As I think about what a year for AI we’ve had for 2023, in these earliest of days for the AI Tech Wave, it’s notable to be reminded that more mainstream US investors are along for the current AI bull market, regardless of the ups and downs to come.

The WSJ reminds us that “More Americans than ever own Stocks” as we say goodbye to 2023:

“The share of Americans who own stocks has never been so high.”

“About 58% of U.S. households owned stocks in 2022, according to the Federal Reserve’s survey of consumer finances released this fall. That is up from 53% in 2019 and marks the highest household stock-ownership rate recorded in the triennial survey. The cohort includes families holding individual shares directly and those owning stocks indirectly through funds, retirement accounts or other managed accounts.”

The scope is historic, with some notable charts and graphs worth perusing:

“The data provide the most comprehensive snapshot yet of how the Covid-era explosion in investing has reshaped Americans’ personal finances. Stuck at home during the pandemic with extra cash, millions jumped into the stock market for the first time. The elimination of commission fees on stock trading across U.S. brokerages made investing cheaper than ever.”

“It created a whole generation of investors,” said Anthony Denier, chief executive of mobile brokerage Webull U.S.”

“Most households own stocks through a retirement account, such as a 401(k), but more Americans in the past few years have invested in individual shares directly. Direct stock ownership increased to 21% of families in 2022 from 15% in 2019—the largest increase on record since the survey began in 1989.”

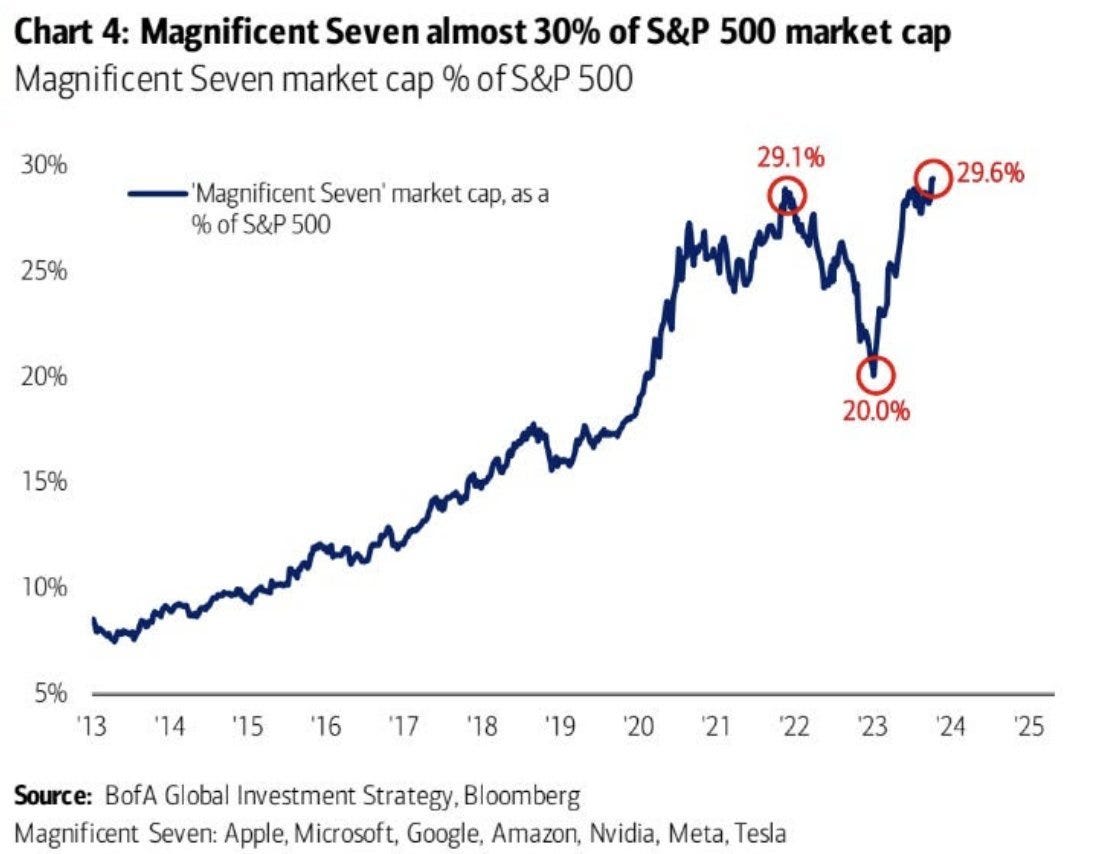

Given that many investors are participating in the markets via passive or actively managed ETF and index funds’, these same investors have also benefited from the run of the so-called big tech ‘Magnificent 7’ I’ve written about before. Especially now with these companies now comprising up to 30% of the S&P 500.

As the WSJ also noted a few days ago in “It’s the Magnificent Seven’s Market. The Other Stocks Are Just Living in It.”:

“Big tech stocks reclaimed their position as the market’s leaders this year. Just how far ahead of the pack have they run? “

Collectively, the stocks known as the Magnificent Seven—Apple, Microsoft, Alphabeta (Google), Amazon, Nvidia, Tesla and Meta—have jumped 75% in 2023, leaving the other 493 companies in the S&P 500 in their dust. (Those have risen a more modest 12%, while the index as a whole is up 23%.)”

“The Magnificent Seven stocks have swelled to represent about 30% of the S&P 500’s market value, according to Goldman Sachs Global Investment Research. That is approaching the highest-ever share for any seven stocks.”

Again, the piece too has useful charts and graphs worth perusing, not the least of which is the chart comparing the ‘M7’ to the entire equity markets of countries like the UK, China, France and Japan:

“The influence of the big tech stocks is massive on a global scale, too. Within the MSCI All Country World Index—a benchmark that claims to cover about 85% of the global investible equity market—the combined weighting of the Magnificent Seven is larger than that of all of the stocks from Japan, France, China and the U.K.”

It’s been quite the year for public investors seeing the performance of the biggest technology companies, partly around enthusiasm around the AI innovations around OpenAI’s ChatGPT a year ago. OpenAI’s partner Microsoft alone has seen almost a trillion dollar increase in market cap from a year ago, while Nvidia of course had a breakout year of almost 250% gains given their dominance in the AI GPU infrastructure market going into next year. Meta, Apple, Amazon, Google, Tesla and other public tech stocks of course have all had a good year to date.

And of course as I’ve higlighted before, it’s important to separate the relatively volatile financial market cycles from the underlying secular technology cycles. The WSJ puts it this way:

“Investors and strategists have long raised concerns about market concentration. When just a handful of stocks are responsible for most of the market’s gains, it becomes more vulnerable to a downturn if a few heavyweights fall.”

“Those worries appeared prescient last year when big tech stocks tumbled as the Federal Reserve began raising interest rates. When rates were near zero, investors chased the robust returns offered by tech and other growth stocks, but when rates started rising, those shares suddenly faced competition from less-risky investments.”

Necessary words of caution as one assesses financial investments and markets always. But also good to see that in the early days of this AI Tech Wave, more investors are benefiting directly for now from their investments in the public markets.

In previous cycles, much of those early gains have come from investments in far earlier stage tech startup and other private market investments, accessible only to a different tier of institutional and ‘accredited’ investors.

It’s notable that public investors are benefiting from an early tech wave directly via the public markets this time around. For now. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)