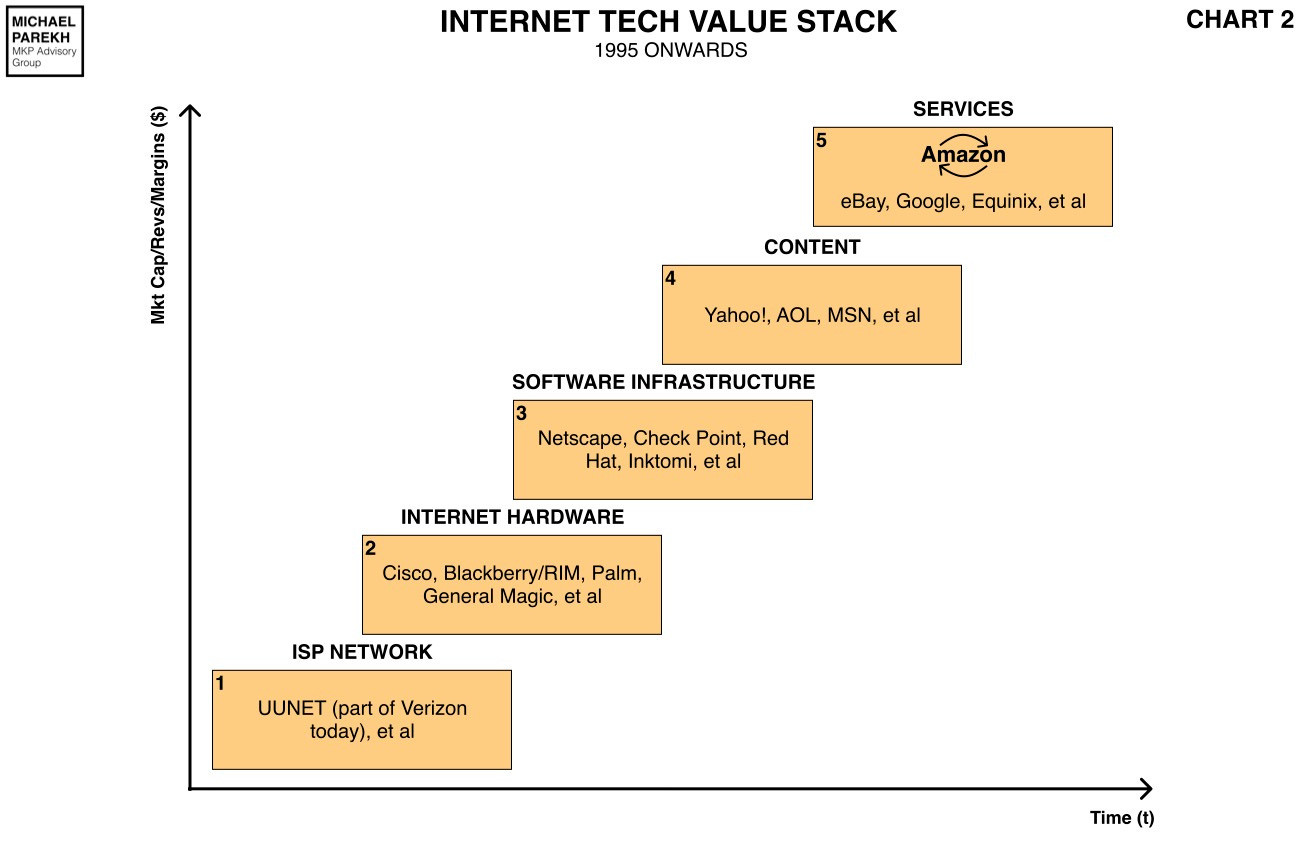

I was there as the head of internet research at Goldman Sachs back in the nineties, so had a front-row seat back then. Was close to the financial and secular tech cycles of both the PC and Internet Tech Waves, presented below as a memory jog:

The one above of course gave us the victory of ‘Wintel’ (Microsoft and Intel), and made Bill Gates Bill Gates. The second of course was Bill’s greatest nemesis in the nineties with the advent of Netscape and its iconic IPO in 1995, the Internet Tech Wave:

That of course gave us Amazon and Google, the current two of the seven ‘Magnificent 7’, and the source of Barron’s concern stated above.

The Bigger Picture this time with the AI Tech Wave though is that Microsoft is uniquely positioned in a fundamental way this time on two fronts, both having to do with the AI Tech Stack chart below.

Those two fronts are Microsoft’s leadership positions in AI data centers with Azure (Boxes 2 and 3 above), and its leadership in AI software infrastructure and customer faces products (Boxes 4, 5 and 6 above).

Their position here is deeply enhanced by Microsoft’s early and deep adoption of the rapidly evolving technologies. And its proactive ‘bundling’ approach to marketing and selling the constantly evolving AI enhanced Copilot branded products and services to its globally wide and deep customer base. This is VERY different from the company’s position in the nineties, in the Internet Technology Wave, the comparison concerning Barron’s this weekend. The whole piece is worth a Sunday read.

The core technology risk for Microsoft of course is their reliance on OpenAI’s core GPT and ChatGPT LLM AI technologies, an outside partner. It was of course highlighted by the unique governance drama last November. But Satya Nadella is acutely aware of that ongoing risk, and is actively focused on building both ‘Big and Small AI’ backups to future speed bumps with that partnership. Eyes wide open.

A lot can go wrong of course in all this calculus, and Microsoft’s progress won’t be in a straight line. And it may all take longer than we think. But the company’s position is very different in this AI Tech wave, than the last big tech waves in internet and mobile. And that for now is the bigger picture here. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)