The headlines tomorrow are going to be unvarnished enthusiasm for Nvidia’s quarterly results yesterday, with folks in my former profession of tech equity research all scrambling to update their financial expectations and price targets for Nvidia. It remains ‘front and center’ in the AI boom. Indefinitely.

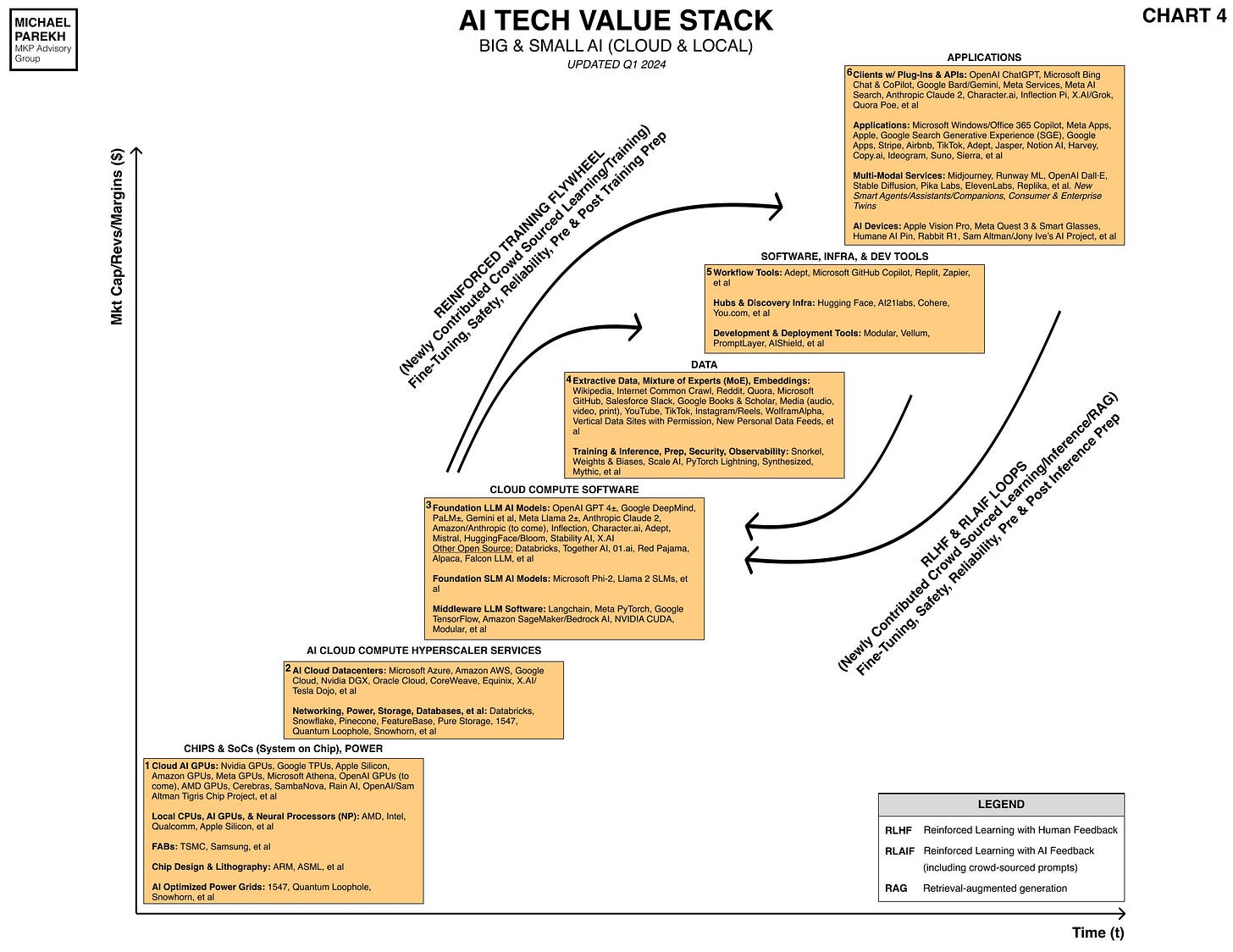

As readers here know, Nvidia remains in the catbird’s seat for AI infrastructure in the multi-year AI Tech Wave gold rush. All the boxes from 2 to 6 below don’t happen without the ‘accelerated computing’ chips and AI data center infrastructure (aka DGX), from Nvidia. As I’ve said many times before, with Nvidia GPUs, ‘AI’ just represents two non-consecutive letters in the English language.

And Nvidia’s ‘overnight’ success led by founder-CEO Jensen Huang, was a multi-decade marathon of near misses, close shaves with corporate death, and canny long-term technology strategies leveraging AI hardware and software. And the music continues for Nvidia, indeed it likely gets louder.

First, let’s get the gawking around the results out of the way. As the WSJ reports in “Nvidia Sales Reach New Heights as Company Forecasts Bigger AI Boom”:

“The chip maker at the heart of the AI craze has had a record run, nearing $2 trillion valuation.”

“Nvidia’s sales more than tripled in its fourth quarter, as the semiconductor maker scrambled to meet the demand for its chips that are powering new artificial intelligence systems.”

“That demand showed up in the company’s results Wednesday. Sales more than tripled in the company’s fiscal fourth quarter from a year earlier and are projected to do so again in the current period. Earnings surged more than eightfold. The results exceeded analyst expectations.

“Nvidia’s results act as a bellwether for the strength of the AI boom, as big tech companies such as Microsoft, Google, and Apple place large bets on the technologyand need Nvidia’s hardware to drive them.”

“In addition to OpenAI’s ChatGPT, a number of other popular AI products have started to hit the market in recent months, including digital assistants for coding and business from Microsoft. Nvidia has transformed itself in the space of three years from a company focused on chips that help videogames run faster to the red-hot center of the AI boom.”

“The company’s stock has soared, including a rise of about 8% after its earnings report on Wednesday. Nvidia crossed the $1 trillion valuation mark in June, and it topped $1.8 trillion before pulling back in the lead-up to Wednesday’s earnings report.”

“Nvidia had revenue of $22.1 billion in its most recent quarter. Net profit was $12.29 billion, compared with $1.41 billion a year earlier.”

Comments by CEO Jensen Huang underlined the long-term nature of the demand for it’s AI infrastructure products, and the necessary ‘careful’ allocation of supply vs the overwhelming demand:

“Chief Executive Jensen Huang described AI as hitting “the tipping point” and indicated demand for the computing power that underlies AI remained astronomical. “Demand is surging worldwide across companies, industries and nations,” he said.”

That last sentence tells you all about the TAM (total addressable market that investment types focus on), that you’d want to know. It’s the mother of all TAMs.

With no end in sight.

I’ll have a lot more to say in future posts about the short and long-term implications of Nvidia’s demand in the context of the exponential changes underway. In both ‘Big and Small AI’ models, both for the ‘Magnificent 7’, and the countless companies big and small building AI products and services on top of them.

For now, let’s get out the umbrella, and just watch Nvidia make it rain. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)