AI: Rise of the AI data center 'Neoclouds'. RTZ #558

...the fast-charging new cloud builders like CoreWeave et al

With a potential trillion dollar plus remaking of AI driven data centers in this AI Tech Wave, it’s inevitable that a new cluster of companies are emerging. They’re building furiously behind the core cloud services providers (CSPs) like Amazon AWS, Microsoft Azure, Google Cloud and Oracle Cloud. These are the ‘neoclouds’, represented by CoreWeave, Lambda, Crusoe and many others worldwide. And they’re in some cases backed by the core AI GPU provider Nvidia itself, an investor in CoreWeave for example.

These neoclouds are rapidly getting the interest of equity and debt investors, from bluechip financial, corporate, and sovereign investment funds.

As the FT highlights in “Wall Street frenzy creates $11bn debt market for AI groups buying Nvidia chips”:

“Wall Street’s largest financial institutions have loaned more than $11bn to a niche group of tech companies based on their possession of the world’s hottest commodity: Nvidia’s artificial intelligence chips. Blackstone, Pimco, Carlyle and BlackRock are among those that have created a lucrative new debt market over the past year by lending to “neocloud” companies, which provide cloud computing to tech groups building AI products.”

“Neocloud groups such as CoreWeave, Crusoe and Lambda Labs have acquired tens of thousands of Nvidia’s high-performance computer chips, known as GPUs, that are crucial for developing generative AI models. Those Nvidia chips are now also being used as collateral for huge loans. The frenzied dealmaking has shone a light on a rampant GPU economy in Silicon Valley that is increasingly being supported by deep-pocketed financiers in New York.”

“However, its rapid growth has raised concerns about the potential for more risky lending, circular financing and Nvidia’s chokehold on the AI market. The $3tn tech group’s allocation of chips to neocloud groups has given confidence to Wall Street lenders to lend billions of dollars to the companies that are then used to buy more Nvidia chips. Nvidia is itself an investor in neocloud companies that in turn are among its largest customers.”

The debt providers of course have the AI GPU chips to lend against, an asset worth its weight in gold almost, amidst the AI Gold Rush:

“Critics have questioned the ongoing value of the collateralised chips as new advanced versions come to market — or if the current high spending on AI begins to retract. “The lenders all coming in push the story that you can borrow against these chips and add to the frenzy that you need to get in now,” said Nate Koppikar, a short seller at hedge fund Orso Partners. “But chips are a depreciating, not appreciating, asset.”

The biggest of the neoclouds is CoreWeave, a company that had one of the timeliest pivots in tech history not so long ago:

“The CoreWeave connection New Jersey-based CoreWeave, the largest neocloud company, began amassing chips when it launched in 2017 to mine cryptocurrency but pivoted to AI two years later. The company now claims to be the largest private operator of Nvidia GPUs in North America, with more than 45,000 chips. “CoreWeave’s initial success was securing GPU capacity from Nvidia at exactly the moment when ChatGPT and AI hit its Cambrian explosion,” said an executive at one of its largest investors. Backed by venture capitalists and Nvidia, its valuation has soared from $2bn to $19bn in the past 18 months. The company is planning an initial public offering in the first half of 2025 that could value it even higher”.

And they have a long list of equity and debt investors:

“CoreWeave has raised more than $10bn in debt in the past 12 months from lenders including Blackstone, Carlyle and Illinois-based hedge fund Magnetar Capital. It announced a further $650mn credit line from Wall Street banks including JPMorgan, Goldman Sachs and Morgan Stanley this month. The debts are secured against CoreWeave’s stock of Nvidia GPUs and the capital is used to buy thousands more. It plans to have 28 data centres across the US and Asia by the end of 2024, nine times its footprint at the start of last year.”

With rising metrics on both sides of the balance sheet:

“The financing means CoreWeave is extremely highly leveraged. When it announced its first $2.3bn debt financing in August 2023, which included about $1bn of loans from Blackstone, it had annual revenues of just $25mn and negative ebitda of roughly $8mn, said two people close to the company. Revenues have since surged to about $2bn this year, one of the people said. CoreWeave declined to comment on its finances. Some of CoreWeave’s largest lenders were persuaded to invest because of a large contract it had negotiated with Microsoft — the biggest backer of OpenAI — last year that would generate revenue of more than $1bn over several years, said several people with knowledge of the deal. “The Microsoft contract was critical,” said a person close to the deal. “They won the contract then said we need $2bn of GPUs, which we were able to finance.”

“Like traditional asset-backed lending, in the event of a default, the lender would own the GPUs as well as the contracts — known as power-purchase agreements — with the companies that lease them. CoreWeave’s success raising large sums of private debt has prompted more lenders into the space. Although most neocloud companies are venture-backed, they are unusual among start-ups for high-capital expenditure, requiring them to turn to credit markets to fund expansion.”

The smaller neoclouds are aggressively following CoreWeave’s lead:

“Macquarie loaned $500mn to Lambda Labs in April, and Crusoe raised $200mn of debt from New York investor Upper90 last year. The Financial Times reported last week that Crusoe was also raising $500mn of equity capital from investors including Peter Thiel’s Founders Fund. In October, Crusoe finalised a $3.4bn deal with Blue Owl Capital, an alternative asset manager, to finance a new data centre in Texas that will lease computing capacity to Oracle and OpenAI. “The scale of the investment makes a lot more sense once people start recognising this is the biggest capital investment in human history,” said Crusoe chief executive Chase Lochmiller.”

And the linchpin now of course is any sort of relationship with Nvidia:

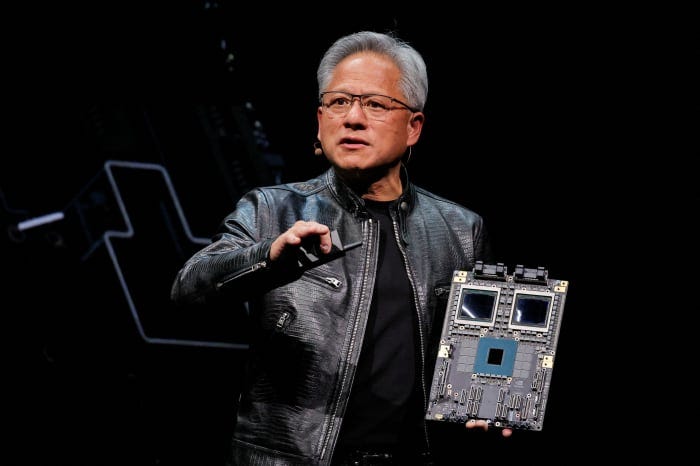

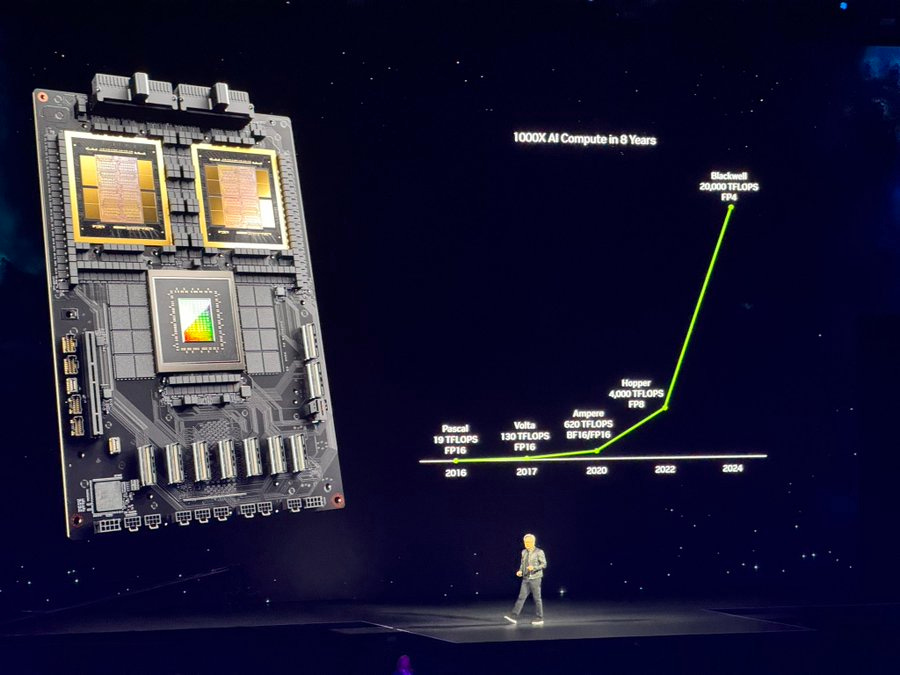

“Exposure to Nvidia Neoclouds are highly dependent on their relationships with Nvidia. For example, CoreWeave was able to get access to tens of thousands of H100 chips as a “preferred partner” of the chip giant but its future growth is reliant on having the same access to Nvidia’s newer Blackwell chips. Nvidia has denied it gives preferential access to its chips to any customer, including those that it invests in. “We don’t help anybody jump the queue,” Mohamed Siddeek, head of Nvidia’s venture capital unit NVentures, told the FT last year.”

“It’s a good thing from a lender’s perspective,” said one of the bankers on the debt deals. “They have control the whole way up the supply chain. That’s a good thing as Nvidia won’t let things get too bad.”

Investors are of course trying to gauge the value of the collateral:

“But the price of GPUs trading in some markets has crashed in recent months. An hour of GPU compute now trades at about $2, down from $8 earlier this year. Even as demand for the chips has continued to rise, supply has improved as reserves of the hardware have been resold, while competition over the number of companies building foundation AI models has narrowed. Some tech giants are developing their own AI chips, while rivals such as AMD have also been racing to release their own high-performance GPUs to challenge Nvidia’s supremacy. “A year ago having access to GPUs was like having a golden ticket to Willy Wonka’s factory,” said a senior executive at one of the large lenders to CoreWeave. “That’s no longer the case.”

And investors are also trying to weigh the valuations of these deals, as the Information highlights here:

“Take Lambda, a 12-year-old startup that rents out Nvidia chips to AI developers via its cloud service and on-premise servers. It has told investors it expects to generate $400 million in revenue this year, according to a person familiar with the deal discussions. That’s decent growth on the $250 million Lambda had expected to generate in 2023 but not as good as the $600 million it originally projected for this year.”

“That lower-than-projected revenue growth may be why the San Jose-based company has discussed raising $600 million at a $2 billion pre-money valuation. The new valuation would reflect a roughly five-times multiple 2024 revenue, roughly at the level of chipmaker Qualcomm and semiconductor equipment company Applied Materials, both of which are growing at single digit percentage levels. (On the other hand, Lambda’s 2023 funding of $300 million was also done at a five times multiple.)”

“Other startups that provide Nvidia chips to developers have also fetched relatively low valuations (though not quite as low as Lambda). Last year, CoreWeave projected it would generate $2.4 billion in revenue this year. In May, CoreWeave raised debt and equity at a $19 billion valuation, implying a roughly eight times valuation multiple on projected revenue.”

“On the higher end is Crusoe, yet another provider of computing services. In its last round in April 2022, Crusoe was valued at $1.4 billion and generating revenue at a pace of $100 million per year, translating to a 14 times valuation multiple. It’s now in talks to raise a new round of equity led by Founders Fund, with a valuation expected to be over $2 billion. Its recent revenue projection couldn’t be learned.”

“These cloud computing providers tend to be more capital-intensive than software companies because they buy Nvidia chips that they rent to customers. While gross margins for software companies like Salesforce and GitLab range between 75% to 91%, the cloud startups’ margins are likely to be in line with public cloud companies, like DigitalOcean’s roughly 60% margins. That would explain the lower valuations.”

“High capital costs are also pushing startups that are designing chips to raise more venture funding.”

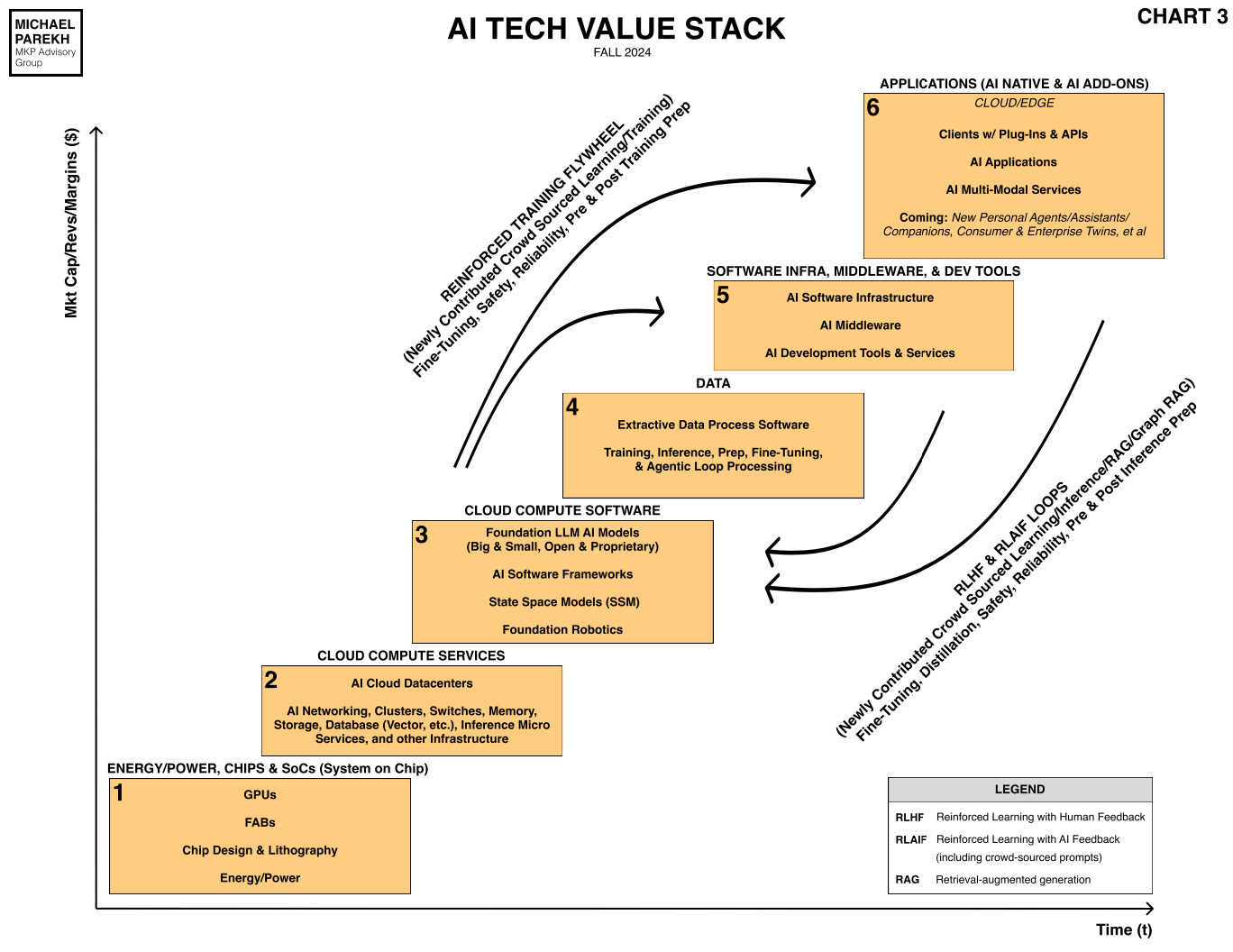

These valuation differentials are of course explained by the relative position of these neoclouds in the lower boxes of the AI Tech Stack above. But they’re critical for the rapid building of the AI data centers needed by the major LLM AI companies, and to their customers to provide the Data, and AI applications and services in Boxes 4 and 6 respectively.

That’s the core race for this year and beyond, with Nvidia, TSMC, SK Hynix and other AI infrastructure providers being the key near-term beneficiaries. And that trend has a few years to go. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

Interesting and valuable article. Thank you. According to IBD... $NVDA just invested $700 in $NBIS

https://www.investors.com/news/technology/nebius-stock-nebius-group-nvidia-investment/?_gl=1*p6xhi6*_gcl_aw*R0NMLjE3MzI1MzgzNjQuQ2p3S0NBaUEzWkM2QmhCYUVpd0FlcWZ2eW5Nd3hwYW5BdVQ1cHQ0Y0wtdlNVWk93c2JYM3RkMlFFQmJMM05QYlBiajdfRElabkp0dUVSb0NaQndRQXZEX0J3RQ..*_gcl_au*MTg1OTMwMzk5Mi4xNzMyNTM4MzY0*_ga*MTQwOTY1NjAyNi4xNzMzMjE4NzY4*_ga_K2H7B9JRSS*MTczMzIxODc2OC4xNC4xLjE3MzMyMTg4MDUuMjMuMC4w