AI: LLM AIs hit close to home, financial analysis. RTZ #369

...and it's a good thing long-term, for the financial industry

Well, it seems like AI models from OpenAI are now brushing up against the capabilities of my life-time profession, financial analysis. Like in a game of Battleship, the latest results are making some direct hits on my long-time core profession, being a financial analyst.

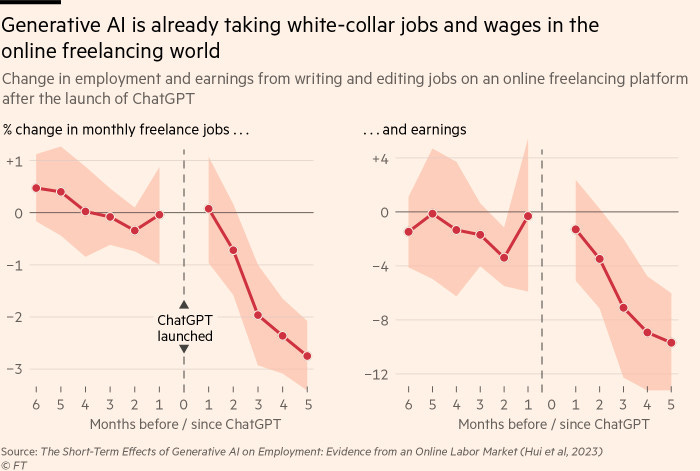

All along in this AI Tech Wave, as LLM AIs keep improving exponentially, one of the counter-intuitive surprises to date has been that it currently seems to be impacting white collar jobs over blue collar jobs. This is opposite of what most tech waves seem to have done historically. And as I’ve noted before, job losses due to AI continues to be one of the earliest, and currently most pervasive fears in these early AI days.

And LLM AI now seems to be hitting close to home, professionally speaking. As Venturebeat explains in “The future of financial analysis: How GPT-4 is disrupting the industry, according to new research”:

“Researchers from the University of Chicago have demonstrated that large language models (LLMs) can conduct financial statement analysis with accuracy rivaling and even surpassing that of professional analysts. The findings, published in a working paper titled “Financial Statement Analysis with Large Language Models,” could have major implications for the future of financial analysis and decision-making.”

“The researchers tested the performance of GPT-4, a state-of-the-art LLM developed by OpenAI, on the task of analyzing corporate financial statements to predict future earnings growth. Remarkably, even when provided only with standardized, anonymized balance sheets, and income statements devoid of any textual context, GPT-4 was able to outperform human analysts.”

Some clever AI innovations made these results possible:

“Chain-of-thought prompts emulate human analyst reasoning”

“A key innovation was the use of “chain-of-thought” prompts that guided GPT-4 to emulate the analytical process of a financial analyst, identifying trends, computing ratios, and synthesizing the information to form a prediction. This enhanced version of GPT-4 achieved a 60% accuracy in predicting the direction of future earnings, notably higher than the 53-57% range of human analyst forecasts.”

Direct hits indeed. That it’s doing it this early in the history of LLM AIs is notable:

“LLMs poised to transform financial analysis despite challenges”

“The findings are all the more remarkable given that numerical analysis has traditionally been a challenge for language models. “One of the most challenging domains for a language model is the numerical domain, where the model needs to carry out computations, perform human-like interpretations, and make complex judgments,” said Alex Kim, one of the study’s co-authors. “While LLMs are effective at textual tasks, their understanding of numbers typically comes from the narrative context and they lack deep numerical reasoning or the flexibility of a human mind.”

Two things of note here in particular:

That a general LLM AI is doing better than narrow LLM AI models developed in the ‘fintech’ space: “The ability of a general-purpose language model to match the performance of specialized ML models and exceed human experts points to the disruptive potential of LLMs in the financial domain.”

It’ll be notable to see the presumed delta in performance with GPT-5 from OpenAI and other next-gen models, which collectively and exponentially are expected to be at least 10x or more better than current state of the art, driven by AI Scaling Laws. Likely available later this year and next.

So although the first set of reactions to the University of Chicago AI study above, of course skew to the likely negative disruptive impact on the world of financial analysts and analysis. But, there is a counter-intuitive case to be made for these developments being a net positive.

Having been a professional sell-side analyst on Wall Street for a very long time, I can personally relate to the trepidation in the industry given these AI trends. But at the same time, I’m confident that these AI capabilities will meaningfully augment AND expand the financial analysis envelope far more than might currently be imagined.

Just as spreadsheets in the eighties spurred the exponential expansion of the financial industries around investing in every asset class imaginable, I can’t help but think these nascent AI capabilities are likely poised to have the same effect.

As an anecdotal example from an unrelated direction, I point to this recent observation by the founder/CEO of cloud company Box Inc., Aaron Levie, in a recent ‘tweet’ on X/Twitter:

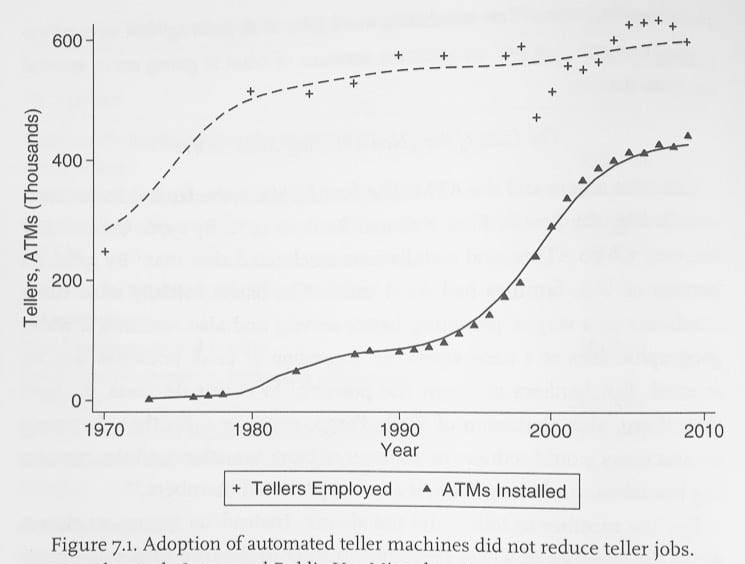

“Bank teller employment continuing to grow during the rise of ATMs is a perfect example of how automation lowers the cost of delivering a particular task, letting you serve more customers, and thus growing the category. We are going to see this over and over again with AI.”

There are many more examples along these lines, where technology tends to expand markets previously presumed to be negatively impacted in its early stages.

Financial analysis is now at the doorstep of these coming LLM AI changes and initial hits. I for one, welcome the new possibilities. Net positive over time. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)