The unusual Microsoft move to partner and invest in G42, a UAE backed AI company in the Gulf middle east, is but the latest series of moves on the US/China ‘threading the needle’ geopolitical chessboard. A subject I’ve talked about a lot here in these early days of the AI Tech Wave.

In particular, this is another tactical move that strives to replace China’s growing influence around tech, trade and politics in one of the richest parts of the world. Both in terms of energy and investment dollars, for decades to come. And energy of course is a key input in the exponential scaling of next generation AI data centers, as I’ve outlined here before. The nuances of the deal are instructive on the larger stakes at play, and the possible moves and counter-moves that can be expected.

As Axios summarizes in “US, Microsoft eblow China’s Ai in Gulf”:

“Microsoft's new $1.5 billion partnership with G42, a government-backed tech-investing giant in the UAE, marks a stunning move in AI's increasingly frantic global chess game.”

“Why it matters: The deal enlarges America's AI tent and sidelines China from the UAE market while placing Microsoft's AI business at the heart of American geopolitical interests and policy.”

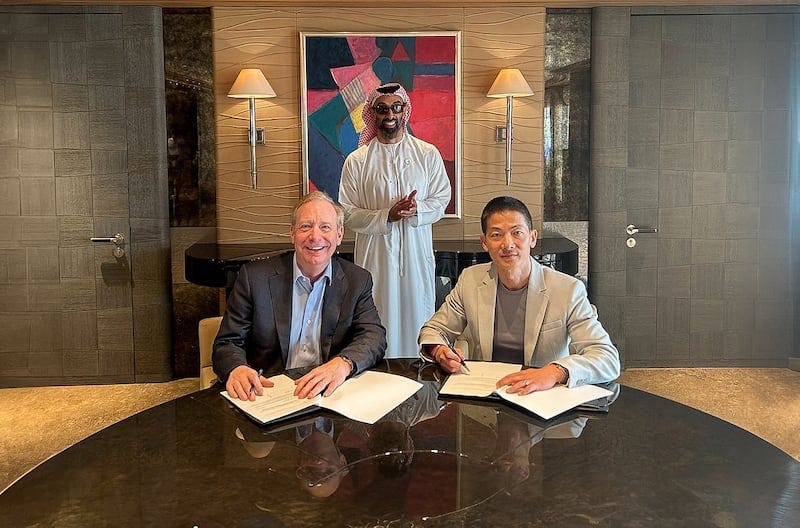

“Driving the news: The deal was partly brokered by Commerce Secretary Gina Raimondo, and hands Microsoft president Brad Smith a seat on the G42 board.”

“G42 gets to put the UAE's homegrown AI models on Microsoft's Azure platform.”

“Microsoft will get much of its investment back as G42 pays for its Azure cloud services. This sort of deal has already attracted antitrust scrutiny in the U.S., EU and U.K.”

“G42 will strip equipment made by China-based Huawei from its systems. G42 separately divested from Chinese companies, including TikTok owner ByteDance, in February under U.S. pressure.”

There’s of course an underlying ‘you’re with us or you’re against us’ dynamic as the foundation of this deal:

“What they're saying: "When it comes to emerging technology, you cannot be both in China's camp and our camp," Raimondo told New York Times.”

“The big picture: The deal showcases the benefits companies and governments can reap if they side with Washington over Beijing on AI development and governance.”

“It also demonstrates the importance the U.S. government and big tech companies place on Gulf markets, for both geopolitical and financial reasons.”

“Between the lines: The deal is a dividend on a 20-year investment by Microsoft, led by Smith, in better government relations at home and abroad.”

“Microsoft has worked furiously to avoid regulatory tangles after the U.S. government's epic effort to break up the company, beginning in 1997, failed. It also faced billions in EU antitrust fines levied between 2004 and 2013.”

“The company's outreach has ranged from a tech demonstration center on the doorstep of EU headquarters in Brussels to a de facto embassy to the United Nations in New York, and it has placed armies of lobbyists on every continent.”

“Catch up quick: G42 is chaired by UAE's most senior security official, Sheikh Tahnoon bin Zayed, and backed by the country's sovereign wealth fund, Mubadala. It has a track record of spreading its geopolitical bets.”

“Peng Xiao, G42's CEO, was born in China — but after gaining U.S. citizenship, he renounced it in favor of Emirati citizenship, per the New York Times.”

“Fun fact: In the name G42, the G stands for group, while 42 is a reference to "The Hitchhiker's Guide to the Galaxy," in which a supercomputer called Deep Thought says 42 is the answer to "the ultimate question of life, the universe and everything."

It’s important to note that the Mideast, the UAE and Saudi Arabia in particular, have also been a focus of intense activity by US and Western VC and other investment entities, seeking long-term multi-billion dollar capital investments in venture startups from early to late stage growth. The Kingdom of Saudi Arabia in particular, is honing plans to invest over $40 billion in AI alone, as the NYTimes notes:

“The Middle Eastern country is creating a gigantic fund to invest in A.I. technology, potentially becoming the largest player in the hot market.”

“The government of Saudi Arabia plans to create a fund of about $40 billion to invest in artificial intelligence, according to three people briefed on the plans — the latest sign of the gold rush toward a technology that has already begun reshaping how people live and work.”

“In recent weeks, representatives of Saudi Arabia’s Public Investment Fund have discussed a potential partnership with Andreessen Horowitz, one of Silicon Valley’s top venture capital firms, and other financiers.”

“The Saudi tech fund, which is being put together with the help of Wall Street banks, will be the latest potential entrant into a field already awash in cash. The global frenzy around artificial intelligence has pushed up the valuations of private and public companies as bullish investors race to find or build the next Nvidia or OpenAI. The start-up Anthropic, for instance, raised more than $7 billion in one year alone — a flood of money virtually unheard-of in the venture capital world.”

“The cost of funding A.I. projects is steep. Sam Altman, the chief executive of OpenAI, has reportedly sought a huge sum from the United Arab Emirates government to boost manufacturing of chips needed to power A.I. technology.”

“Saudi representatives have mentioned to potential partners that the country is looking to back an array of tech start-ups tied to artificial intelligence, including chip makers and the expensive, expansive data centers that are increasingly necessary to power the next generation of computing, according to four people with knowledge of those efforts, who were not authorized to speak publicly. It has even considered starting its own A.I. companies.”

I’ve already discussed at length the capital required to continue to scale LLM AI in just the next 3-5 years. The mideast is the obvious nexus point for a number of key inputs in this equation. The geopolitical points with China are of course an additional driver. This AI Great Game in the region is just beginning. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)