AI: Regulators 'Yellow Flag''Magnificent 7' Walled Gardened Silos

...an earlier headwind than in prior Tech Waves & competition driver

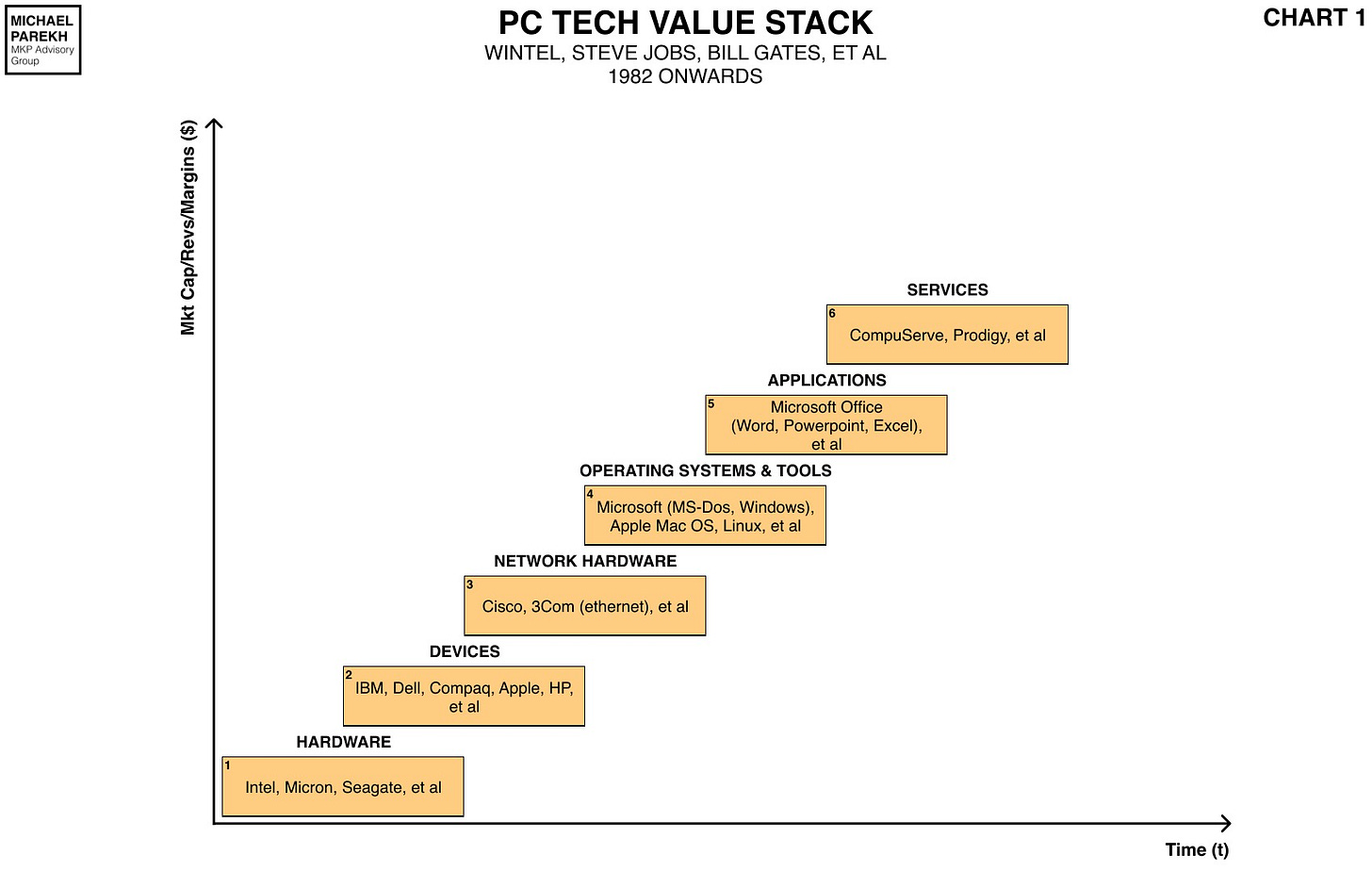

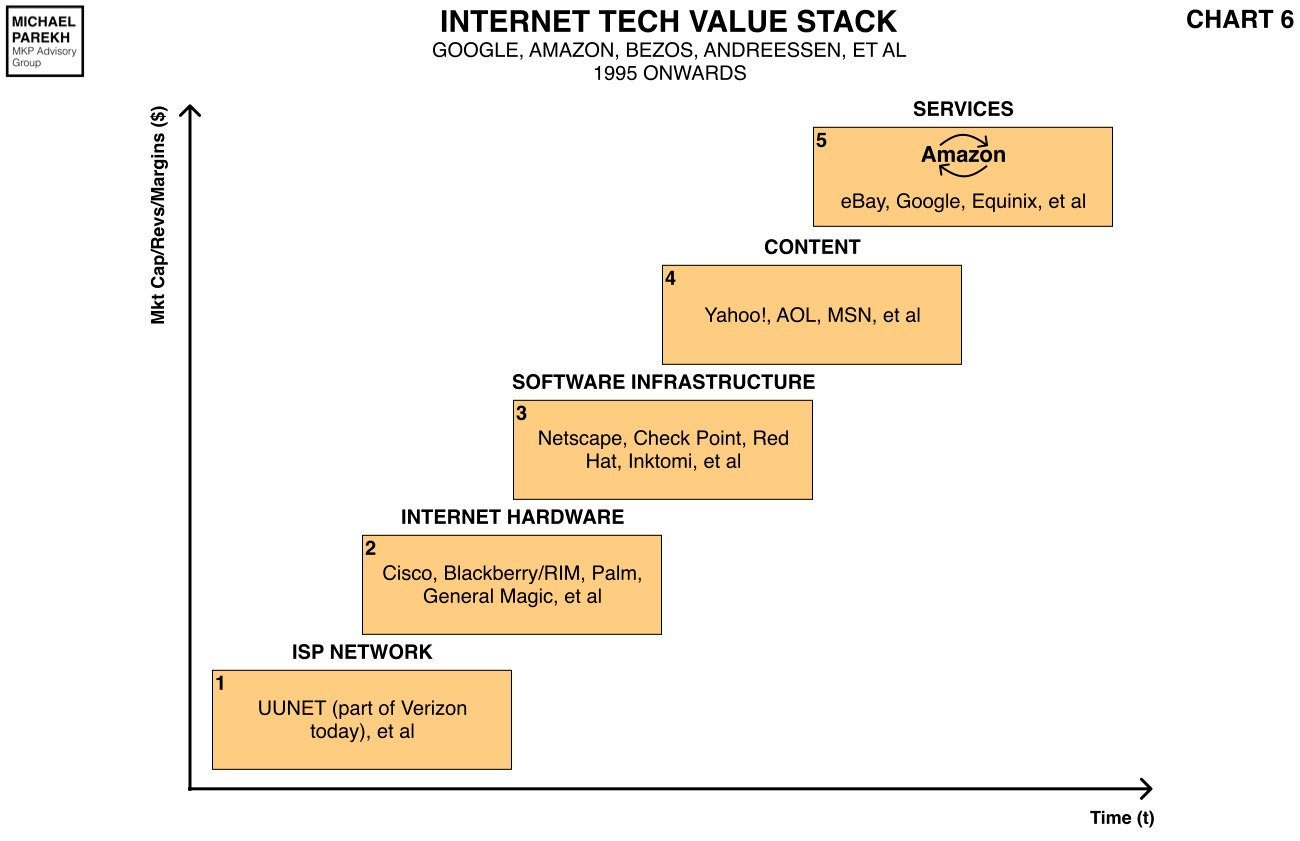

I’ve earlier outlined a series of headwinds in this AI Tech Wave for both incumbents and startups, especially going into 2024. And compared them with those at various stages in the PC, Internet and other major tech waves. I particularly outlined these tech waves in the context of Microsoft in the Bigger Picture post yesterday.

The Yellow Flags are out earlier this time than in the PC and Internet tech waves.

A particular one has been regulatory issues around market dominance of ecosystem dominant Silos. They have often emerged in the later stages of earlier tech cycles. This time, particularly due to the unprecedented market dominance of the big tech ‘Magnificent 7’, the regulatory initiatives are emerging earlier for many incumbents than prior waves and cycles, like the DOJ action against Microsoft in the nineties.

This market dominance is not just measured in financial clout, where the ‘Magnificent 7’ already comprise of almost 30% of the S&P 500 valuation.

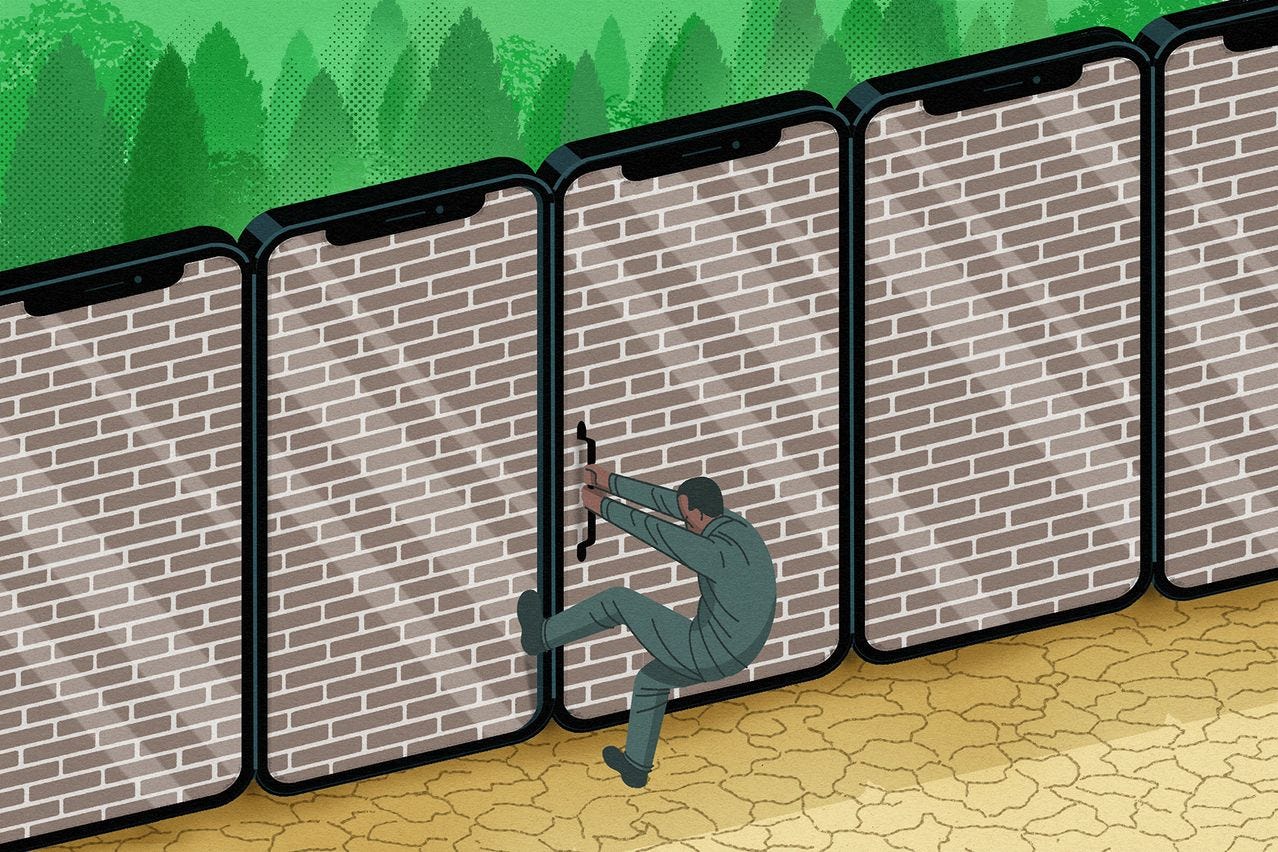

It’s particularly pronounced in the ecosystem Silos of the various companies, also known as their ‘Walled Gardens’.

Examples include of course almost everyone of the ‘Mag7’, including Apple, Google, Microsoft/OpenAI, Meta, Amazon, Nvidia and Elon/Tesla.

The WSJ outlines this well this week in the context of Apple, but the piece could well be a template for Google and other big tech silos:

“The tech giant’s ‘walled garden’ has driven record revenues, but the way the company is trying to preserve it has become an invitation for regulators to pounce, partners to defect and competitors to circle.”

“Chief Executive Tim Cook has turned his company into a juggernaut on the strength of its integrated “walled garden” of gadgets and services. It’s a strategy that has churned out enormous profits—and yet it’s increasingly a problem for the company.”

“Apple’s hardware business is showing weakness, with sales of some devices leveling off and others declining. To shore up its revenue, the company is increasingly dependent on its growing services offerings—subscriptions, commissions on sales in its App Store and the like—and is now in a position where it must defend and try to increase that revenue at all costs. In the long run, this strategy could backfire.”

“Apple’s walled garden is unusually comprehensive, even by the standards of the industry. It’s not just the collection of gadgets it sells. It’s the fact that they are all integrated—in terms of both their hardware and software—that makes it very difficult for Apple customers to use devices outside of it, or switch to a competing ecosystem altogether. It has, in the words of regulators and economists, high switching costs.”

This theme of walled gardens and regulatory efforts echoes in this other piece by the NY Times on how “Apple and Google are losing power”:

“What you can and can’t do with your apps is dictated by Apple and Google rule books that are longer than the U.S. Constitution.”

“The companies say their control gives you one place to find apps while protecting you from bad apps that could steal your money or your personal information. (Their protections are good but imperfect.)”

“Those rules also help Apple and Google steer the internet economy and generate more than $40 billion in yearly revenue from their app stores.

“Apps are so handy, and Apple and Google demand so much silence, that it’s hard to know what money-saving deals or imaginative ideas you might be missing.”

“Now, because of legal changes starting to bubble up for Europeans and Americans, you can start to glimpse an alternative app reality.”

“Those first glimmers, including complicated changes that Apple announced Thursday for iPhone users in the European Union, won’t immediately and dramatically change your app experiences.”

“Eventually, though, you could have more options to download apps, pay less to buy digital stuff from apps and use features that weren’t possible before. Or very little might change, because Apple and Google won’t loosen their iron grip without a fight.”

The WSJ outlines Apple’s responses to the EU rules in particular in this other piece worth reading:

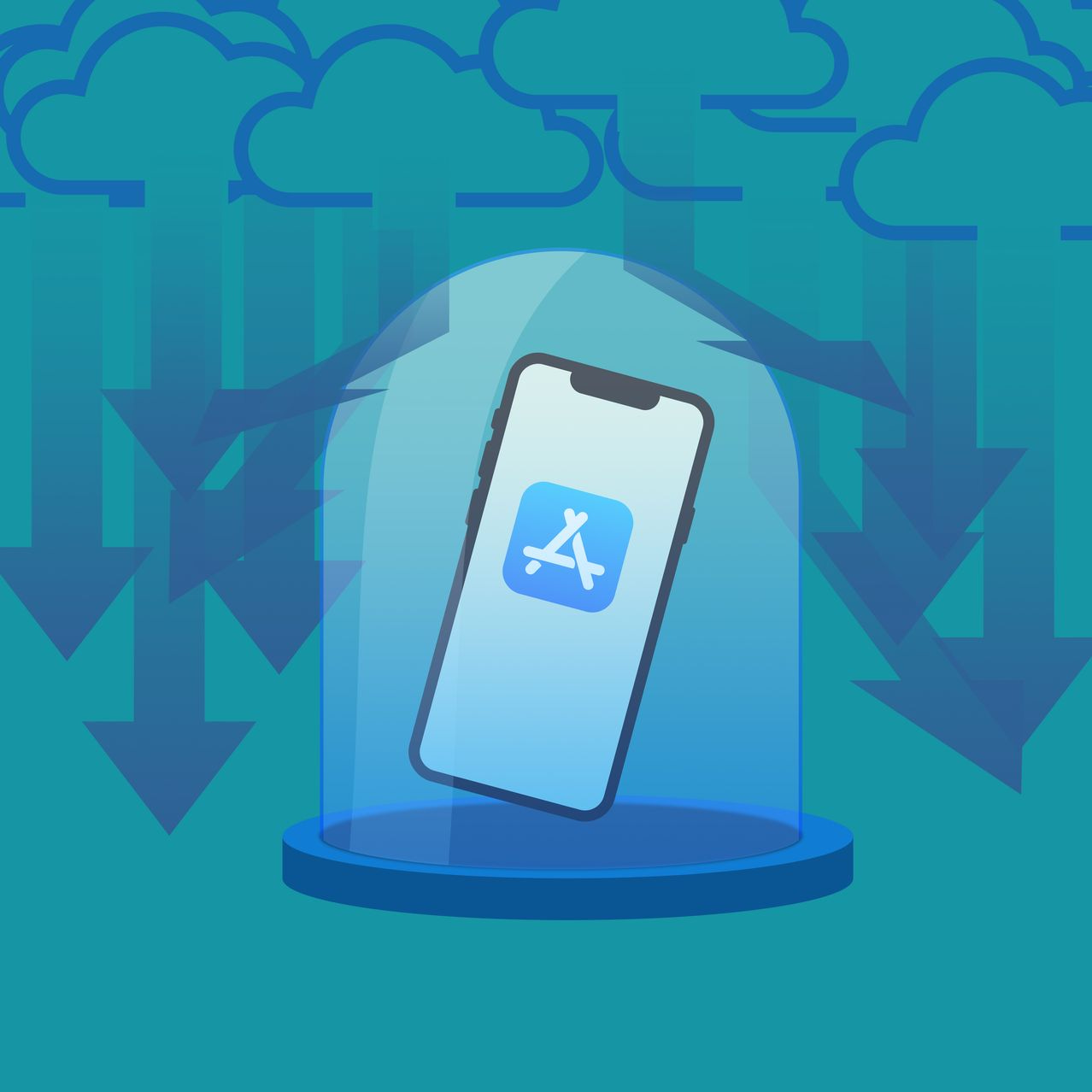

“Apple is planning to add new fees and restrictions when it begins allowing people to download apps outside of the iPhone’s closed ecosystem.”

“The plan, a response to a new European law intended to crack Apple’s current grip on apps, will allow users to download software onto the iPhone for the first time without using the App Store.”

“The new policies, which will apply only in Europe, set up a major test of the legislation and how it will be enforced as Apple faces challenges from courts, regulators and software-makers globally about its tight control of third-party software.”

“Meta Platforms, Spotify and other companies are preparing new download options for customers in anticipation of the new rules. Meta is considering a system that would allow people to download apps directly from Facebook ads. Spotify plans to offer users the ability to download some of its iPhone apps directly from its website, according to the company. Microsoft has weighed a launch of its own third-party app store for games in the past.”

It’s going to be a long tussle back and forth, emulated both by Google in particular as well. Ironically, as described above, many of the big tech companies will of course take advantage of the tiny breaches in Apple’s walled garden or silos, at the same time.

Apple of course is both complying and fighting hard to keep every iota of its competitive advantage in all markets:

“Apple has defended its policy of controlling downloads via the App Store, saying it is necessary for keeping the iPhone safe and relatively free from viruses. Critics have called Apple’s system anticompetitive, saying it collects unnecessarily high commissions and unfairly competes with Apple’s own apps.”

“Apple’s approach to the EU law will help ensure the company maintains close oversight of apps downloaded outside the App Store, a process known as sideloading. The company will give itself the ability to review each app downloaded outside of its App Store. Apple also plans to collect fees from developers that offer downloads outside of the App Store, said people familiar with the company’s plans. The company hasn’t yet announced its plans and they could change.”

All the big tech companies have unprecedented market and market share heft relative to all earlier prior tech waves. And they’ve also been very proactive of course in acquisitions and partnerships with emerging startups in both the AI and prior tech waves to take advantage of opportunities offensively and defensively.

This week saw the FTC under regulator Lina Khan draw a bead on that trend, as the NYTimes highlights in “Federal Trade Commission Launches inquiry into AI deals by Tech Giants”:

“The Federal Trade Commission opened an inquiry on Thursday into the multibillion-dollar investments by Microsoft, Amazon and Google in the artificial intelligence start-ups OpenAI and Anthropic, broadening the regulator’s efforts to corral the power the tech giants can have over A.I.”

“These deals have allowed the big companies to form deep ties with their smaller rivals while dodging most government scrutiny. Microsoft has invested billions of dollars in OpenAI, the maker of ChatGPT, while Amazon and Google have each committed billions of dollars to Anthropic, another leading A.I. start-up.”

“Regulators have typically focused on bringing antitrust lawsuits against deals where the tech giants are buying rivals outright or using acquisitions to expand into new businesses, leading to increased prices for consumers and other harm, and have not regularly challenged stakes that the companies buy in start-ups. The F.T.C.’s inquiry will examine how these investment deals alter the competitive landscape and could inform any investigations by federal antitrust regulators into whether the deals have broken laws.”

“The F.T.C. said it would ask Microsoft, OpenAI, Amazon, Google and Anthropic to describe their influence over their partners and how they worked together to make decisions. The agency also said it would demand that they provide any internal documents that could shed light on the deals and their potential impact on competition.”

“Our study will shed light on whether investments and partnerships pursued by dominant companies risk distorting innovation and undermining fair competition,” Lina Khan, the F.T.C. chair, said in a statement.”

It’s a yellow flag for AI acquisitions for now. Not to mention of course the separate antitrust regulatory initiatives against Big Tech going into 2024, as the WSJ outlines here:

“U.S. antitrust cases against tech giants Google and Meta Platforms are expected to come to a head in 2024, likely producing long-awaited rulings that could shape the legacies of top Biden administration regulators.

“Silicon Valley and its critics have seen their patience tested on some of these cases. A U.S. antitrust case brought against Alphabet’s Google unit in 2020 went to trial in 2023and now heads to closing arguments in May.”

“I think 2024 could be a big year for the enforcers,” said Rebecca Allensworth, a professor at Vanderbilt Law School. “But as the U.S. v. Google case illustrates, it’s been slow going.”

But unclear how many will slow down, or even stop for now.

The AI opportunity is too big to ignore for all technology companies, and over the long term, likely existential for all. Regardless of their current size, clout, market dominance and defensive actions to date.

As a tech optimist, one result of a lot of these initiatives will be opportunities for many Big Tech companies in the AI Tech Wave, to compete more vigorously with each other’s tech Silos.

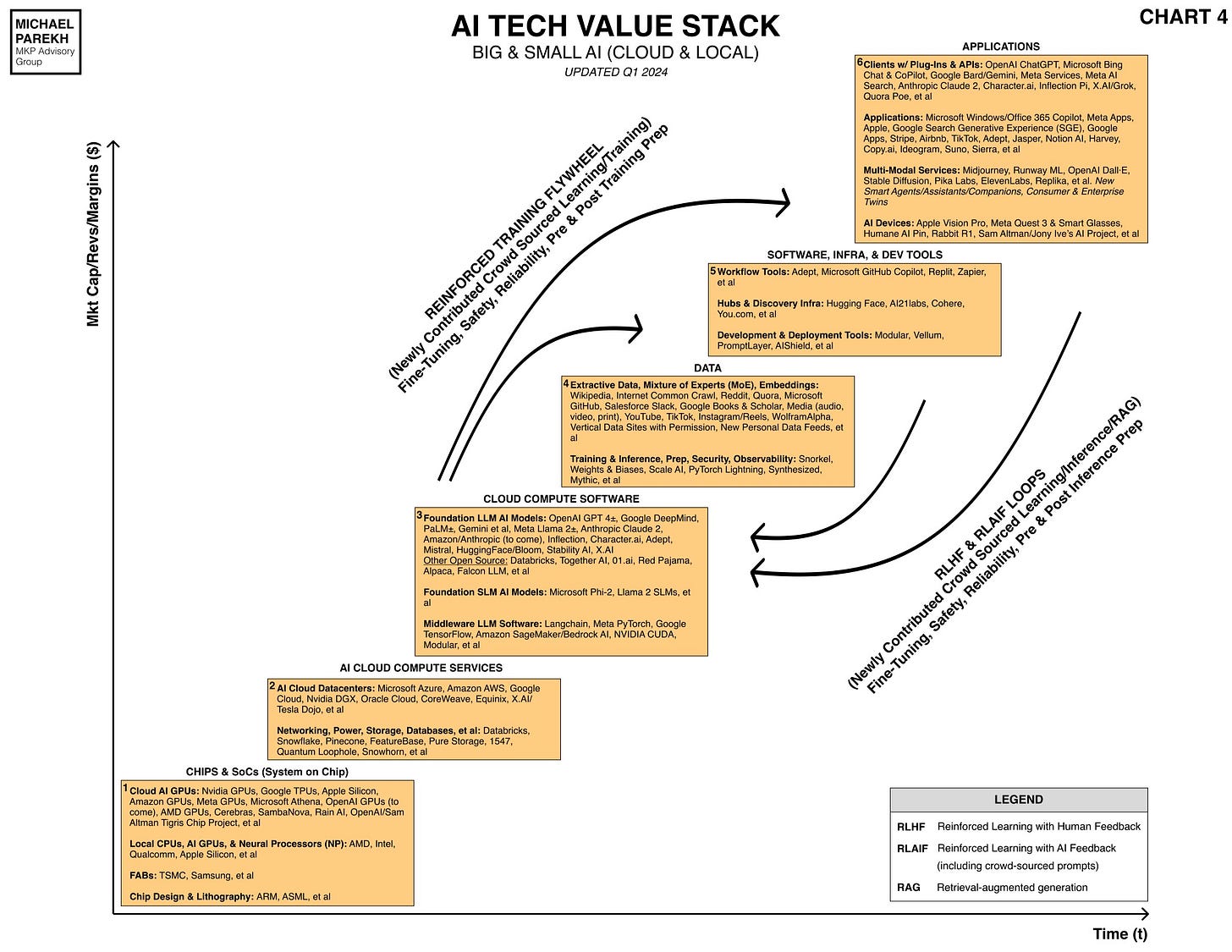

Smaller tech companies and startups will also likely benefit potentially, especially as the AI Tech Wave very uniquely merges both the ‘Big AI’ and ‘Small AI’ trends I’ve discussed at length. Should benefit every company in every box above, and increase competion and partnership opportunities for big and small galore.

This is happening already in earnest this year, and will accelerate concurrently in the next few years. Mainframes and PCs happening at the same time as it were instead of decades apart in prior cycles. I discussed this in particular for Microsoft and Apple just a few days ago.

Regulators are but one more headwind to both counter for some incumbents, and in many ways accelerate competition, for all in this race, big and small. It all may end up being better for the industry and society, sooner than later. Especially if we keep existential fears around AI in check. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)