Happy July 4th!

Hard to believe, but in just three years, the USA will be celebrating its 250th Birthday on July 4, 2026.

Still a toddler compared to Europe, China, or India, but very much en route. The country will be led either by 46 in his second term, or a new 47.

And AI, the main topic around here, will be in its fourth year of intense global commercialization. I’ve already given you all my AI preview for the second half of 2023, so thought it’d be useful to think about what we might expect by July 4, 2026, as you all get ready for hot dogs and fireworks today.

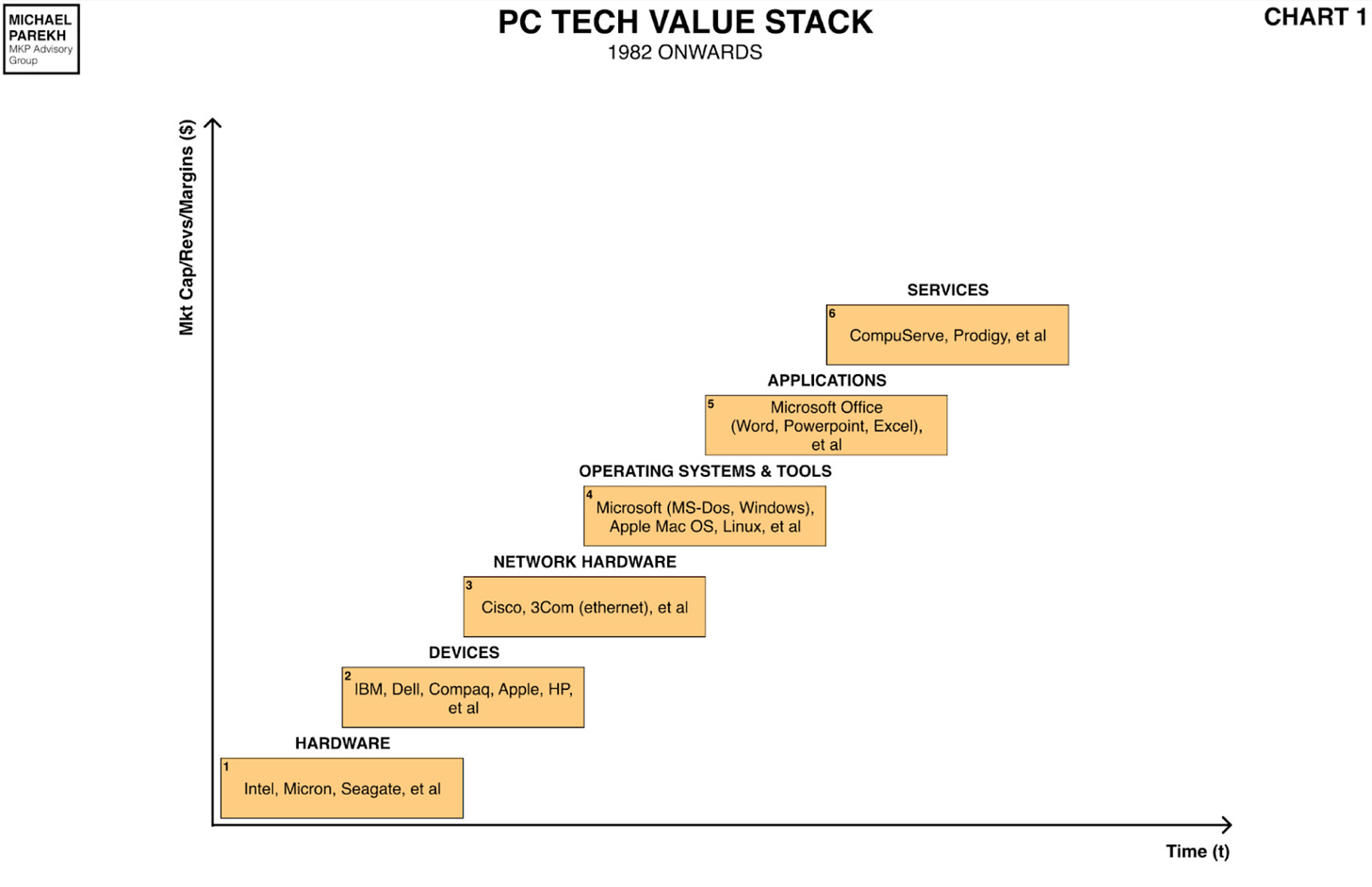

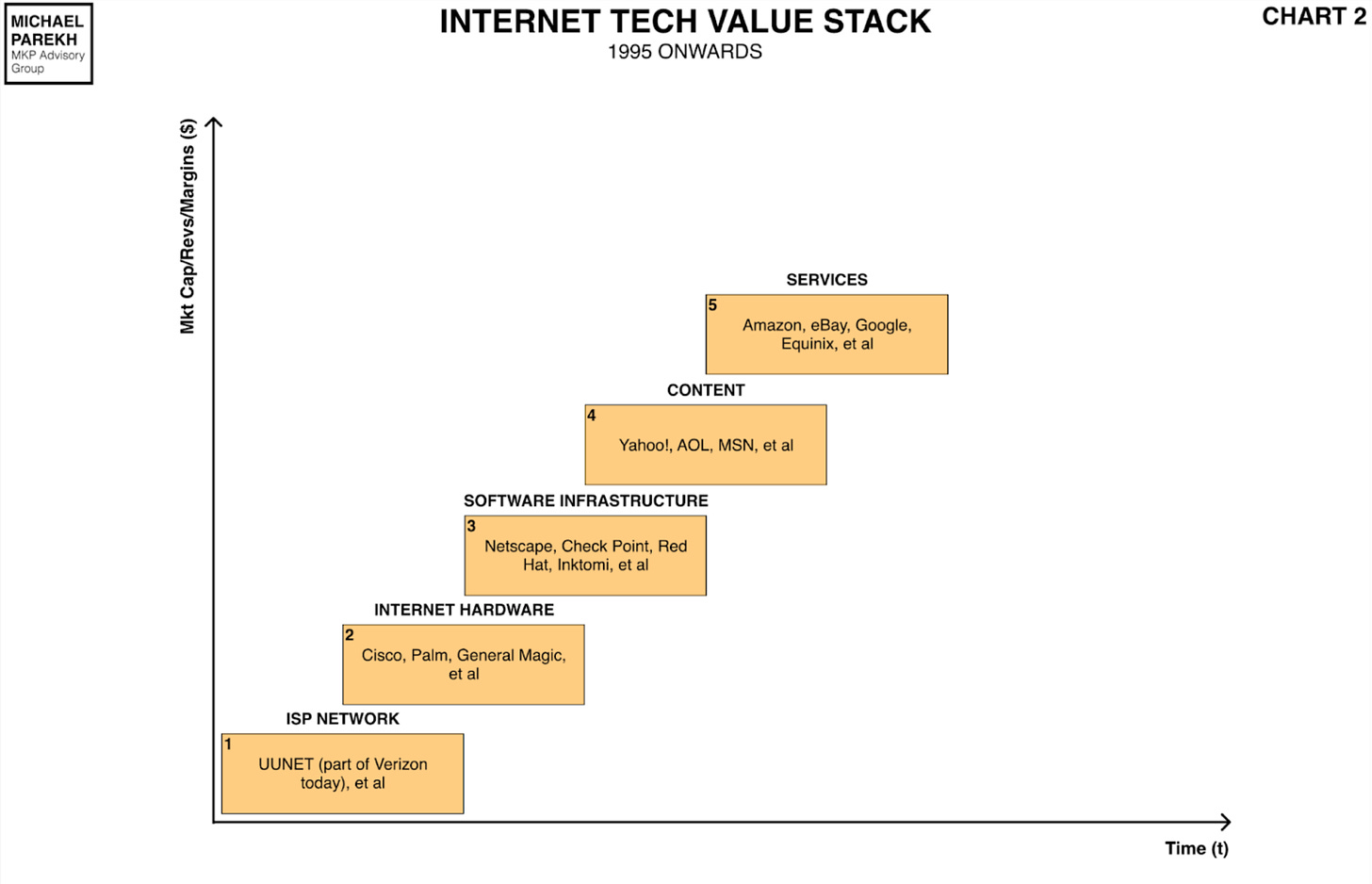

You know I like using past major Tech waves as templates for the future, having gone through the compare and contrasts of the PC and Internet cycles vis a vis the current AI wave.

In those contexts, the AI commercialization wave will be in the mid 1980s of the PC wave, and the late 1990s in the internet wave. So about where Microsoft went public in 1986, and when Google got founded in 1998. Again, tech always takes longer than we think. Microsoft didn’t become ‘Microsoft’ until Windows 95 in the mid-1990s.

Of course, this time the global markets are much bigger and far more global. So our next Microsoft and Google can come from pretty much anywhere in the world. China is already well on its way with their next big global tech giants in Bytedance/TikTok, Shein, Temu already making market share inroads in the US and beyond.

The available number of online population by 2026 will likely be over 4+ billion, with global GDP approaching $125 trillion. Goldman Sachs estimates today that LLM and Generative AI will likely add another $7 trillion plus to global growth in ten years, so we will have upgrades to those numbers by then.

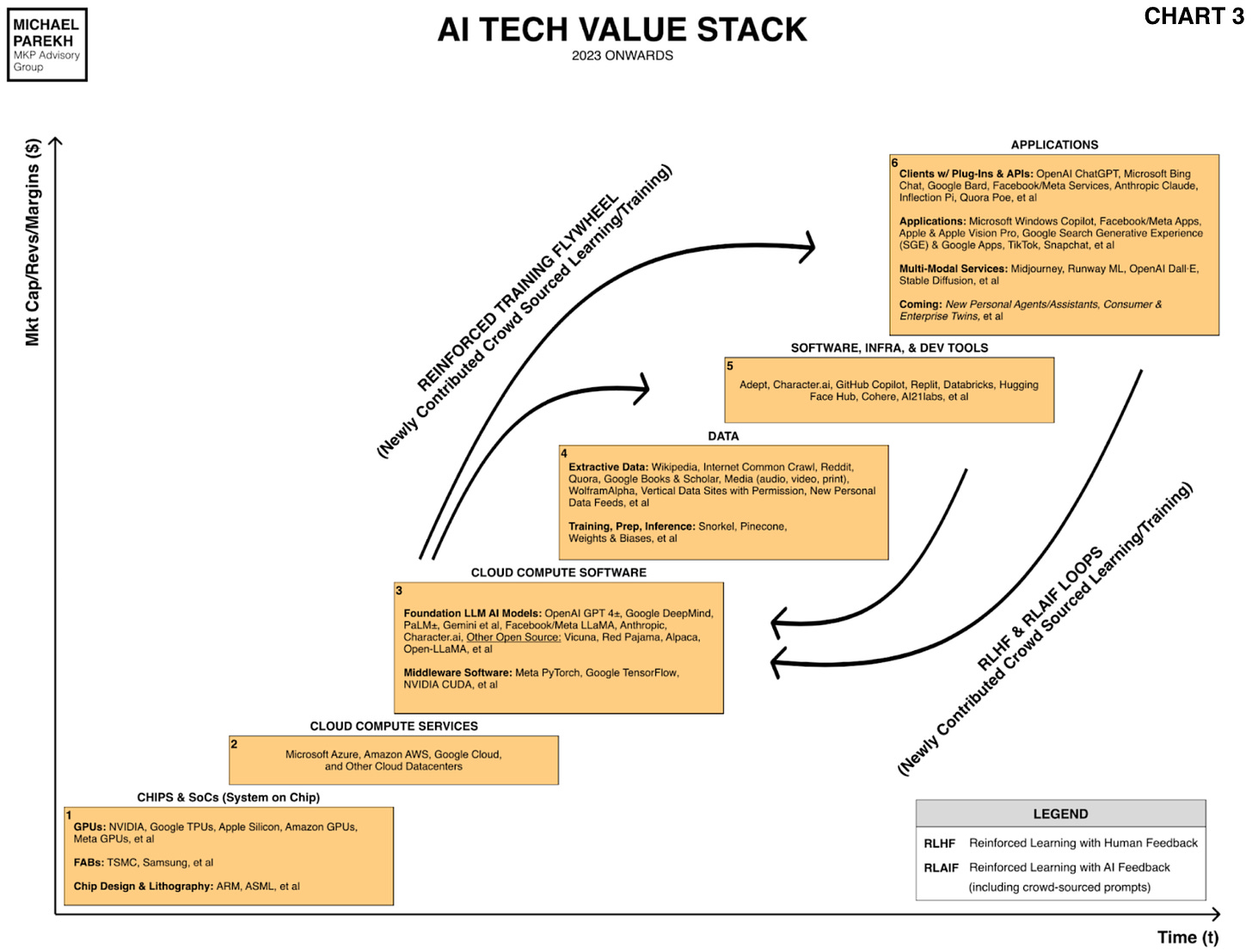

So if we look at Chart 3 above, the following items can tee us off:

Picks and Shovels still rule: Infrastructure companies (Boxes 1-3) will still be going strong with continued reinvention of the underlying AI ‘Compute’ layers, from chips to data centers to networking to databases to software infrastructure. GPUs should be in easier supply. Compute costs for LLMs will likely show greater efficiencies than expected today. We may have multiple Foundation LLM models with a trillion or more parameters, larger context windows, more memory (GPT 5 and 6 from OpenAI for example), but there likely will be a cast of additional specialized LLMs that provide multimodal and hard reasoning/logic capabilities than currently envisioned.

Data, Data, Everywhere: DATA, Box 4 above will likely be a far richer landscape than envisioned today, with far more new pools of Data unleashed, especially from the Edge on local devices. As posited before, Apple has interesting opportunities here, even before it Vision Pro platform, which by 2026 will be in its third year of global rollout.

AI Beyond Search: By 2026, we should now have strong evidence of how consumers and businesses are using LLM AI in applications, services, and even possibly ‘smart agents’ (Boxes 5 & 6 above). And uses of AI far beyond Search and ChatGPT style chat bots will likely be the norm not the exception.

Smarter AI Agents: Smart agents in particular are the current holy grail, and the underlying technologies around customization and memory have still to be built at scale. By 2026, we likely get the first possible peek at Smart agent traction at mainstream scale (hundreds of millions of users). Maybe even finally useful Voice AI ones via Alexa, Siri, and Google Nest.

Reinforcement Loops Emerge at Scale: The big questions today are of course around the reliability and accuracy of AI, and a lot of promise hangs in the balance around reinforcement learning feedback loops in the billions and trillions. By July 4, 2026, we will likely know if the current aspirations of ‘Sparks’ of super intelligence and AGI were in the ballpark.

Regulatory Stability in AI: Also, regulators around the world will likely have figured out the right balance between fear and opportunity around AI. The EU AI Act maybe in its second or third year, with others like it in the US and elsewhere. Optimistic that startups the world over have opportunities to go head to head with incumbents without undue regulatory friction. And do it open source if they choose.

Working with China: Finally, as I said in my second half preview, the big, big difference this time of course is geopolitical competition with China and deglobalization/reglobalization that is underway currently. That is a major headwind we did not have in earlier waves. And it’s a wild card that possibly up-ends the Math for all of the above.

I am encouraged by the upcoming visit by US Treasury Secretary Yellen to China. But we will need sustained calmer heads on all sides to prevail, and thread some geopolitical needles. Its critical for the US Tech Growth machine to do its global thing, AI powered and all. Great expectations indeed.

Stay tuned.

And a Happy 4th to All!!