AI: Weekly Summary. RTZ #548

...week ending November 22, 2024

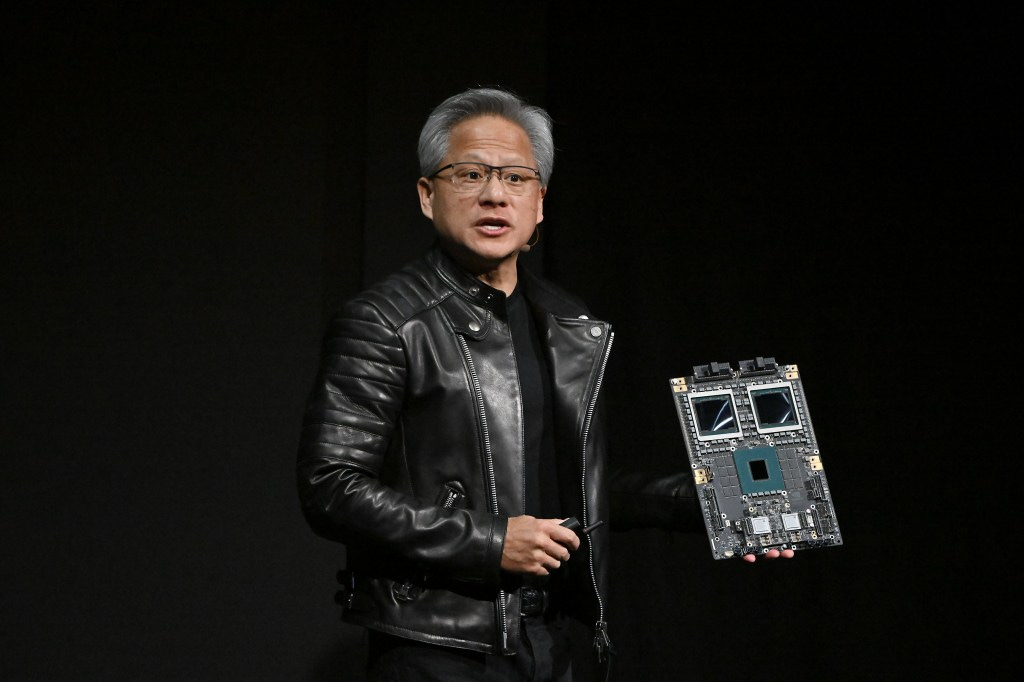

Nvidia’s reports a strong quarter again: Nvidia delivered another solid quarter in a series expected to continue given strong multi quarter demandm of its Hopper and Blackwell AI GPU infrastructure. The company is making progress ramping up Blackwell despite recent technical teething problems. Customer concentration remains high with its big tech hyperscalers. Recent concerns over AI Scaling remain a non-factor, given the new uses for AI for reasoning and agentic work flows. Nvidia overall continues to execute on both hardware and software cylinders. More here.

Google’s DOJ ‘Remedies Phase’: Google is entering its regulatory ‘Remedies’ phase, with the government focusing on a possible divestiture of its Chrome browser platform, amongst other areas. The company is planning on appealing, and the overall litigation will likely span years. The legal issues are complex, including the company’s default $20 billion annual payments to Apple and other platform vendors. In the meantime, OpenAI is reportedly ramping up its own ‘AI browser’ as the broader competitive dynamics in the AI industry remain fierce. More here.

Meta expands AI Tools for Enterprise: Meta continues to expand its AI tools business, this time on the enterprise side. Meta has already been focusing these Ad AI tools efforts on the consumer side of their business. So this entrance marks focusing on the ‘low-hanging fruit’ on the business side.. I’ve discussed Meta’s possible extended opportunities on the enterprise cloud side of the business, but that remains an area yet to be officially explored by Meta. More here.

Anthropic/Amazon and Elon’s xAI close big equity rounds: Anthropic and Amazon closed their second $4 billion round of partnership investments, bringing Amazon’s investment in the second largest LLM AI company to $8 billion. Anthropic will make Amazon’s AI platform their primary training infrastructure, an important business decision. Note Google remains an early Anthropic investor. Separately, Elon Musk completed its $5 billion funding round for xAI as well, at a valuation of $50 billion. The big LLM AI companies continue to raise additional capital for the AI Scaling ahead. More here.

AI “Capex” the new M&A for Big Tech: The AI Capex wave for data centers and power continues unabated, with Wall Street noting that these rounds are ‘the new M&A for Big Tech’. These trends are likely to expand under the new administration, something noted by Microsoft this week as well. All this despite the ongoing debate amongst investors on the pros and cons of these mega investment rounds. Focus continues on ramping up AI data centers of a 100,000 Nvidia GPUs and more, with a starting tab of $10 billion+. Gigawatts of Power not included. More here.

Other AI Readings for weekend:

Feature piece on Google’s path to AGI under Sir Demis Hassabis. More on Google AI Gemini strategy here.

Microsoft releases ‘safer’ Recall for Windows AI PCs. More on prior tech issues here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)