From the beginning of AI: Reset to Zero, I’ve highlighted that the frameworks being used to understand AI in these early days are to learn from the past to figure out the future. As someone who had a professional seat at the table in the PC and Internet Tech waves, and the accompanying booms and busts, I’ve from the beginning used those frameworks to map out the AI Tech Wave that I discuss often in most pieces here.

An adjacent part of that Internet wave in the 1990s of course was the accompanying capex (capital expenditure) boom in Telecom infrastructure for the internet, spurred by the timely Telecom Infrastructure Act of 1996. That opened up the otherwise highly regulated telecom industry for companies big and small to compete in the gold rush to rebuild and build the telecom networks optimized for internet protocols like TCP/IP using fiber and other high-bandwidth networking technologies.

The ultimate capex raised via private and public sources, including equity and debt, from 1995 to the internet/telecom ‘bust’ in 2002, was over hundreds of billions of dollars in today’s numbers. A lot more detail here on that history and numbers from ‘Fabricated Knowledge’ here for those interested:

“At the peak, telecom Capex was approximately $120 billion in 2000 dollars, or ~$213 billion in today’s dollars. This is one of the largest bases of capital ever built in such a short amount of time, and this capacity led to a glut in fiber that took almost a decade to backfill. But I’m getting ahead of myself.

The cumulative investment was well over $500 billion, including $800 billion in M&A in 1999.”

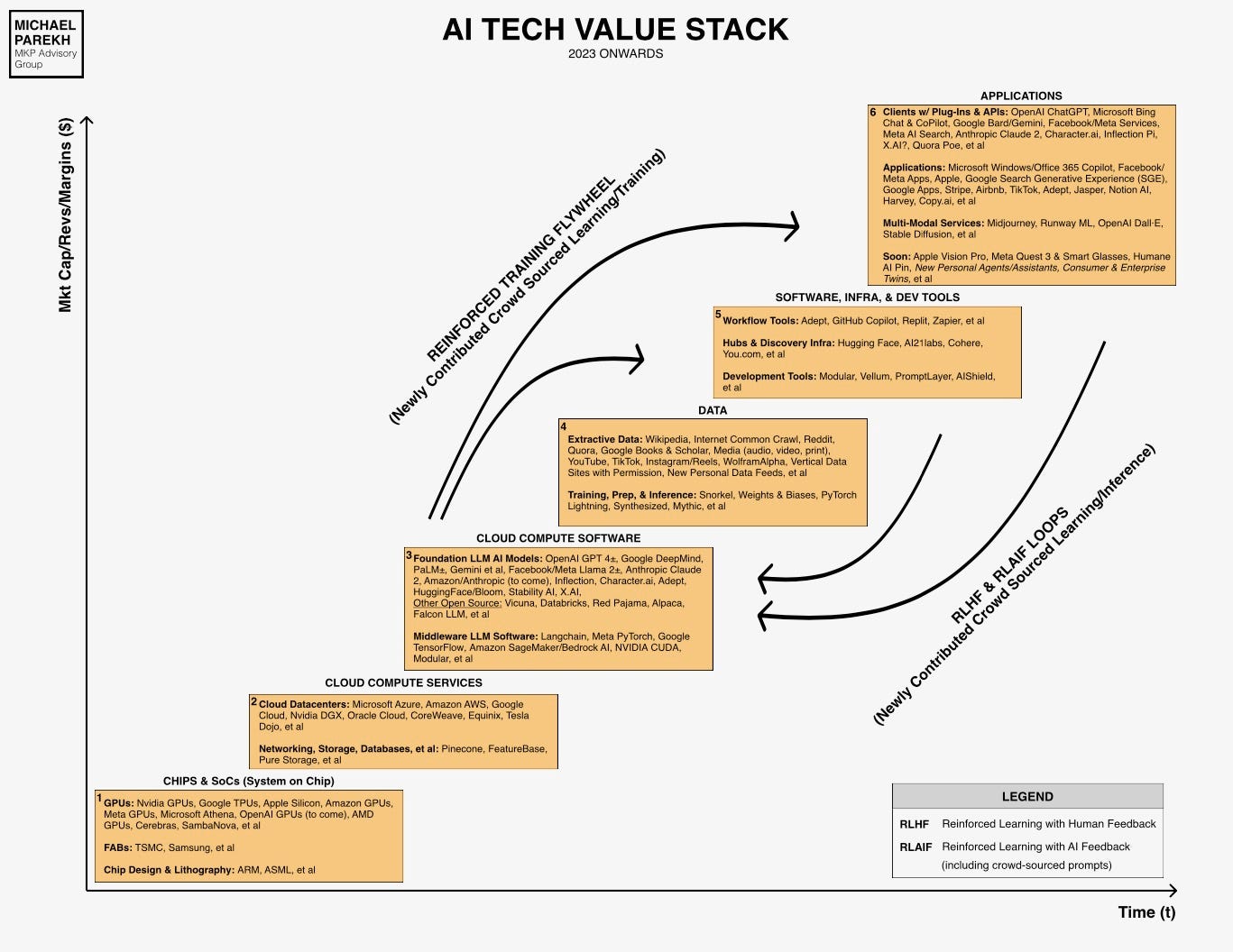

But the key analogy to today is of course the AI gold rush today in GPU filled cloud data centers that can run ever larger Foundation LLM AI models that can then be built upon to deliver the cornucopia of AI applications services highlighted in Box 6 in the chart below.

Since OpenAI’s ‘ChatGPT moment’ just ten months ago, we’ve already seen hundreds of billions committed here by companies large and small. As the internet/telecom waves teach us, this part of the AI tech wave boom and cycle can easily run five years or more. And the ultimate companies and services that become the long-term winners like Google and Amazon (amongst others) in the earlier cycles take time to emerge.

As I’ve pointed out before Google wasn’t even incorporated until 1998, three years after the Netscape browser moment in 1995 that electrified the world then like ChatGPT today.

But unlike in that cycle, a key difference is that almost every interesting AI application and service needs an exponential amount of both LLM AI model inference compute and GPU capacity with EVERY user query. In the internet/telecom waves, connectivity to the internet was the key driver of course, and that evolved from narrowband wired connections (CompuServe, AOL etc.) from 1995 into the early 2000s, to wired broadband and eventually to wireless broadband into the 2010s.

The telecom infrastructure SUPPLY that got built in the 1990s into the early 2000s was built so far ahead of the eventual DEMAND, that the networks were less than 5% used at the end of that time frame.

That is likely NOT going to be repeated this time around because of the need for ‘reinforced learning loops’ for inference cycles driven off every user query in every AI application and service, be it to generate photos, videos, or smart agents saying smart-ass things to their users. That variable use component is a distinct difference to be aware of this time around.

The other key difference of course is the ‘extractive’ Data depicted in Box 4 above. The AI Tech Wave is going to need boundless amounts of it going forward, both human and AI generated (synthetic). And contrary to some fears, the supply here as well is likely to be endless. That supply curve and investment to build that out as yet to get started in this wave. But it’s ahead of us as well.

And it too will take three to seven years or more to build out.

So for both those reasons, the buildout of GPU-driven capacity run AI big and small, and the buildout of never-ending extractive Data for AI applications big and small, this time the supply and demand curves may end up rhyming differently than earlier tech waves. The AI Tech Wave is likely to have some surprises relative to the PC, Internet and telecom waves of years past. Both in the financial and the secular cycles. Booms, Busts, and whatever comes in between. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)