As I look at my AI outlook pieces for 2023 and the next three years, as well as several pieces on AI chip infrastructure challenges for the industry, the issue of the world’s chip dependence on Taiwan and China comes up front and center. Have discussed at length the dependencies on Taiwan Semiconductor for most of the chips for the tech industry, with the AI just being the latest key layer of demand. Nvidia, whose AI chip infrastructure drives the majority of the AI Tech Wave going into 2024 and beyond gets all their chips made in fabs at TSMC, in Taiwan.

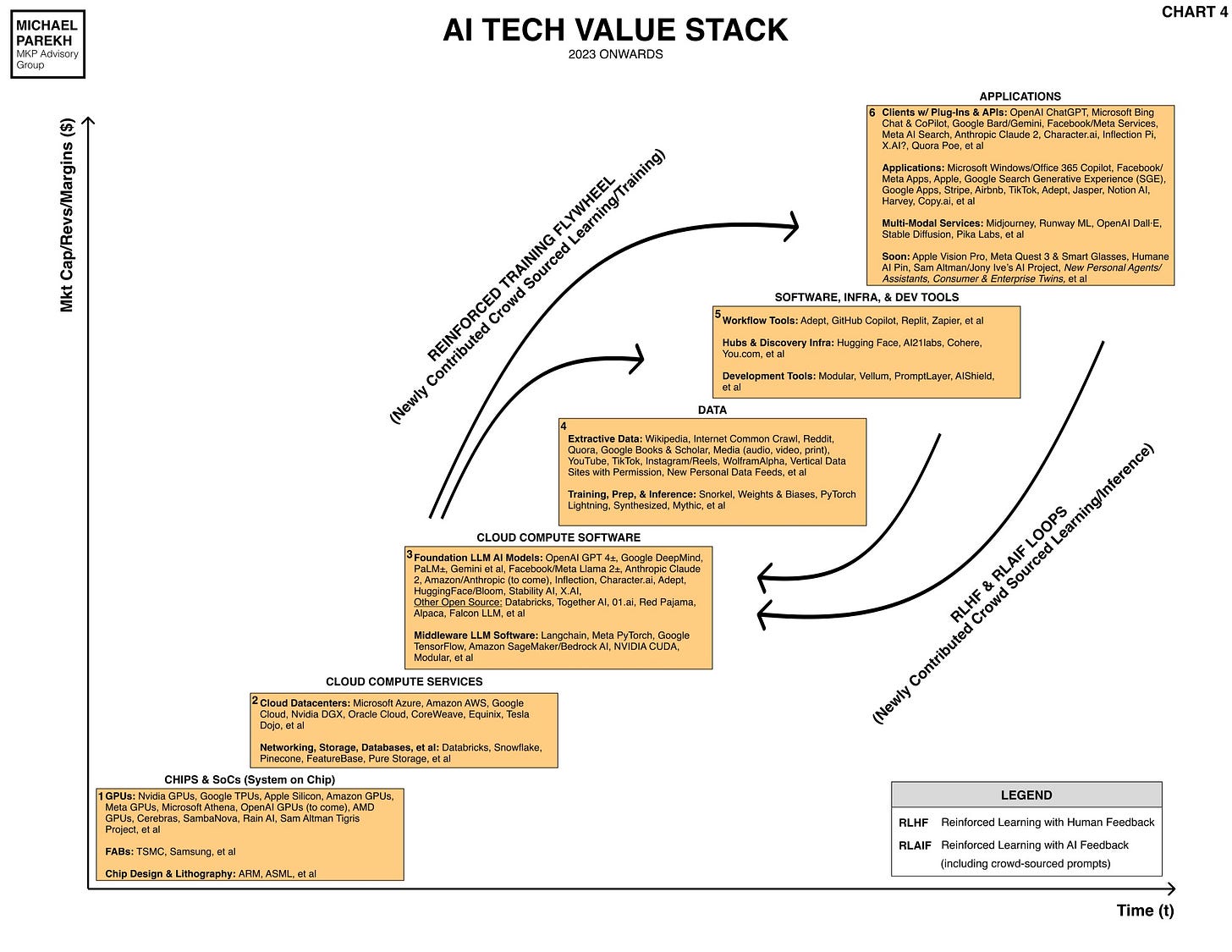

We’re talking about of course the critical Box number one below, where all the AI infrastructure starts, from the chip making companies to the chip designers and the manufacturing ‘fab’s themselves. The underpinnings of the multi-hundred billion AI tech investment wave well underway.

So it’s important to recognize that a possible ‘relief’ point for the world’s anxiety over chips may be the place that was the original perceived ‘competitive threat’ to the US’s technology leadership back in the 1980s.

I’m talking of course about Japan. Japanese tech industry may ironically be the near-term answer to the worl'd’s chip infrastructure concerns while the US and China figure out how to ‘thread the needle’ on their co-dependencies and national security issues.

Nvidia’s founder/CEO Jensen Huang was just in Japan and highlighted this point directly, highlighting that Jensen Huang

“Said on Monday his company would do its best to supply its artificial intelligence processors to Japan amid extremely high market demand.”

“Japan is rushing to rebuild its once world-leading semiconductor infrastructure and catch up on the development of AI technology. The graphics processing units (GPUs) made by U.S.-based Nvidia dominate the market for AI.”

"Demand is very high, but I promised the prime minister we will do our very, very best to prioritise Japan's requirements for GPUs," Huang told reporters at Prime Minister Fumio Kishida's official residence in Tokyo.”

Japan is proactively and opportunistically stepping up to the plate to accelerate chip opportunities:

“Huang's visit came less than two weeks after Japan passed an extra budget that included about 2 trillion yen ($13.60 billion) earmarked for chip investment.

Some of the funds are expected to be used to support Taiwanese chipmaker TSMC (2330.TW) and chip foundry venture Rapidus, which aims to manufacture cutting-edge chips in Japan's northern island of Hokkaido.

"The semiconductor industry that Japan is now starting to grow and foster will be able to produce GPUs," Huang said.”

As Bloomberg explains, TSMC is weighing a third chip plant in Japan with cutting edge 3nm technology, with the investment coming in at $20 plus billion over the coming years.

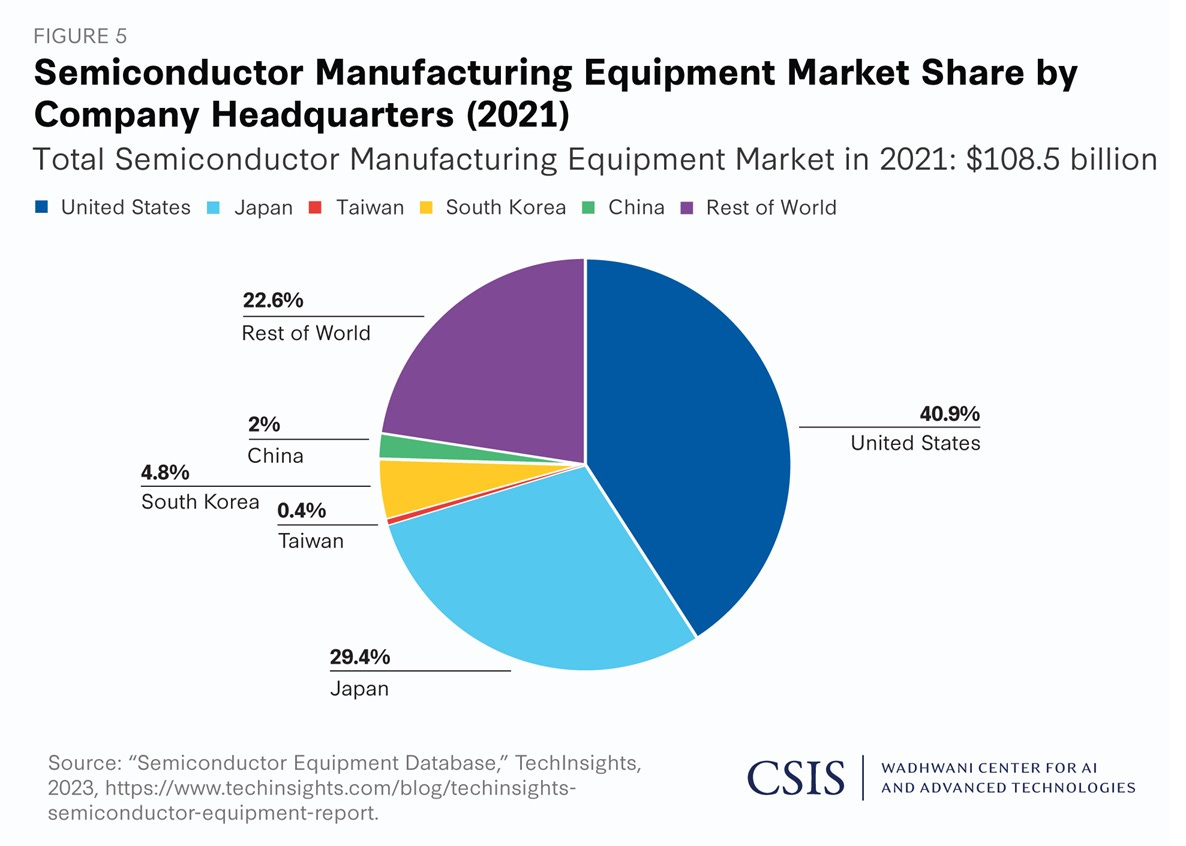

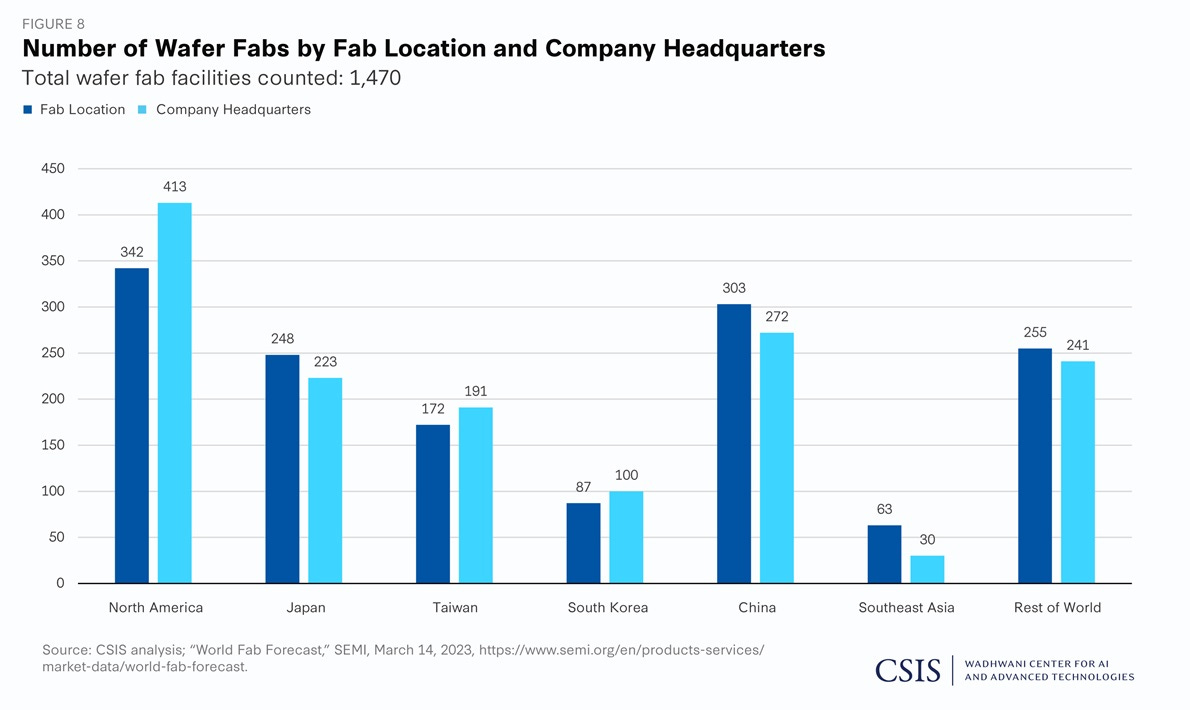

Japan is not just about the ‘fabs’ for next generation chips, but also has incumbents like Canon, startup companies like Rapidus and others, that are ramping up to provide the state of the art chip making equipment currently provided by companies like ASML of the Netherlands in the EU. More to the point, Japan has an existing, deep supply chain that can provide the tools and materials for ramping up this expansion at scale.

As economist writer Noah Smith notes in his latest piece (worth a full read):

“Japan is especially important for making the tools that are used to make chips — you hear a lot about the Netherlands’ ASML, but Japan is actually the second biggest toolmaker for the industry, behind only the U.S.”

“An area where Japan is even more dominant is photoresist — a material used to make the molds used to carve computer chips. As of 2022, Japanese companies had a combined photoresist market share of more than 72%.”

“There are a few more examples like this. Chipmakers who put their fabs in Japan will have easy access to these pieces of the supply chain. But even more importantly, those Japanese semiconductor tool and component industries employ a whole lot of engineers who know a whole lot about making chips. Those engineers form a deep skilled workforce that companies like TSMC, Samsung, Micron, and the rest will be able to draw from.”

“In fact, Japan also has a lot of existing fabs.”

Useful to remember at a time when US/China tussles over AI tech and chips are in the news. And while countries like India and others are ramping up their capabilities to make chips and upstream advanced tech products like iPhones for Apple/Foxconn at scale.

The land of the rising sun, Japan, is a key player in the tech and AI infrastructure landscape ahead. Glad they’re ramping up as more than a ‘backup’. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)