AI: Wall Street leans in to AI 'Compute' capex. RTZ #544

...despite rising fundamental and financial AI concerns

Wall Street is climbing up the ‘Walls of Worry’ around AI investments, for now.

The last few weeks have seen a series of posts here highlighting the ongoing Wall Street debate between two camps in this AI Tech Stack: those leaning into the massive AI Compute Capex investments, and those focused on questions regarding the AI Scaling roadmap, and the timing of investors returns via new AI products and services. And I’ve generally concluded that these will be tough to sync up, with the rewards typically lagging the investments, sometimes by a lot.

For now, the leaning into AI Infrastructure investments continue, as Bloomberg highlights in “Wall Street's Elites Are Piling Into a Massive AI Gamble”:

“Finance’s biggest names are ready to gatecrash the artificial-intelligence party. “

“At a dinner hosted by some of Morgan Stanley’s top bankers in New York last month, one topic dominated the table talk: the fortunes to be made from the frenzy around artificial intelligence.”

“In the room were many of the marquee names of private capital. Apollo Global Management Inc., Ares Management Corp., Blackstone Inc., HPS Investment Partners, KKR & Co. and Oaktree Capital were all invited, the very same firms who’ve recently emerged as a serious threat to Wall Street banks’ long reign over the lucrative world of corporate finance.”

I’ve highlighted similar enthusiasm for AI investments abroad as well, particularly in the middle east.

Bloomberg continues:

“But on the night in question Morgan Stanley was preaching unity, according to people who attended. So massive is the demand for investment dollars to build the scaffolding for the latest digital revolution, it argued, that there’s no need to compete over who gets to do the lending. Bankers and private financiers should instead be ready to combine their forces — and their firepower.”

“While much of the speculative hype around AI has played out in the stock market so far, as seen in chipmaker Nvidia Corp.’s share price, the giddiness is spreading to the sober suits of debt finance and private equity.”

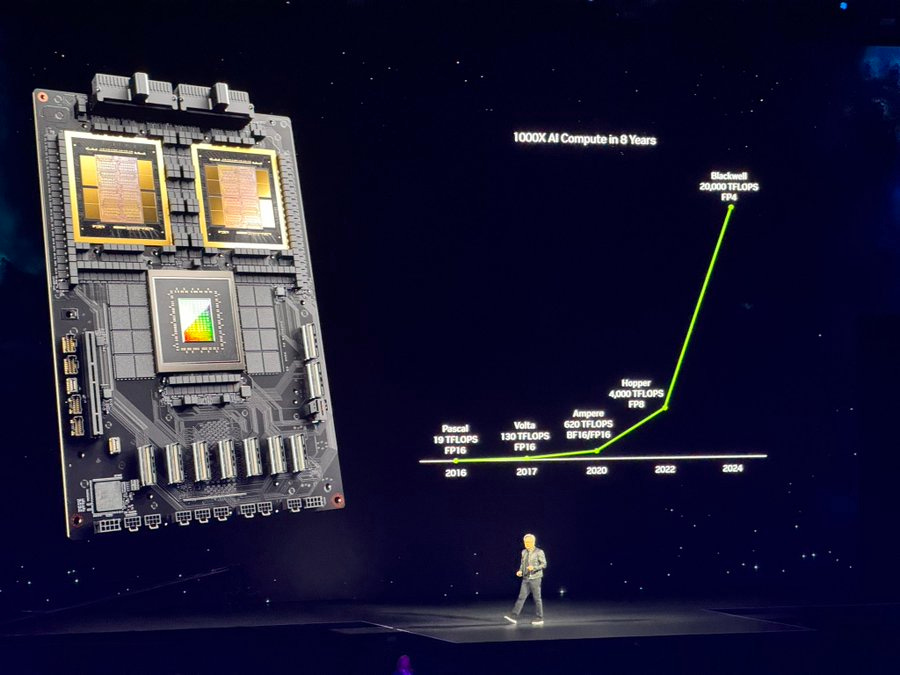

Nvidia, TSMC and other AI semiconductor companies remain the foundation of the AI Infrastructure capex boom for now.

“Analysis by Bloomberg News estimates at least $1 trillion of spending is needed for the data centers, electricity supplies and communications networks that will power the attempt to deliver on AI’s promise to transform everything from medicine to customer service. Others reckon the total cost could be double that.”

“Even Wall Street skeptics on AI’s ultimate money-making potential, such as Goldman Sachs Group Inc.’s head of equity research Jim Covello, have said it’s worth staying invested in those who provide the plumbing. The wealth of Silicon Valley’s and Seattle’s tech giants, who want some of this capacity anyway for cloud storage and the like, offers a degree of comfort.”

This debate is of course one I’ve discussed in detail.

“Banks are racing to keep up with the burst of activity. JPMorgan Chase & Co. has set up a dedicated infrastructure team to corral its troops, according to a person with knowledge of the matter, as has Deutsche Bank AG and others. One rival banker admits his firm is juggling so many data-center deals that it doesn’t have enough staff to cope with the workload.”

“It’s the same for debt funding. At its dinner, Morgan Stanley said banks don’t have the balance-sheet heft to satisfy the thirst for credit, hence its pitch to partner up with private capital: There’s room at this feast for everyone.”

“For investment bankers, the opportunity arrives just as many were hunting their next meal ticket. Providing debt financing to companies has long been a crucial Wall Street profit engine, but the business has been through a rough patch of late. While public equity markets have been going gangbusters over the past couple of years, supercharged by AI mania, returns on investment-grade credit have been anemic. Leveraged-finance teams, who fund riskier private equity buyouts, have suffered as M&A dried up.”

Power for these AI data centers is of course also in the mix. Both via equity and debt investments.

“It’s not just the funding of mammoth new data centers coming to the rescue. Two of corporate finance’s dustiest corners have been shaken into life by the tech industry’s hunger for processing power: Utilities and telecommunications are suddenly among the hottest credit markets around.”

“For private-market behemoths like Apollo and KKR, digital infrastructure is also a chance to turn the page on a tough period when higher interest rates upended the economics of deals struck in the cheap-money era. Firms including Blackstone, Brookfield Infrastructure Partners and Stonepeak Partners have been gobbling up data centers and laying the groundwork to build them, too.”

“BlackRock CEO Fink Sees ‘Dawning of Infrastructure’”

“BlackRock Inc.’s boss Larry Fink told Bloomberg TV his firm will raise as much as $120 billion in debt linked to data centers, after teaming up with Microsoft Corp. to bankroll the development of the buildings and energy infrastructure. Bankers and private lenders will be desperate for a slice of such deals.”

Some of the risks of course is in building the facilities at the scale required, a turbulent topic I covered yesterday.

“Nonetheless, even amid the AI delirium there are notes of caution. Some point out that while private equity firms have a solid pedigree in real estate, they haven’t done construction work at the epic scale and expense of some of these data centers — known as “AI factories” in the lingo of Nvidia’s founder and chief executive officer, Jensen Huang. Innovation is constantly upending technology, adding jeopardy to long-term capital projects.”

“And AI’s acolytes still haven’t dreamed up a “killer app” to match the wildly successful e-commerce and GPS location-based upstarts of the Web 2.0 era. Even if they do, the tech industry’s brightest minds are working to make the software and hardware more efficient, to lessen the need for scale and power.”

The whole piece is worth reading in full, especially given the scale and complexities involved.

For now, the investment camp is leaning into this AI Tech Wave opportunity, despite the walls of worry on Wall Street possibly ahead. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

The above reminds me a little of the story of the oil prospector who died and went to heaven. And St. Peter said, ‘Well, I checked you out, and you meet all of the qualifications. But there’s one problem.’ He said, ‘We have some tough zoning laws up here, and we keep all of the oil prospectors over in that pen. And as you can see, it is absolutely chock-full. There is no room for you.’

And the prospector said, ‘Do you mind if I just say four words?’

St. Peter said, ‘No harm in that.’

So the prospector cupped his hands and yells out, ‘Oil discovered in hell!’

And of course, the lock comes off the cage and all of the oil prospectors start heading right straight down.

St. Peter said, ‘That’s a pretty slick trick. So,’ he says, ‘go on in, make yourself at home. All the room in the world.’

The prospector paused for a minute, then said, ‘No, I think I’ll go along with the rest of the boys. There might be some truth to that rumor after all.’