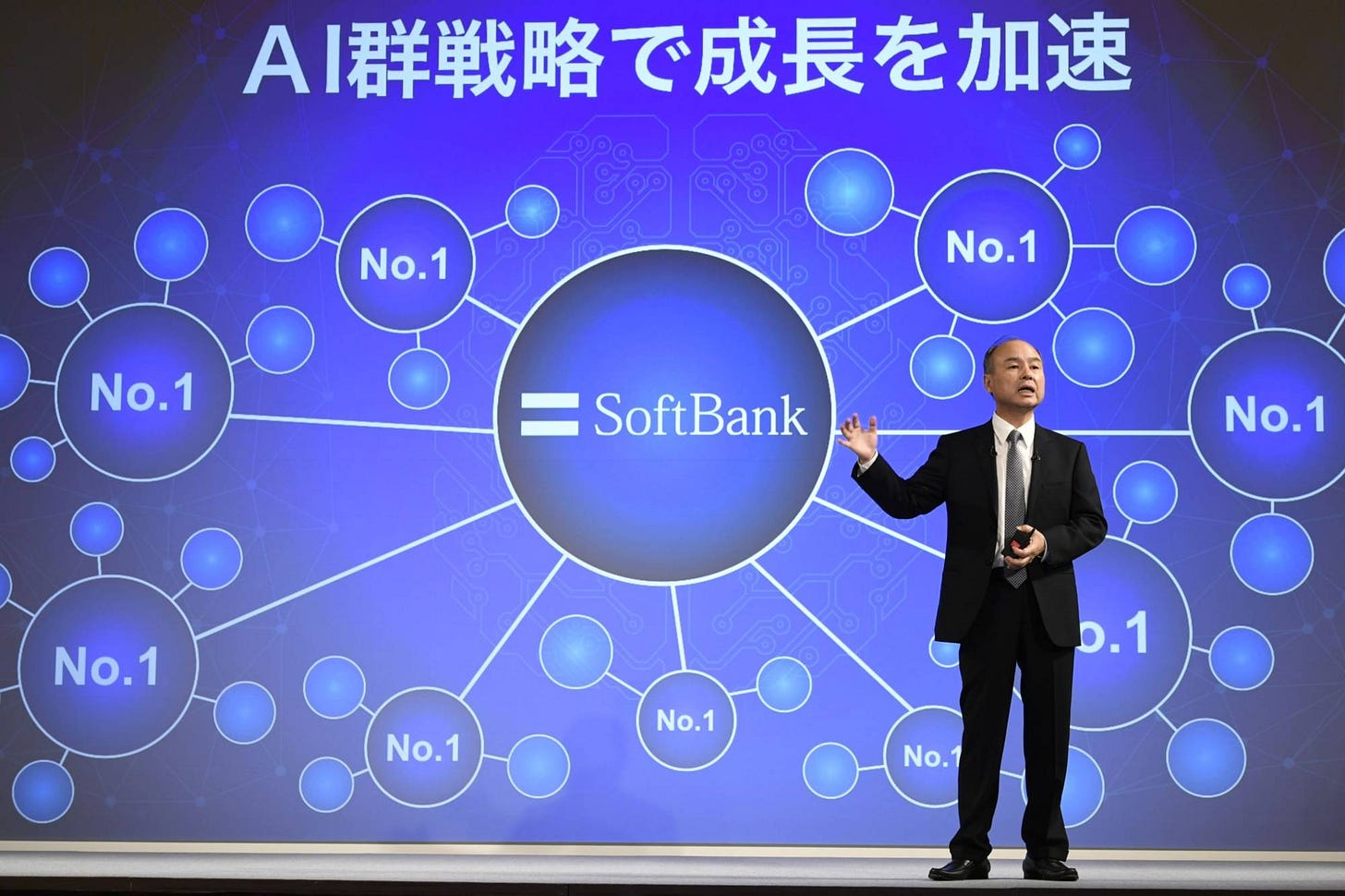

For those not in the tech business, Masayoshi Son, founder and CEO of Softbank may not have much resonance. But he’s been a propelling force in technology through the PC, Internet and for several years now, far before OpenAI’s ‘ChatGPT moment’, the AI Tech Wave.

Google him and you’ll discover all types of stories documenting his historic ups and downs, successes and failures, supremely timed opportunities and missed opportunities. Including the ups and downs of his Vision Funds.

And he’s a polarizing figure for so many depending on their perspectives. From my perspective, he’s been a net positive for the technology industry over the last forty years. (Disclosure: I was the Internet analyst at Goldman Sachs, when it led the IPO of Yahoo! 1996, and the Firm engaged with Masa Son and Softbank in the 1990s).

What brings this to mind today is this latest Information piece “Softbank’s Masayoshi Son Looks for Investing Redemption”:

“Son has focused on a secretive SoftBank investing operation separate from the Vision Fund, which is working on an effort that goes by the code name Project R, according to people with direct knowledge of the matter. Through it, Son has made hefty bets on a nascent autonomous vehicle startup and a new warehouse as a service venture. Artificial intelligence is another area of focus for the project.”

Note that Masa Son has been focused on AI and robotics, amongst other tech areas for some years now. They resulted in his early investments in semiconductor companies like Arm Holdings (2016) and Nvidia a few years ago. I’ve discussed both in recent posts.

And of course Masa Son has had multiple ‘once in a lifetime’ type of successes with his early investments in the rise of the internet in Asia, with his early Vodaphone investment in Japan which turned into the leading broadband telecommunications provider inn that country, Coupang in South Korea, and Alibaba in China, one of his biggest successes.

In recent days of course, there’s been the reports of him potentially investing a billion or more in a new AI device by OpenAI’s Sam Altman and former Apple uber-design chief Jony Ive:

“But Son is still getting close to the AI action. As The Information first reported, he has participated in discussions with Altman and Ive, who played a key role in designing the iPhone and other smash Apple products, about a device that would feature AI at its core. The Financial Times later reported that OpenAI is in advanced talks to launch a new venture to build the device, with over $1 billion in SoftBank funding.

“It’s strategic Masa,” said a person close to SoftBank. “He’s not [just] trying to place a bet on Uber or WeWork, but trying to be involved in business creation.”

I had a recent piece on how in these early days of AI, the game is wide open in terms of how AI gets delivered to consumers and businesses at scale, and the meaningful experimentation it’s going to take to figure out the eventual ‘product-market-fit’ of these applications and services.

Looks like it’s also driving Masa Son currently. As the Information piece highlights, Masa Son is actively focused on his ‘next act’:

“The 66-year-old billionaire—whose fortunes have swung wildly over decades of investments in the tech industry—lately seems to be in a melancholy mood as he reflects on what he has achieved over his career. At a June shareholder meeting, Son said he had been thinking “about the rest of my time as a businessperson,” “felt ashamed that I made many mistakes, bad investments,” and had been filing hundreds of patents himself.”

“How many years do I have? How many years [are] there for me? What have I done?” he said through an interpreter, adding: “Sometimes I felt a bit sad.”

“It’s easy to understand his lack of cheer. Over the last six years, SoftBank spent more than $150 billion in outside money and its own capital investing in startups through two Vision Funds, without a lot to show for it.”

Sounds like he’s pretty motivated to figure out his next up cycles, financial and secular. He remains a formidable presence and platform in the world of technology investment, with multiple decades of ‘pattern recognition’. Would re-iterate here that Masa Son despite his many dynamics with both financial and secular technology cycles, should not be under-estimated going into this AI cycle. Stay tuned.

(Update: The Information had a subsequent piece on Masa Son’s ‘Project R’, his ‘next act’, that may be of interest).

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)