Another quarter for Nvidia to show that demand for its full AI GPUs and hardware/software suite remains strong and accelerating (NIM, Nvidia Inference Microservices above, and all). As the WSJ notes in “Nvidia’s Sales Soar as AI Spending Boom Barrels Ahead”:

“AI chip giant gives strong outlook, pointing to healthy demand for next-generation chips”.

“Nvidia sales surged in its latest quarter and profits nearly doubled, a sign of the strength of an artificial intelligence boom that has made the company the world’s most valuable.”

“Sales were $35.1 billion, the company said, up 17% from a year earlier and ahead of forecasts in a FactSet survey of analysts. Profit reached $19.3 billion, also ahead of Wall Street forecasts.”

“Nvidia’s shares fell 2% in after-hours trading, however, with the results falling short of some investors’ expectations following several quarters of sky-high revenue and profits.”

“A Journal analysis of Nvidia’s share performance the session after it reported earnings shows the stock has risen 3.75% on average since 2014, closing up in 27 of the 43 sessions. “

The company continues to expand its various moats, something I’ve detailed before.

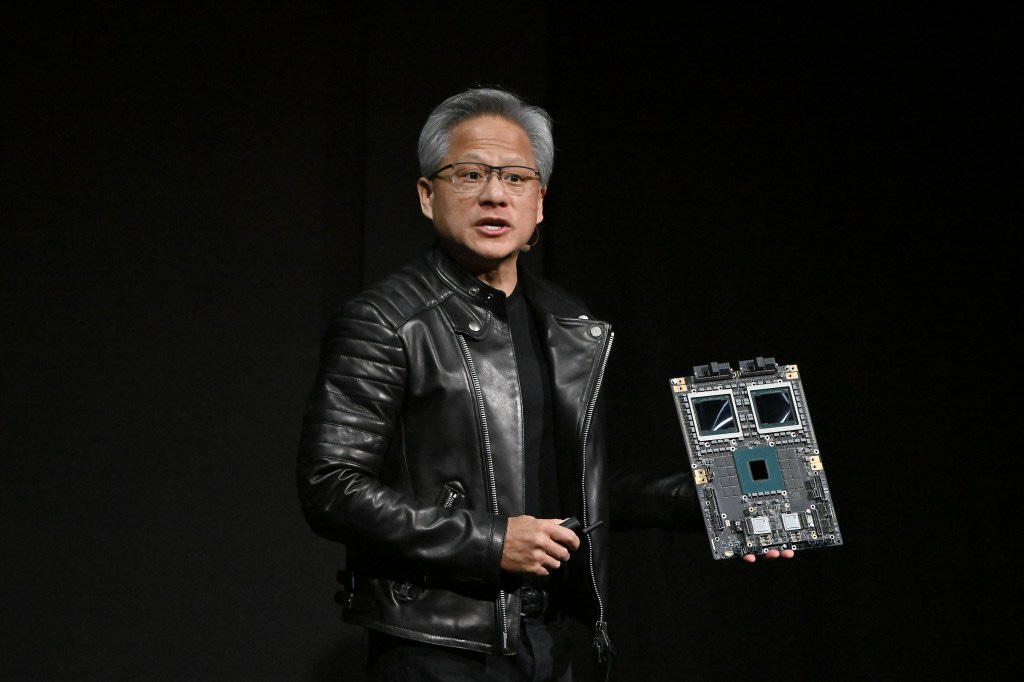

“Led since its founding in 1993 by Chief Executive Jensen Huang, Nvidia has engineered a stunning rise to the top of the semiconductor world over the past two years. Nvidia’s chips—initially developed to improve computer graphics—were well-suited to AI tasks and big tech companies began investing tens of billions of dollars to build advanced AI tools.”

“So hot was the demand that Nvidia couldn’t keep up with it, and its chips became the most coveted products in the tech industry.”

“Huang’s tech celebrity rose into a stratosphere occupied by visionaries like the late Apple co-founder Steve Jobs. Revenue and profits rose to unprecedented levels, and the stock surged, roughly tripling this year alone. It hit a $2 trillion valuation in February, crossed the $3 trillion mark in June, and reclaimed the title of world’s most valuable company earlier this month.”

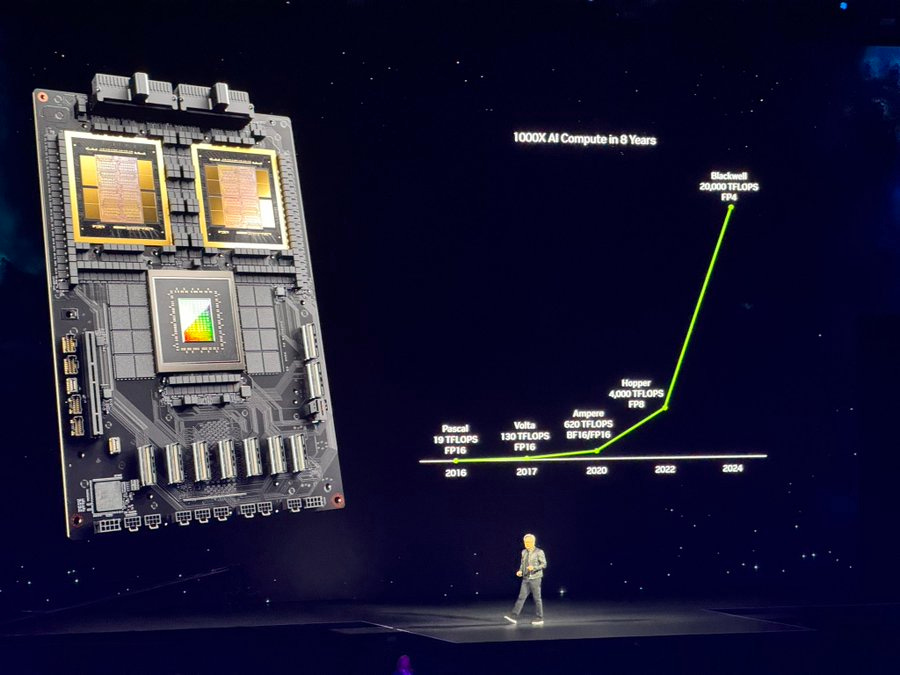

The company continues to execute despite the short-term teething problems of its latest Blackwell chips, being awaited eagerly by the world’s AI data centers:

“Analysts had been expecting a strong quarter for Nvidia following earnings reports from big tech companies that outlined rising capital spending. With the AI boom, much of the tech giants’ spending goes toward Nvidia’s chips.”

“The company’s rise has come with complications. In its previous earnings report in August, Nvidia blamed engineering issues with Blackwell chips for narrower profit margins and a $908 million provision. Despite the hiccup, the company has stuck to an expectation that Blackwell will bring in several billion dollars of revenue in its current quarter, which ends in January.”

“Nvidia’s increased size over the last two years means it is getting harder for the company to sustain its dramatic revenue growth rates. Revenue more than tripled in its quarter ended in April, but has lost pace in the two quarters since.”

“Nvidia is also being challenged by rivals including Advanced Micro Devices, which expects to sell $5 billion of AI chips this year, and by a crop of AI chip startups offering newfangled approaches to the computations that underlie the most advanced AI models. Some of its biggest customers, including Amazon.com and Google, also have been working to develop their own AI chips and reduce dependence on Nvidia.”

“And antitrust regulators in Europe and the U.S. are looking closely at Nvidia’s business given its dominance in the market: Analysts estimate it has more than an 80% share in AI chips.”

“To keep its edge, Nvidia is leaning into new markets and uses for its chips, including drug-discovery applications, humanoid robots and a push by countries to invest in national AI infrastructure. Nvidia expects so-called sovereign AI investments to add $10 billion to its sales this year from zero last year.”

There has been concern in recent weeks that AI Scaling may be slowing down, something I’ve addressed in detail in this two part series. If anything AI Scaling is finding new techniques to grow,, something underlined vividly by Microsoft CEO Satya Nadella at a recent conference this week. The full minute long video is worth watching.

Overall, we’re ending this second anniversary of OpenAI’s ‘ChatGPT’ moment this month and the AI Tech Wave thus far with continuing momentum for Nvidia and the industry on building out the AI ‘Compute’ infrastructure at scale. It’ll take a few years, and lots of dollars, but for now the die is cast. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)