The Information has a detailed profile on venerable VC Vinod Khosla by uber-technology journalist David Kirkpatrick titled “Vinod Khosla can see the Future. It just got hazy for a minute”. An early investor in a long, long list of lodestone tech companies from Google and Amazon to most recently OpenAI, it’s a good read and romp through the details of Vinod’s illustrious, and ongoing career as a ‘Venture Assistant’. It spans across the PC, Internet, and now the early stages of the AI Tech Wave. And it has strong resonance in style and subtance with the most up and coming uber-VCs of a younger generation. Let me unpack and explain.

First, an intro to Vinod and his namesake VC firm Khosla Ventures, for those not familiar with his background and track record. As David Kirkpatrick explains:

“Khosla Ventures currently manages $15 billion, and since its founding in 2004 it has been the first or a very early investor in numerous marquee companies, including Square, Stripe, Affirm, Instacart and DoorDash. Those bets have paid off in the hundreds of millions or more. Khosla has also invested in scores of nascent companies and is almost constantly adding more to his portfolio, many of them focusing on AI, climate, food, health or energy.”

“Earlier in his career, he spent 18 years at Kleiner Perkins Caufield & Byers, whose éminence grise, John Doerr, was initially Khosla’s teacher and later a close partner and friend. Doerr told me that Khosla “made Kleiner $10 billion in profits” from a group of fabulously successful fiber-optic and internet investments in the 1990s, including Juniper, Cerent, and Excite. But, he added, “probably the most significant thing Vinod did” was pioneer the movement into clean-tech investing. “Here’s what sets Vinod apart,” he continued. “He imagines a world that’s different from the way our world is today. And he really, really, really doesn’t like to give up.”

I had the pleasure of meeting with Vinod and his partner at Kleiner Perkins, John Doerr in 1994, at the iconic silicon valley diner on Sand Hill Road, Buck’s.

I walked them through the investment framework I’d developed for the then nascent ‘Internet Tech Wave’, as the equally nascent Internet Equities Research Analyst for Goldman Sachs. It was the year before the ‘Netscape moment’ in 1995, when its IPO kicked off the Internet Tech Wave for the next decade, both up and down on Mr. Market’s whims. Not unlike the OpenAI ‘ChatGPT moment’, now a full year old this November 30th. And a similar echo with the ‘poster boys’ of both ages, Marc Andreessen then, and Sam Altman now.

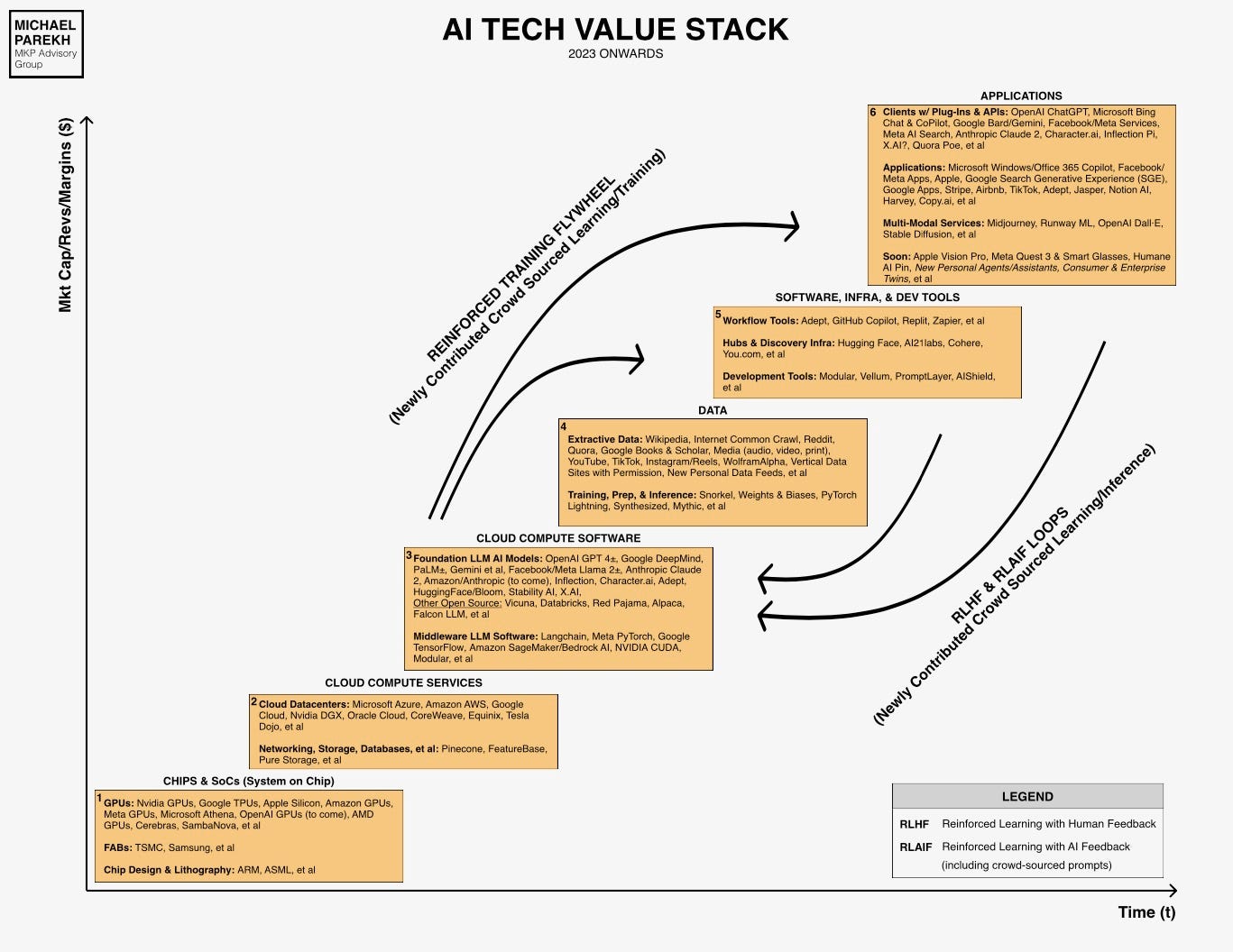

The chart below laid out how I thought the Tech Stack would progress over the next five to ten years, as the Internet got commercialized, with the early focus being on the hardware, software, and TCP/IP network infrastructure of the internet being the first part of ‘Gold Rush’.

I remember both Vinod and John peppering me with pertinent, pithy questions and points. They and their firm then of course went on to be early investors in leading companies across the boxes in the chart above, with the most famous and successful investments being of course in ‘up and to the right’ Box # 5 with Google and Amazon, starting with Netscape in the beginning of that wave (Box # 3 above).

Vinod in particular did very well for his founders and investors with Internet infrastructure companies in the middle boxes like Juniper, Cerent, and others, after spending 1994-1995 deeply thinking through the opportunities to remake the tech hardware, software and networking infrastructure with TCP/IP infrastructure protocols. He was very focused on the in the weeds infrastructure phase of that early gold rush. You can hear him talk about his own record and approach in this op-ed he wrote around the recent OpenAI drama. Well worth reading as well.

If the chart above looks familiar, it’s not an accident. It’s what I’ve built my AI Tech Wave chart on, in the early days of AI commercialization today. And it’s the subject of this site that I’ve now written over 150 daily posts focusing on AI.

And yes, Vinod again was focused earlier than most on the software and infrastructure this time as well, being the ‘first VC investor’ in Open AI in Box # 3 above.

The core things that come across in the profile piece is Vinod’s uniquely direct and deeply focused style catering to founders. As he’s often expressed it himself, he and his firm is in the ‘venture assistance’ business, not the venture capital business.

That core focus on founders through their ups and downs also comes across with the leading new generation of successful tech and AI VCs, as illustrated in this Fortune magazine profile on Thrive Capital’s 38 year old billionaire VC Josh Kushner. Also a piece worth reading.

As I’ve detailed in earlier posts on founder/CEOs like Nvidia’s Jensen Huang and others, building companies, especially tech companies in the current global investment environment, is extraordinarily hard. Most fail.

Cover stories of the successful founders are but the tip of the tip of the startup iceberg. I have deep operational scars from building startups that have shaped me going forward. But they’re also deeply rewarding in what you learn along the way.

Early investors like Vinod, Josh and others have to have a massive appetite for hard work, tenacity, empathy, and fortitude to help founders, navigate the ups and downs of their journeys.

Roller Coasters are a tame ride in the country by comparison. As I’ve said before, other tech waves that have preceded over the past few decades, are but a dress rehearsal for the AI Tech Wave ride ahead. We need to brace ourselves for the rides ahead. The most successful VCs just happen to be in the lead car. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)