OpenAI & Microsoft re-alignment: OpenAI and Microsoft continue to work hard to come to terms on a revised agreement. Especially around the critical IP access arrangements around declarations of AGI. Each side continues to return to the table while threatening drastic actions on either side. The desire to keep the iconic partnership intact continues to drive both leaders, despite widening differences over a multitude of issues. Much depends on the definition and timing of AGI, artificial general intelligence. A possible solution might be to ‘move the ‘goalposts’ with a shift toward ASI instead, artificial super intelligence, which would add more time to the clock. That may buy more time on the impasse. Microsoft continues to need access to the latest and greatest AI IP from OpenAi, despite its various in-house AI hardware and software efforts under AI chief Mustafa Suleyman. Meantime, OpenAI continues to try and move forward with Microsoft on AGI definitions. More here.

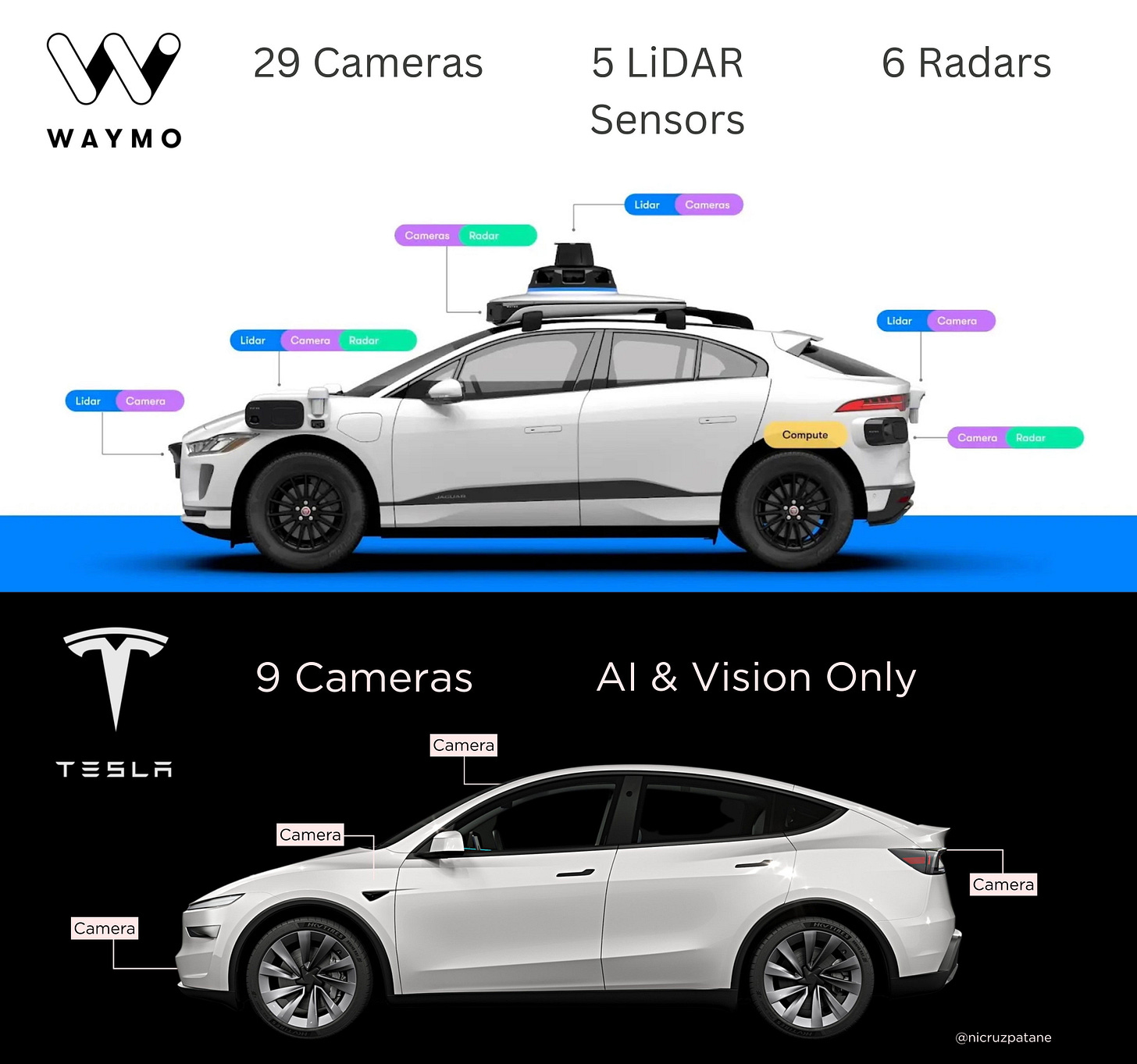

Tesla Robotaxis vs Waymo/Uber: Tesla’s Elon Musk launched its long awaited Robotaxi test in Austin with less than a dozen cars, equipped with supervisors in the front passenger seat. The market rewarded the company with an almost 10% move, while discounting the self driving taxi service Waymo by Google. Waymo has deployed over 700 self-driving cars in over half a dozen cities, many in partnership with Uber. And is currently running at a 250,000 rides per week pace, Tesla however continues to enjoy a perceptual advantage relative to investors and media, given the showmanship by Elon Musk. There remains a big difference in the sensor suites between the two companies’s cars. Self driving cars remain one of the key applications of AI technologies, with market leaders being Google in the US, and several AI/Auto companies in China and beyond. More here and a video podcast here.

Google launches Gemini CLI for Developers: Google continues to accelerate its efforts to leverage its full stack strength in its Gemini LLM/SLM AIs, with Gemini CLI, a more robust capability for Developers to build on top of Gemini..It’s a new open source, competitive AI Agentic service, that ups Google’s developer game worldwide. The service is being offered at market competitive volumes and prices. And puts Google neck and neck with competitive AI Coding offerings from OpenAI, Anthropic and others. These early battles for Developer attention and adoption is critical at this stage of the AI Tech Wave, as both add on and native AI applications/services are built on top of Ai infrastructure for customers large and small. More here.

Apple’s ‘Build vs Buy’ decisions: Media and investor speculation continues to ramp on Apple’s AI position post delays around its Apple Intelligence powered Siri at this year’s WWDC. Possible acquisition targets range from Perplexity to Mistral to Cohere, Databricks and others. Apple has generally opted for ‘Build’ vs ‘Buy’ options over its history, even if it takes longer building competitive offerings relative to market expectations. This AI Tech Wave is likely to be the same, but it remains to be seen. Particularly given the accelerated pace of acquisitions by many of its peers. Note that a theoretical Perplexity acquisition at its last $14 billion private valuation would be less than half a percent of its $3 trillion market cap. About the same Apple paid of one of its largest, $3 billion Beats acquisition in 2014 on a then market cap adjusted basis. More here.

Meta’s AI redo: Meta’s Zuckerberg remains laser focused on ‘Amping Up’ its AI position, even if it means ‘disinvesting’ in its flagship open source Llama LLMs. This follows last week’s $15 billion investment in Scale AI, and related management shuffles. And its public AI Talent war tussles with OpenAI over ‘$100 million’ signing bonuses. Meta did manage to lure some OpenAI research talent away despite OpenAI reports to the contrary. The verbal public arguments intensified by both sides, with senior executives commenting on the state of affairs both internally and externally.Meta’s founder/CEO ‘Zuck’ continues to lean in on talent acquisitions large and small, including ‘acqui-hires’ from recent multi-billion dollar Unicorns by ex-OpenAI founders like Safe Superintelligence and Thinking Machines. In addition, Meta is raising $29 billion from private credit markets to fund its rapidly growing AI data centers. More here.

Other AI Readings for weekend:

Anthropic & Meta’s mixed AI ‘Fair Use’ Cases. Lots more litigation to follow from and by all sides. More here.

New AI research suggests AI ‘Chain of Thought’ may not be as interpretable as assumed. More here and here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)