It’s earnings season again for the big tech ‘Magnificent 7’ this past quarter, and year-end 2023. Particularly as AI ‘FOMO’ optimism continues to fuel the markets for now in this AI Tech Wave. As Barron’s put it pithily going into this week:

“For technology investors, this coming week is the Super Bowl. Earnings reports from the five most important companies in the business are just days away. Alphabet and Microsoft provide updates on Tuesday, then Amazon, Apple, and Meta Platforms check in on Thursday.”

Well, today saw Google and Microsoft kick it off first, as Barron’s again noted:

“Alphabet and Microsoft provided updates after the market closed today. Both companies delivered overall earnings beats, but investors still sent the stocks lower.”

“For the Google-parent, search advertising was a slight weak spot.”

The WSJ elaborated on Google, highlighting that the company’s “Ad Sales fell short of Wall Street’s Lofty Expectations”:

“Google’s advertising sales fell short of Wall Street’s expectations, sending shares tumbling despite strong growth in other areas of the search giant’s business.

“Google recorded $65.5 billion of total advertising sales in the fourth quarter, an increase of 11% from the same period last year. Those financial results missed analyst expectations but were a marked turnaround from a year ago, when Google reported its first drop in ad revenue since the beginning of the pandemic. Alphabet parent company of Google, reported fourth-quarter revenue of $86.3 billion, up more than 13% from the same period last year. The results marked the company’s fourth straight quarter of accelerating sales growth.”

“Google’s ad and cloud-computing businesses have faced heightened scrutiny following recent earnings reports, as the company attempts to overcome the perception that it has fallen behind rivals in artificial intelligence while trying to maintain business growth.”

“Sales in Google’s cloud-computing business climbed 26%, recovering somewhat following a disappointing third quarter that some investors viewed as a sign of weak demand for the company’s AI services. Revenue in that unit increased to $9.2 billion, reversing a slowdown in growth.”

“Alphabet’s shares, which had gained about 10% this year through Tuesday’s close, dropped more than 5% in after-hours trading.”

“The company is pouring resources into artificial-intelligence systems, an area that has also captivated fellow tech giants such as Meta Platforms and Microsoft Chief Financial Officer Ruth Porat said AI was increasingly contributing to growth in the cloud division, without giving specific financial numbers.”

Microsoft fared relatively better in Wall Street’s eyes, especially on the AI front.

Again, as the WSJ noted in “Microsoft Earnings Jump as AI Demand Boosts Cloud Unit”:

“Microsoft recorded its highest profit growth in more than two years as excitement about artificial intelligence helped power the growing demand for its cloud services.”

“Microsoft’s net income rose 33% to $21.9 billion in the three months through December. That is the strongest quarterly expansion for the company since the quarter ended September 2021.”

“The company has been on a run since last year. It has been the vanguard of current investor enthusiasm that new AI-driven products will transform the industry, helping Microsoft to dethrone Apple as the company with the highest market value in the world. It also climbed above $3 trillion in market capitalization last week, becoming only the second company after Apple to reach that mark.

“A growing body of evidence makes clear the role AI will play in transforming work,” Microsoft Chief Executive Satya Nadella said on an earnings call.”

Remember that these results by Google and Microsoft, along with Meta, Amazon and others this week, bodes particularly well for Nvidia’s momentum in AI GPUs and infrastructure in this gold rush. At least for the next couple of years as I’ve highlighted in other posts.

For now, these big tech companies continue to be the tail that wags the dog as far as the broader markets are concerned. Especially driven by the AI investment enthusiasm worldwide. Again, as Barron’s noted separately as well:

“Apple, Tesla, and the Rest of the Magnificent 7 Are Larger Than Entire Countries’ Stock Market”

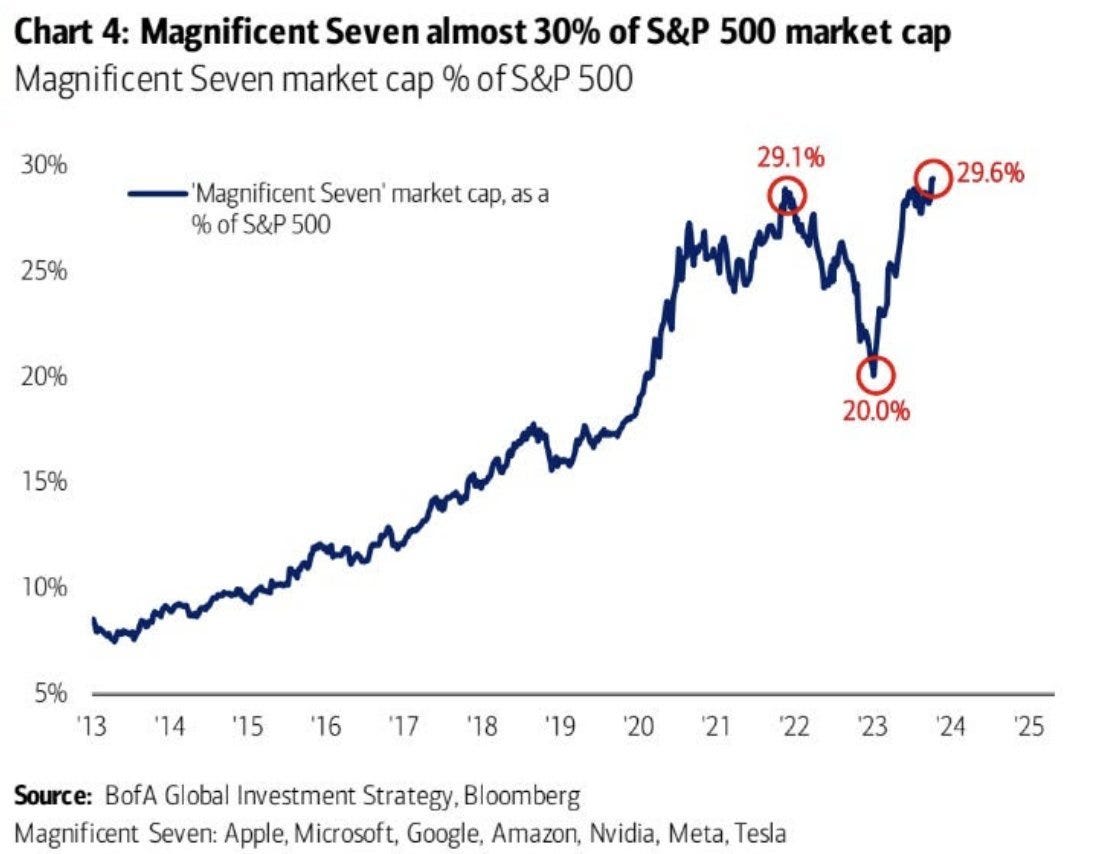

“The Magnificent Seven stocks’ meteoric rise has led to concerns about their lofty valuation and overconcentration in the stock market today.”

“Combined, the seven names— Amazon, Apple, Alphabet, Microsoft, Meta Platforms, Tesla, and Nvidia —boast nearly a $12 trillion market cap, making up 28% of the S&P 500 and nearly 23% of the entire stock market in the U.S.”

“To further put it in perspective, the seven stocks alone are four times the market cap of the entire Russell 2000, notes Torsten Slok, chief economist at Apollo Global Management. The group is also larger than any single country’s stock market except for the U.S., data shows.”

“All stocks trading on China’s Shanghai and Shenzhen exchanges are worth a little over $8 trillion, just two-thirds the size of the Magnificent Seven.”

Useful context to keep in mind, this early in the AI Tech Wave. Let’s see how Thursday goes for the other big tech names. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)