Given the ongoing public and private market bull run we’ve seen so far in this AI Tech Wave, it was a just a matter of time questioning the current AI ‘Boom’, especially for Nvidia, and its prescient founder/CEO Jensen Huang. The WSJ’s “Nvidia’s Surge Stokes Talks of a Bubble” summarizes it like this:

“Nvidia’s meteoric surge has helped push the stock market to record highs. It also has some on Wall Street saying the “B word.”

“Rising enthusiasm for artificial-intelligence technology has made Nvidia’s chips a must-have product, and in turn, transformed Nvidia into the market’s hottest stock.”

“The stock has risen more than sevenfold since Oct. 14, 2022, and Nvidia is now the third-most-valuable U.S. company, with a market value above $2 trillion. The chip maker added nearly $280 billion in value in just two trading sessions after reporting blowout fourth-quarter results on Feb. 21. It took just 180 trading days for Nvidia’s value to rise to $2 trillion from $1 trillion; it took more than 500 trading days for both Apple and Microsoft to reach that milestone.”

The piece then compares the qualitative and quantitative differences with prior Tech wave bull runs:

“The surge has some Wall Street professionals wondering whether the enthusiasm is morphing into a classic stock bubble.”

“We’re getting a lot of calls from clients about AI stocks,” said Emerson Ham III, senior partner at Sound View Wealth Advisors, who has recommended chip stocks for his clients since 2018. “Whenever anything goes too well, I get nervous. We’re having conversations with clients about taking some cream off the top.”

“Others were more blunt: “The current AI bubble is bigger than the 1990s tech bubble,” wrote Torsten Slok, chief economist at Apollo, in a note to clients last week.”

Yours truly ran one of the leading internet research groups that cycle, so had a first hand look at the fundamentals, market moves, and emotions raging from greed to fear.

The WSJ piece goes on to highlight one key difference this time around (some links mine):

“Bulls and bears on the stock agree on one thing: Nvidia’s rise is accompanied by blowout profits. That sets the enthusiasm over artificial intelligence apart from speculative manias of the recent past, such as cannabis or blockchain stocks.”

“In the most recent quarter, Nvidia earned a profit of $12.29 billion, up from $680 million in the three months that ended in October 2022. Gross profit margins rose to nearly 76%, from 53.6% over that same period.”

“As a result, the stock has actually become cheaper by some measures: Nvidia trades at 32 times its expected earnings over the next 12 months, according to FactSet. The two-year average is 38 times. The S&P 500’s multiple is 20.6.”

“We can’t call it a speculative mania because it trades at lower P/E than it did a year ago. Nvidia is talking the talk and walking the walk,” said Joseph Zappia, principal and co-chief investment officer at LVW Advisors.”

The question of course is are the burgeoning profits and margins SUSTAINABLE, and if so, is it measured in quarters or years.

As a former equity research analyst who has always followed the technology fundamentals first, I would continue to focus on the competitive dynamic realities and perceptions of Nvidia’s grip on AI GPU chips and infrastructure.

On that front, Nvidia has an uncomfortable lead (for competitors and customers) on the underlying AI hardware and ‘free’ CUDA AI software ecosystem around its AI chips and data center infrastructure. The stock will rage both up and down on perceptions of these dynamics. Again, as the WSJ piece highlights:

““I think people are forgetting this is a boom-and-bust company,” said Fred Hickey, editor of the High-Tech Strategist. He is betting against Nvidia through long-dated put options purchased after last month’s earnings report, he said. Nvidia shares have fallen by 50% or more on 14 separate occasions since the company went public in 1999, according to Dow Jones Market Data. Most recently, the stock dropped 56% over a two-month period in 2018 and again over an eight-month period that ended in 2022.”

And unquestionably every chip company on the planet is racing to play in the AI infrastructure game, both for training and inference chips at scale.

Heck, as outlined in these pages on Nvidia, even the company’s best customers like OpenAI, Microsoft, Google, Meta, Amazon and others are racing to roll their own AI chips as fast as possible. But that takes billions in investment, and most importantly, YEARS to get into the game at scale.

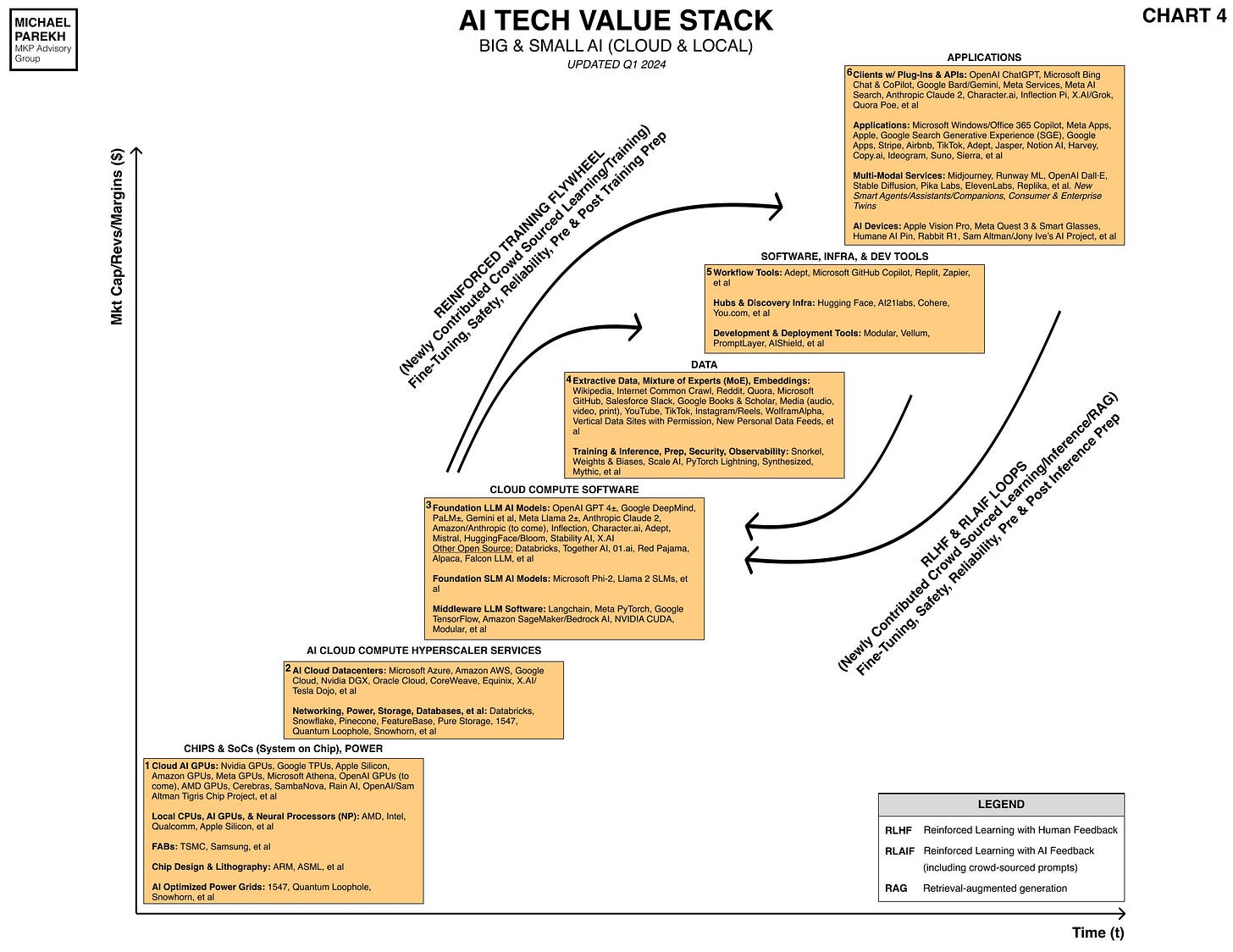

In the meantime, Nvidia is banking software company like margins, more in line with Boxes 5 and 6 above in the AI Tech Wave chart, than what’s typical for Boxes 1 through 4 above. The lower in the tech stack historically, means more cyclicality due to supply/demand and competitive pricing pressures from the strongest and broadest markets above.

The public market investors know this, and thus the expected volatility in Nvidia and other AI driven tech stocks. It’s a long game, with short, hyper fear and greed market pricing cycles. There are opportunities for both short and long-term investors. But as usual, understanding the core technologies, the similarities and key differences with prior tech waves, and clear thinking separating greed from fear, will help win the day. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)