AI: Dell building an AI head of steam. #571

...AI servers & storage another critical input beyond AI GPUs and Memory

We’ve discussed many critical inputs for the multi-trillion dollar AI Data Center ramp underway worldwide in this AI Tech Wave thus far. AI GPUs (Nvidia mostly), High Bandwidth Memory (HBMs from SK Hynix mostly), and more are just the beginning. Not to mention seemingly insatiable amounts of power, nuclear, natural gas and otherwise. But another critical input are servers and storage for the data centers. And one company older than Nvidia (40+ years to $NVDA’s 30+ years), is Dell.

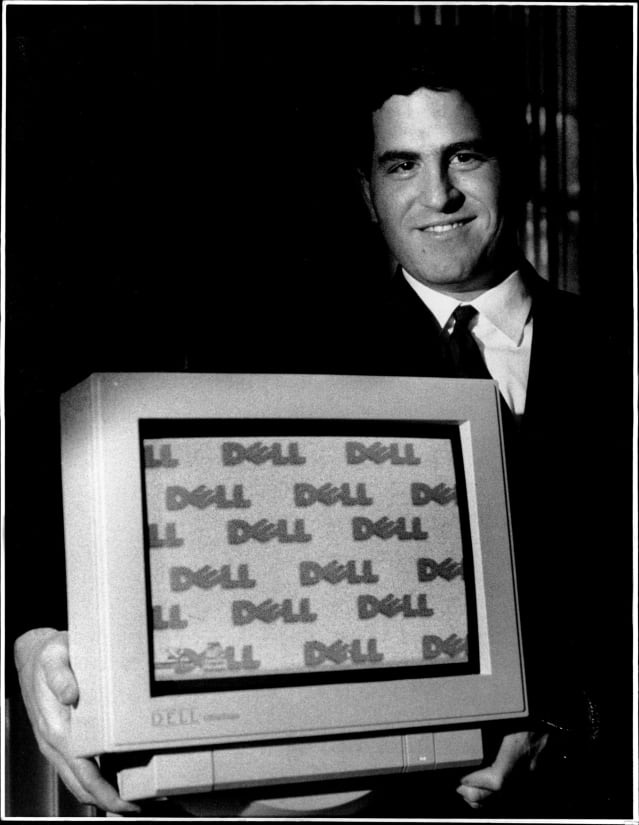

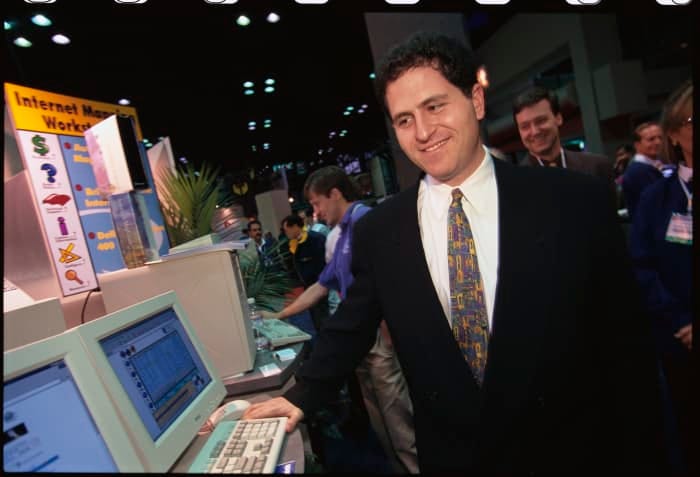

Founded by founder/CEO Michael Dell in his teens in his dorm room, Dell Technologies has come a long way beyond its roots as a PC company. Just as founder/CEO Jensen Huang has brought Nvidia a long way from its gaming GPU roots over 31 plus years.

Now at a market cap approaching a hundred billion, and several incarnations as a public to private to public company over the decades, both the company and its founder are ready for an AI Close-up. I know both since my former firm Goldman Sachs took Dell public the first time around in 1988.

As the WSJ explains in “Michael Dell spent 40 years preparing for an AI Boom no one expected”:

“Michael Dell DELL is pulling off one of the most surprising transformations in the history of tech at the company that bears his name, all without changing his approach to business.”

“He is now the world’s 13th-wealthiest person—neck and neck with Nvidia founder Jensen Huang. He is also the second-longest serving chief executive of any big U.S. company, after Warren Buffett—if you elide a three-year break from 2004 to 2007, when he was the chairman of Dell’s board. He remains the youngest CEO of a company to enter the Fortune 500—a record even Mark Zuckerberg couldn’t break. He is, somehow, not yet 60 years old.”

“His company has transitioned from a nostalgic mid-90s PC maker to a globe-straddling AI-supercomputer builder that operates in 180 countries. While selling PCs and peripherals still accounts for about half of the company’s revenue, the real business of Dell is infrastructure—the digital kind.”

And the company is clearly on yet another transition again:

“What Dell really wants to talk about is computers. Not PCs, per se—Dell is an infrastructure company now, he emphasizes often—but machines vastly more powerful. These include racks of servers—such as the company’s PowerEdge lineup, powered by Nvidia’s latest chips—for companies that want to train their own AIs.”

“Building these souped-up machines is a continuation of his early days working out of his dorm room at the University of Texas at Austin. The world has changed, but Michael Dell is still doing more or less the same thing, only with better components and 120,000 employees.”

The whole piece is worth reading, especially for the multi-step transitions the company made along the way. But the current one, leaning into the AI data center infrastructure boom, is particularly interesting:

“Dell, still based just outside of Austin, doesn’t design or manufacture microchips. It sources them from Intel, Qualcomm, Nvidia and others. And while it writes some of its own software, for the most part the company is a sort of Switzerland in terms of its neutrality toward what runs atop its hardware.”

“The company specializes in everything sandwiched in between those two ends of the technology stack—between chips and software. It turns out that in the age of AI, there’s a tremendous demand for racks of servers and huge arrays of storage.”

“Each rack of servers is a stack of computers about the size of a bookshelf. These racks are crammed together inside the vast data centers where the internet actually resides, and the most power-hungry ones, for training AI, can consume as much power as 100 average American homes. They generate so much excess heat that they have to be liquid-cooled. Each one costs hundreds of thousands of dollars—Dell won’t say exactly how much.”

And the key sub-component is hardware storage. GOBS of it:

“In the past two years, his company has sold storage arrays capable of holding a total of 120,000 petabytes, says Dell. For perspective, OpenAI’s latest chatbot, GPT-4o, was trained on about a petabyte of data, which represents all the text on the open internet, the transcripts of over a million hours of YouTube videos, plus countless images.”

“In that same period, Dell went from having 30 to 40 customers buying AI servers from the company to more than 2,000. “And it will probably be 4,000 in another couple of quarters,” he adds.”

Even at today’s scale, it’s a trend barely getting started, especially since as I’ve discussed before, the critical unique variable in this AI Tech Wave vs others in the past is the DATA, Box no. 4 below.

And as I discussed yesterday, AI Data is evolving rapidly from its current form below.

As the WSJ continues:

“Revenue in Dell’s server business grew 58% last quarter, and 80% the quarter before, mostly because the world just can’t stop producing more data at an ever-faster rate. All those short-form videos, social-media posts, hours of streaming entertainment, cloud-gaming services, and fire hoses of consumer-tracking data have to go somewhere, after all. That has translated to an insatiable demand for storage, and computers to process it—and record revenue for Dell.”

And they’re front and center in the 100,000+ AI GPU Data center race currently led by Elon Musk with xAI/Tesla, Mark Zuckerberg’s Meta and others:

“Tentpole AI projects are also boosting Dell’s bottom line, as when the company was called on to provide much of the hardware inside Colossus, the new AI supercomputer built by Elon Musk’s AI company, in Memphis, Tenn. “It’s an amazing engineering feat,” says Dell. “He placed incredible demands on us, and many others.”

Dell has been inside that data center, with its endless rows of blinking, humming server racks holding 100,000 Nvidia chips. When I asked him what it looked like, he deadpanned, “It looks like a Dell commercial.”

Add Dell to the popular Nvidia image below, as another key seller of AI pickaxes and shovels.

Michael Dell has his sights on the opportunity ahead:

”Dell says he thinks we’re just at the start of what will be hockey-stick growth for adoption of AI. But, he adds, “I also believe that any technology that is sufficiently game-changing, by definition there are going to be some excesses—and some mistakes that are made.”

“Whether or not those mistakes are isolated, or the entire tech industry is systematically overestimating future returns from for AI in ways that could lead to a bust, is the question on which the future.”

It won’t all be in a straight line of course. And there’ll be long waits and unexpected zig zags ahead. But Dell has a solid place in this AI Tech Wave opportunity indeed. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)