AI: Bundle, then Unbundle

...endlessly for Services far beyond media

Netscape CEO Jim Barksdale in 1995, formerly a cable company executive, famously riffed on one of the oldest tenets in business:

“Gentlemen, there’s only two ways I know of to make money; bundling and unbundling.”

That statement foreshadowed the unraveling of Netscape a few years later, as Microsoft bundled its competing ‘Internet Explorer’ browser into its market leading Windows operating system for free (they got their hand slapped for it later). We have seen this cycle in businesses ranging from music to cable to streaming in recent years.

It comes to mind now given the latest unbundling tussle between Disney and cable company Charter, as The Information headlines: “John Malone’s Charter Squeezes Disney at Vulnerable Moment”:

“Bob Iger’s path to rescuing Disney just ran into a roadblock. Disney’s cable channels, including ESPN, went dark on Thursday on the No. 2 cable operator, Charter Communications, amid a fight about how much Charter should pay to carry the channels.”

“Make no mistake: This is not one of those boring cable TV industry battles that have been going on intermittently for years. This is shaping up to be a defining moment in the yearslong decline of cable TV.”

“Charter says it will ditch Disney’s channels permanently if it can’t get the deal it wants. And while that might sound like more of the same bluster, there’s reason to believe Charter executives mean what they say. The cable operator, which is partly owned indirectly by wily cable mogul John Malone, appears to be choosing a moment to squeeze Disney when it is most vulnerable.”

Here’s the crux of the issue:

“What does Charter really have to lose? Like most cable operators, it likely makes little money from offering video anyway. Internet service is where the money is for cable nowadays.”

As TV has generally unbundled from cable to streaming over the past decade, it’s increasingly getting bundled again in new streaming packages by big tech and media companies. Indeed, companies like Disney are fundamentally rethinking their long successful business models facing these changes.

And Big Tech companies, led by Google’s YouTube TV, Apple’s Apple TV Plus, Amazon Prime Video, Disney Plus and a bunch more, are re-bundling cable, after having just unbundled cable over the past few years. Also companies like TikTok, Google YouTube, and Meta among others, are accelerating more abundant content with the ‘Creator Economy’, that will increasingly see bundling of its own, funded by advertising and/or commerce.

These trends, are accelerated by the onset of AI technologies. AI takes previously scarce content, and makes it more abundant, with AI generated ‘Digital Twins’ and ‘Smart Agents’, not to mention ‘Counterfeit People’. This of course, is what’s unsettling the media industry already in terms of its writers and actors.

And this is all further turbo charged by the 'Creator Economy’, which is already a $250 billion revenue business today, and is expected to reach almost half a trillion by 2027 on Goldman Sachs estimates.

We’re on the cusp of an accelerating set of bundling and unbundling ahead. Not just in the context of media services that we’re familiar with, but this content further atomized by software, unbundled and then rebundled at a rapid rate by some of the AI technologies mentioned above.

If one considers how LLM AI works, at a deep level barely understood by its top engineers, new AI software is essentially ‘bundling’ all traditional software, with all forms of data. Then running probabilistic matches at incredible speeds on almost impossible AI software and hardware, and then ‘unbundling’ answers to user queries with unsettling ‘emergent’ responses, and thus ‘behavior’.

In a recent piece titled “Are we there yet?”, I outlined how the AI Tech Wave this time, buttressed uniquely with ‘reinforcement learning' feedback loops, would redefine how ‘content’ is going to be reconstituted and redistributed in newly created ‘Services’, driven by copious new Data, and ever larger LLM AI models with more powerful GPUs.

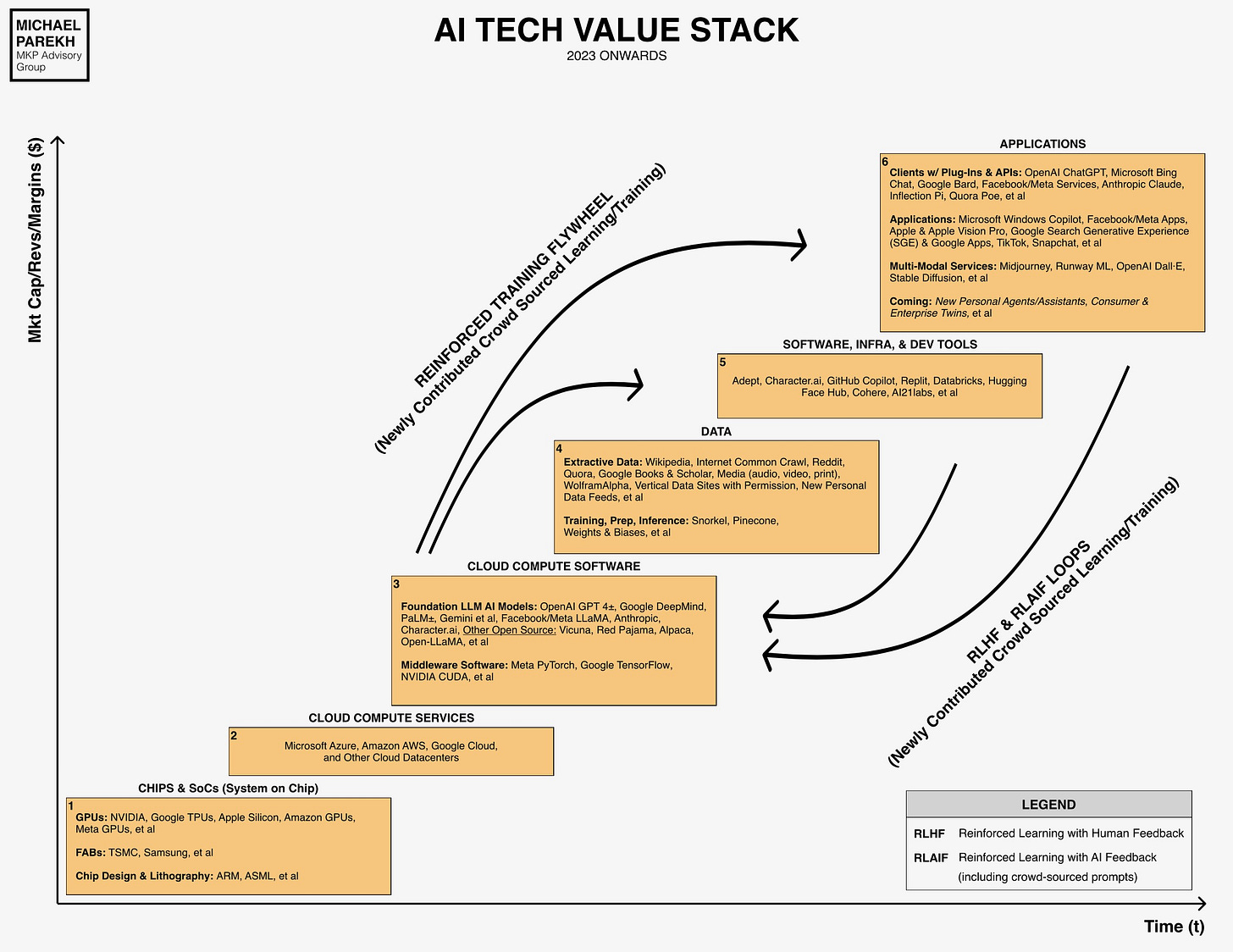

The AI Tech Wave chart above is a way to understand these ‘services’, as they’re enabled by the first five hardware, cloud software and data infrastructure boxes, made more reliable, accurate, and safer over time with the reinforcement loops, driven eventually by endless usage by consumers and businesses.

Both directly, and indirectly through AI ‘smart agents’, bots, and software daemons (more on that soon). Via voice, video and a range of other ‘modalities’.

Note the left axis are general financial metrics like revenues, margins, market cap etc., while the bottom axis is of course time over years.

Services in this context describe how businesses and consumers will directly and indirectly use the underlying AI infrastructure, be it open source or closed paid for API feeds. It could be for a range of LLM AI models. Examples here are Amazon AWS API transaction feeds and fees, OpenAI/Microsoft ChatGPT Enterprise), subscription services, that are of course ad/marketing based services“. Examples here are Google AI-powered Search, TikTok’s AI ‘Entertainment’ feeds, Meta ‘Smart Agents’, and others.

And of course Apple doing its thing with its ‘Everything App’ services, with a wide range of AI opportunities at the Edge, and its upcoming Vision Pro platform (at such a bargain price).

All of those are Services too, and they were one of Apple’s most robust revenues lines in the recent quarter. A lot of bundling and unbundling to come here. Especially media…think court-side seats at the key sports events in the millions.

Also note that the word ‘services’ has different meanings from a software engineering perspective.

The first five boxes in the ‘staircase’ are of course infrastructure tech stack components, built from hardware, networking, chips, software of all types.

Currently, Nvidia is the leading enabler, with its industry leading GPUs, CUDA software, and AI DGX Cloud data center infrastructure, that’s increasingly becoming the ‘Intel Inside’. That was a very successful ‘bundling’ strategy for Intel in the nineties, and is echoed in this generation of semiconductors by Nvidia driving the AI wave.

Nvidia is increasingly ‘bundling’ their AI hardware infrastructure as services, within the leading cloud compute data center company offerings from vendors like Amazon AWS, Microsoft Azure, Google Cloud, Oracle and others. Another ‘bundling’ into data center services, driven in this case by Developers picking their favorite AI software and hardware.

Recognize that all the layers in each Box are changing very fast of course, and this chart will be updated as time goes on.

And at every step of the way, we will see ongoing iterations of bundling and unbundling to make the business models work, as companies seek their ‘product-market-fit’. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)