AI: Unbundling Big Tech

…proactively without regulatory nudges

AI: In my View, Sep 17

In this Sunday’s ‘AI: In my View’, I’d like to zoom out on ‘Bundling/Unbundling’ discussed recently to drive businesses, and to potentially apply it to businesses bundled within companies. Big Tech currently is seeing a rising trend of antitrust and regulatory activity worldwide, as I highlighted yesterday. This week alone saw the Google DOJ Search bundling antitrust Trial kick off here, along with follow up regulator activity in Europe on Meta’s targeted advertising across its properties. With the onset of a new AI Tech Wave, it may be time for Big Tech to consider voluntary unbundling of some businesses, for the net benefit of current and future stakeholders. Without waiting for the government or regulators to force their hand on their terms. Let me explain.

First let’s highlight the current antitrust environment against Big Tech. Every 25 years sees government regulatory/antitrust actions in tech that eventually end up being beneficial for all parties concerned, even the companies at the receiving end of the actions. We saw that in the case of both IBM AND the telephone industry almost fifty years ago, and in the PC industry now almost twenty five years ago in the nineties. Would recommend Professor Scott Galloway’s piece in the context of this history of business concentrations in tech and beyond.

The government nudged unbundling of IBM with its software and hardware integration led to the opportunities in the late 1970s for Microsoft and Apple to do their thing. Just two decades later, similar ‘nudging’ by the government on Microsoft with its browser bundling gave Google an opportunity to do its thing starting in 1998. Search and productivity apps running on the internet instead of being bundled into the PC’s operating system and hard drives at its point of sale. It even allowed Google’s Android and Chrome operating systems to get breathing room vs the then dominant Windows.

It’s useful to remind ourselves in 2023, that we are equidistant from 1996 when Netscape challenged Microsoft, and Microsoft saw subsequent DOJ action on its bundling of its internet browser with Windows, to 2050. Only 27 years from then to now, and now to then. And that time-frame is useful to keep in mind as we consider the innovation ahead around AI technologies in this tech wave. It’s going to take about 25 years or so to begin really showing what it can do to ‘augment’ us all.

The promise of AI is great, but technologies always take longer to cook than we think. and investors especially need to keep in mind that financial cycles are not always correlated with the underlying technology cycles. But that’s a topic for another day.

It’s notable that government actions of the day seldom specifically anticipate the technologies that are eventually enabled to do their thing. The browser integration issue with Microsoft was in the context of Netscape’s Navigator browser. Nothing to do with all the internet applications that eventually got enabled and empowered at scale without the encompassing shade of a huge tree above. Google didn’t get even get founded until 1998. That innovation as we saw in that and in so many other cases, happens organically, bottom up mostly. And typically independent of the focus of the regulatory action in question.

It happens as the underlying technologies evolve with every tech wave, from PC to Internet, from narrowband to broadband, from desktop to cloud and mobile, from closed to open source software, from computing applications integrated together, to applications enabled via abstracted APIs.

And it’s going to happen again. Even potentially upending some of our early consensus assumptions and views currently held on the AI technologies of today. Will have more to say on all that ahead.

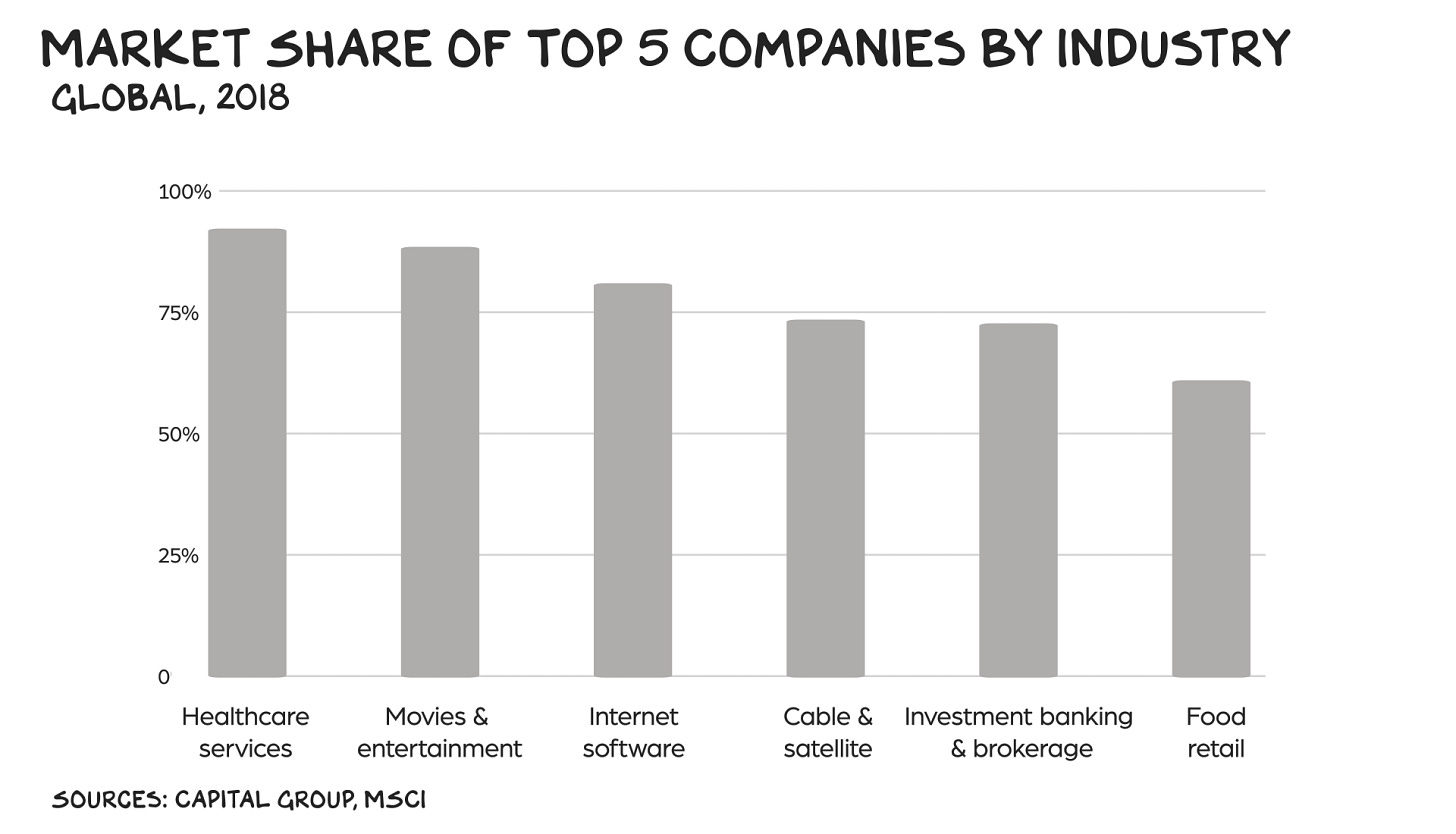

Every one of these macro and micro technology evolutions gives new opportunities for companies up and down the AI Tech Stack to innovate for customers over and over again. Concentration of markets by a few companies can make that innovation slower, and sometimes impossible to scale.

Today’s actions against Google, Meta, Apple, Amazon, Nvidia, and Microsoft in various jurisdictions both here and abroad are another set of opportunities for a new generation of companies deploying technologies to serve customers in new ways. Independent of the China, India challenges and opportunities. Unlike previous cycles, each of big tech companies today have formidable regulatory and media staff to proactively focus on dealing with, and bracing for regulatory challenges in every major market of the world.

My argument this time is that at a time when most of these companies have valuations that span over a trillion dollars, their managements, boards, and investors may be well-served to think proactively about unbundling some of their businesses. Allow them more degrees of movement for bigger futures ahead. Before governments and regulatory authorities peck away on disparate fronts to force their hands on the drivers of their successes past.

At a time when all traditional software is going to be changed fundamentally with AI software, humans are fundamentally going to be able to create and reason via AI software and data as never before. ‘Augmented’ in the word of the day.

The market opportunities ahead may behoove big tech companies to consider proactively unbundling some of their businesses from the mother ship for them to become their own trillion dollar market cap companies. Serving not just the eight billion potential humans today, but the ten billion that will potentially have access to AI and other technologies at ever lower prices in just 27 years, by 2050. Giving the senior leadership and teams of the independent companies to do their thing.

Just as a random example, imagine the CEO of an independent YouTube being able to compete for independently for global user and investor attention and resources, as the CEO of Netflix or Disney does today. Or an Amazon AWS being able to compete for all the independent stakeholder attention that the founder/CEO of Nvidia gets in the cloud computing segment as it’s going to be remade totally by AI in a few years. Across all major global markets and regulatory jurisdictions.

Wall Street loves doing ‘Sum of the Parts’ calculations and project price targets based on possible futures. It’s what just drove Tesla’s valuation up this week on an analyst got more excited about what Tesla could potentially do with their ‘Dojo’ AI platform. The analyst went onto project another half a trillion dollars plus in market cap to come on a ‘sum of the parts’ calculation.

Today’s big tech will all do mostly fine in their current forms, but the possibility exists that their individual parts could do far better faster, as separate sums from the total part today. In global markets where time and resources to scale to billions keep going up exponentially. Not to mention the winner-take-all competition for global attention, in the increasingly ‘Creator’ and AI influenced world of hyper social media, Twitter/Xs, and TikToks.

Just look back at what Elon Musk has been able to do in terms of investor and user attention in a little over a decade for Tesla, this year the world’s leading EV auto company. Becoming ‘the richest man in the world’ didn’t happen without tens of millions of twitter followers, and millions of investors chasing the future in ‘investment arks’ with tech ETFs, and investor meme-power on Reddit and Robinhood. Not to mention targeted, board-approved stock compensation packages on the individual companies results over time.

And not to mention selling millions of ‘world-climate saving’ cars with Full Self Driving (FSD) software capabilities to come soon, just paid for in the billions today (artfully borrowing a page from Tom Sawyer and his fence painting volunteers willing to pay for the privilege). And do it all without figuratively spending a dollar in marketing and advertising vs most big auto companies around the world that spend billions.

Today’s consumer facing startups in every field need every freedom of action that a founder/CEO of a Tesla, or OpenAI gets today as an independent company about to remake the future. It’s tough to do being buried one or more levels deep in a multi-trillion dollar big tech. Also, there are only so many top priorities that CEOs, boards, and large institutional investors can focus on at any given time. Especially given where the technology hockey pucks and geopolitics are going today.

And it’s not just big tech. Imagine GM, Ford, Toyota and other auto companies being able to move with the degrees of freedom that Tesla has today, especially now that the underlying secular trends, not just AI, are becoming clear. And Autos are but one industry that has seen concentration in an unparalleled period of globalization and tech-driven capitalism. Professor Scott Galloway’s piece mentioned earlier highlights these concentrations in many other industries, all also being jostled with the coming AI challenges and opportunities.

There’s a lot more to unpack around this idea of unbundling proactively. And I will do so in future posts. AI is but one big catalyst for them all today. But for now, I just want to underline that we’re at yet another potential peak of governments ‘nudging’ tech and so many non-tech companies again. Just for being so successful in a capitalistic context, under the rules that set their individual tables.

But it’s equally capitalistic to consider proactively unbundling businesses before the government comes knocking. And more often than not, before new technology waves do it instead. And then counter-intuitively creating for more value for shareholders and stakeholders in the long run. It’s happened many times before, and history rhymes. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)