AI: Healthy Wall Street debates around AI. RTZ #490

...Goldman Sachs publicly discusses AI Tech Wave pros and cons

Today’s piece is on the ongoing debate around this AI Tech Wave that I’ve long written about around the Scaling AI infrastructure investments vs the eventual returns to the companies and shareholders. And it’s a bit personal. Let me explain.

The NY Times has a timely piece asking “Will A.I. Be a Bust? A Wall Street Skeptic Rings the Alarm”:

“Jim Covello, Goldman Sachs’s head of stock research, warned that building too much of what the world doesn’t need “typically ends badly.”

It’s personal of course because I spent over two decades at the Firm from 1982 on, with most of the last decade as the head of Internet Research. And had the pleasure of knowing and working with Jim as a semiconductor analyst. As well as others mentioned in the NYTimes piece, especially George Lee, the current co-head of the Firm’s geopolitical advisory business.

But first some more context around the AI debate at Goldman Sachs (GS):

“Mr. Covello, the head of stock research at Goldman Sachs, has become Wall Street’s leading A.I. skeptic. Three months ago, he jolted markets with a research paper that challenged whether businesses would see a sufficient return on what by some estimates could be $1 trillion in A.I. spending in the coming years. He said generative artificial intelligence, which can summarize text and write software code, made so many mistakes that it was questionable whether it would ever reliably solve complex problems.”

“The Goldman paper landed days after a partner at Sequoia Capital, a venture firm, raised similar questions in a blog post about A.I. Their skepticism marked a turning point for A.I.-related stocks, leading to a reassessment of Wall Street’s hottest trade.”

“But Mr. Covello, 51, has experience with tech booms and busts. He followed the bursting of the dot-com bubble as a semiconductor analyst and was scarred by watching colleagues lose their jobs. More recently, the Goldman veteran joined an internal team that has been evaluating A.I. services for the firm to use. He said the services he reviewed were costly, cumbersome and not “smart enough to make employees smarter.”

“The industry’s history has led some people to say Mr. Covello’s call for caution is premature. Shortly after Goldman’s paper was published, George Lee, co-head of the firm’s geopolitical advisory business, challenged Mr. Covello in an email, saying A.I. was poised to save workers time and improve their productivity. Mr. Lee urged him to be patient.”

I can relate to this debate at GS on two fronts.

First, I had a similar set of debates internally at the Firm as the Internet commercialization wave above went through its set of infrastructure and telecom investments. And its now famous boom, bust and then boom cycles from 1995 to 2001 and from then to now.

Second, as readers here know, I’ve been writing for a while here on the ongoing debate between the two camps on the AI Tech Wave around the infrastructure investments to come. For 490 daily posts on AI industry pros and cons.

As I said in “Syncing AI's $600 Billion+ Investments vs Returns” this July 15th,

“This debate is an evergreen and perennial one across every tech wave of the past. But it’s ramped up faster this time since OpenAI’s ‘ChatGPT’ moment almost two years ago. The GS 30+ page piece on AI this time is also worth perusing for the charts and data, as is Sequoia’s arguments on ‘AI’s $600 Billion Question’ as summarized in the chart above.”

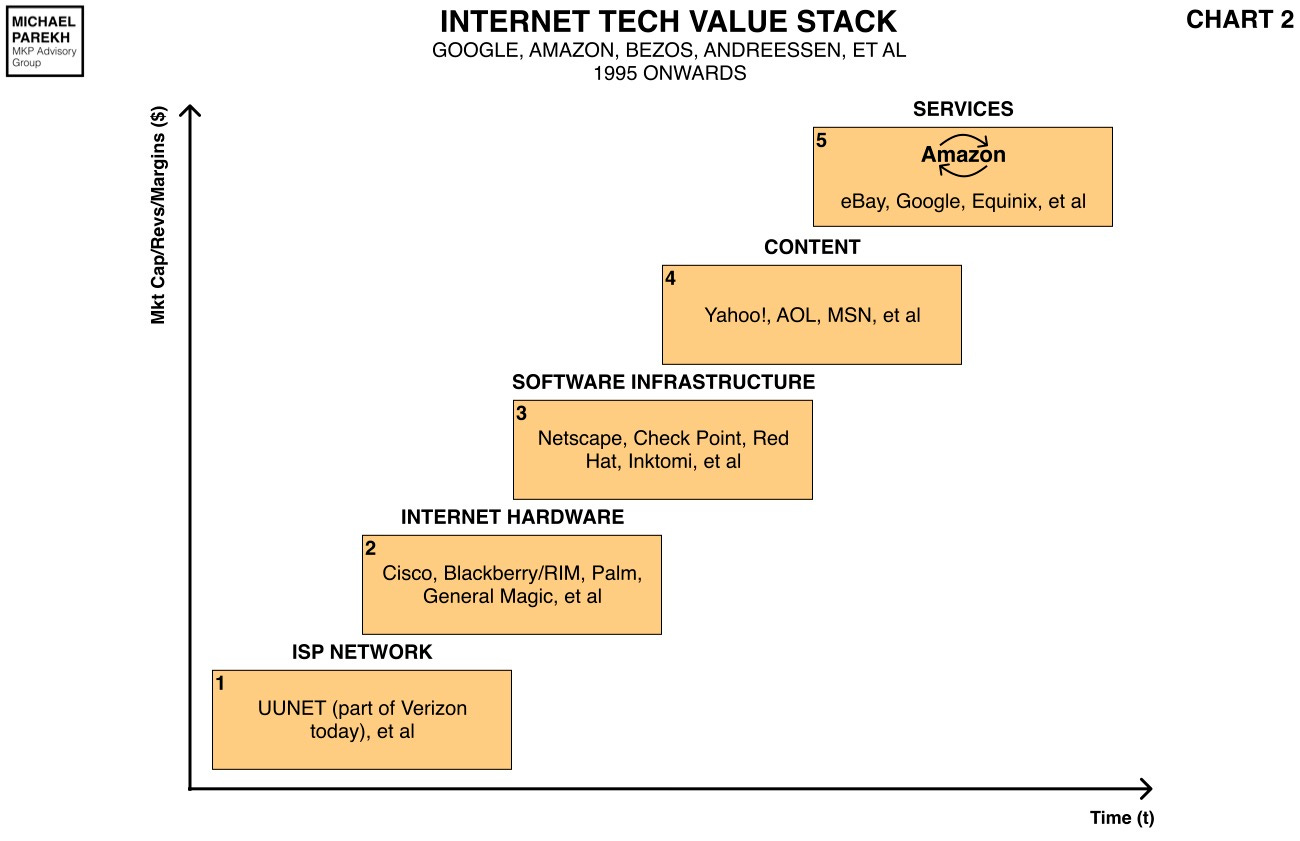

“I wrote about this debate twice last year, and earlier this year in this AI Tech Wave. The debate goes up and down the AI Tech Stack I’ve summarized briefly in a video before.”

“It’s a topic that we discussed this week on the ‘Trends with Friends’ podcast with Public/Private Investors Howard Lindzon, JC Parets, and Barry Ritholz (who runs $5 billion in assets). At the 58 minute mark here, we discuss the above reports and the market context. We had a broader discussion a couple of weeks ago on ‘AI’s Exponential Value Growth’. “

“This is a point I’m familiar with from my days at the head of Internet Equities Research at Goldman Sachs, when the telecom industry raised over a trillion dollars to build out the internet telecom infrastructure. I had similar debates and discussions back then with my heads of GS Equities Research and other senior folks.”

“In hindsight that Internet/Telecom capex wave was out of sync as the full utilization of that internet backbone, that took a decade or more longer than originally anticipated.”

“I also discussed this evergreen debate on investment vs returns last fall in “Booms that Rhyme”, on why the AI buildout this time is likely to get used faster than the Internet/Broadband/Cloud/Mobile waves and capex buildouts.”

My ex-colleagues Covello and Lee had a similar debate at a Goldman Sachs conference a few days ago:

“At Goldman’s annual tech conference this month in San Francisco, the firm put Mr. Covello and Mr. Lee before a few hundred people to explain their diverging views on A.I. Mr. Covello focused on the technology’s shortcomings, citing a Business Insider article about a pharmaceutical company that canceled its Microsoft A.I. services after finding the capabilities on a par with “middle school presentations.”

“Mr. Lee shook his head. He highlighted a Princeton University paper that found that A.I. helped 5,000 developers across 100 companies achieve a 20 percent productivity increase.”

The discussion got feedback on both sides from the audience:

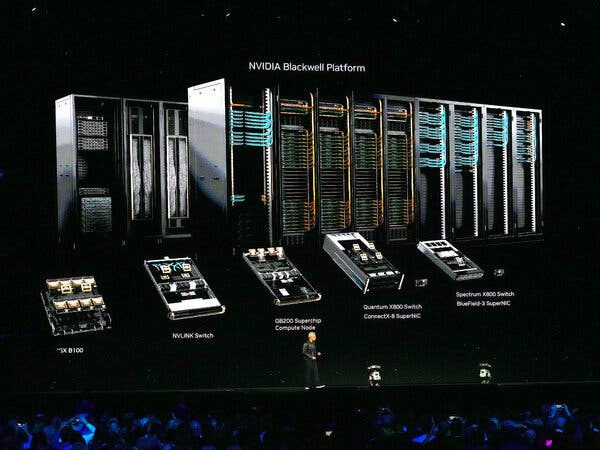

“Some people in the audience questioned whether Goldman was covering its bases by spotlighting its in-house A.I. pessimist at a conference headlined by A.I. evangelists like Jensen Huang, the chief executive of Nvidia, the world’s leading maker of A.I. chips. But many people considered the debate constructive.”

If the Internet wave is any indication, this AI Tech Wave is also going to see both sides proven right and wrong at different times. With Nvidia being center stage in providing the key components.

The key from my perspective is to follow where the underlying technologies are heading on a bottoms up basis. Deep in the tech weeds, up and down the Tech Stack. And then follow the ongoing AI research and engineering innovations.

That then determines the “AI Table Stakes” involved, and their scaling requirements in hardware and software. Leading on to clearer probabilities on value creation across the AI Tech Stack, investment directions and timing. Of course all the while keeping a sharp eye on the strategic and tactical moves across the tech stacks amongst incumbents, rapidly evolving startups, and competitors of all types.

Also these days closely tracking geopolitical and regulatory headwinds that are uniquely global and local. And then be prepared for the inevitable volatility on all these variables that makes it all calculus rather than algebra. Then finally determine the probabilities of the operational metrics that of course drive the ultimate financial rewards. Those of course almost always lagging the massive financial investments by years at times. Oh, and be ready to modify and communicate one’s conclusions and conclusions constantly to all types of investment constituents.

There’s no reason it’s going to be that different this time. And it’s commendable that the senior folks at my former Firm are debating the pros and cons in public. Two opposite ideas can be right at the same time. Across different timeframes.

To be clear, my collective work across the AI Tech Wave for over a decade now, does put me more in the positive than the negative camp in this debate.

As I said yesterday with conviction, I’m inclined to be in the ‘glass half full’ camp on this AI Tech Wave. Especially given the ‘dress rehearsal’ tech waves I’ve gone through over three decades of analyzing across all these tech and vertical industry sectors. The bottom up pattern recognition helps on the probabilities going forward. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

Hey Michael,

As a GS Alumni as well (I was in the Securities division in London), I want to thank you for your amazing work you are doing everyday with these daily posts and takeaways on AI. You are definitely a source of inspiration for me and hope to get to see you live someday, maybe at a conference!

PS on this, we host one in Monaco every year in November, I would love to have you over if you are free during that period in 2025!

Best,

Leo