This past week saw various US authorities take action against Nvidia, Microsoft and OpenAI. Government Actions against Nvidia, Microsoft/Inflection & OpenAI: All three US tech companies saw new antitrust probes via various US agencies. The Microsoft inquiry by the FTC looks into the multi-billion Inflection ‘Acquihire’ deal. As the NYTimes outlines it, the Justice Department takes the lead in investigating if Nvidia violates antitrust laws.

Finally, the FTC is leading an examination on OpenAI/Microsoft deals with other AI companies. These investigations are on top of ongoing government actions against Google, Apple, Amazon and Meta on a variety of antitrust and anti monopoly concerns. All at a time when these companies are driving AI investments in the hundreds of billions of dollars to explore the next layers of mainstream possibilities with AI products and services at scale.

As I’ve outlined before, another difference in this AI Tech Wave is that the tech industry is seeing regulatory headwinds earlier than in previous tech cycles. As Axios summarizes: “US to open broad antitrust probe into AI giants”:

“U.S. regulators are moving ahead with antitrust investigations into the roles that Microsoft, OpenAI, and Nvidia play in the artificial intelligence industry, per a source familiar with the matter.”

“Why it matters: The broad probe shows the intensifying scrutiny of AI and regulators' concern of the technology's concentration within some of the largest companies in the world.”

The NY Times clarified the context further”:

“Federal regulators have reached a deal that allows them to proceed with antitrust investigations into the dominant roles that Microsoft, OpenAI and Nvidia play in the artificial intelligence industry, in the strongest sign of how regulatory scrutiny into the powerful technology has escalated.”

“The agreement signals intensifying scrutiny by the Justice Department and the F.T.C. into A.I., a rapidly advancing technology that has the potential to upend jobs, information and people’s lives. Both agencies have been at the forefront of the Biden administration’s efforts to rein in the power of the biggest tech companies. After a similar deal in 2019, the government investigated Google, Apple, Amazon and Meta and has since sued each of them on claims that they violated antimonopoly laws.”

What’s new here of course is that Nvidia is now also under scrutiny, at a time when it’s role in the AI Tech Wave is more central and critical than ever:

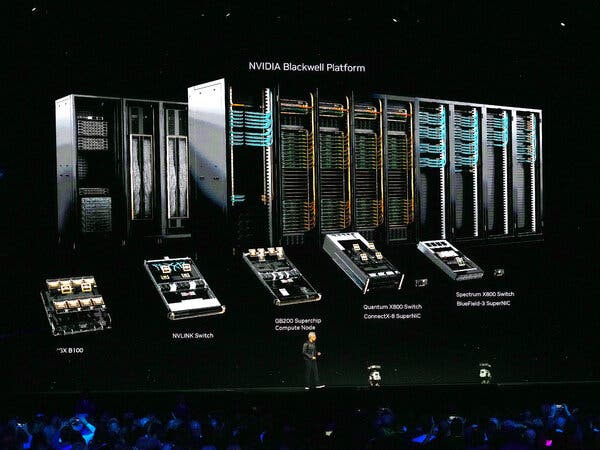

“Nvidia, a Silicon Valley chipmaker, is the primary provider of graphics processing units, or GPUs, which are components adapted for A.I. tasks like machine learning. After A.I. took off, tech companies raced to get their hands on Nvidia’s GPUs, doubling and tripling its sales. Nvidia’s stock price has soared more than 200 percent over the past year, and the company’s market capitalization exceeded $3 trillion for the first time on Wednesday, surpassing Apple.”

“Industry players have grown worried about Nvidia’s dominance, two people with knowledge of the concerns said, including how the company’s software locks customers into using its chips, as well as how Nvidia distributes those chips to customers.”

As Axios emphasizes:

“What we're watching: The two-pronged investigation by U.S. regulators is a setback for the companies involved, at a time when AI has turbocharged their stock prices.”

“This is a new chapter of federal agencies aiming to dissuade consolidation of power, focused on the powerful AI technologies of today as antitrust cases focused on tech conduct of the past continue.”

From my perspective, this focus by authorities comes at a time when for now, further innovation and advancement in AI requires unprecedented amount of capital investment relative to prior tech cycles. And earlier this time than in previous cycles.

While these actions for now are unlikely to slow down that pace of investment and continued competition in AI by the big players, the potential unintended consequences for the US AI competitive posture vs rivals around the world remain an important variable to consider. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)