AI: Bottom up vs Top down

...China just a case in point

AI: In my View, Sunday August 27, 2023

In this Sunday’s ‘AI: In my View’, I want to suggest a framework different from the top-down perspective of the China-US geopolitical relationship. And instead augment it with a bottom-up look at where tech driven innovation has come from to date. And will come from going forward. Taking in what’s already been happening globally and at scale. Let me make my case.

I’ve already argued in an earlier piece that threading the top down relationship with China in a balanced way is increasingly critical, despite the rising geopolitical tensions between the US and China. My key point:

“Geopolitical realities will make it ‘insanely hard’ for our best entrepreneurs to take AI technologies and make the execution of their innovation work at global scale. Whether they’re doing it as startups or big tech incumbents. Governments can help by ‘threading the needle’ of their national political ‘Kabuki theater’ imperatives, while pragmatically managing the beneficial ‘Math of global trade’”.

At stake of course is the $100 trillion plus global economy, with US and China at the top currently. And their current very visible and up front ‘trade tussle’.

Also at stake is the impact AI is expected to have in trillions of dollars in augmented growth, as expounded on in reports from folks like Goldman Sachs, McKinsey and others.

The politics continue to build with the latest White House curbs on AI GPU export curbs on China, and the multi billion dollar Nvidia GPU buying binge by tech companies in China to get ahead of those curbs and bans.

On the ‘threading the needle’ side, it’s encouraging that this week will see the US sending US Commerce Secretary Gina Raimondo for high level meetings with Chinese officials, following recent visits by the US Treasury Secretary Yellen, and Secretary of State Blinken. Not to mention the independent visit by 100 year old Henry Kissinger, with a personal meeting with Xi Jinping no less. The leaders of both nations are talking through the top-down issues.

But the point I’d like to make is that from a technology perspective, innovation happens bottom-up, in many cases despite top-down government trade and regulatory machinations. We saw that through the PC and Internet tech waves globally, and now we’re poised to see it with the AI Tech wave.

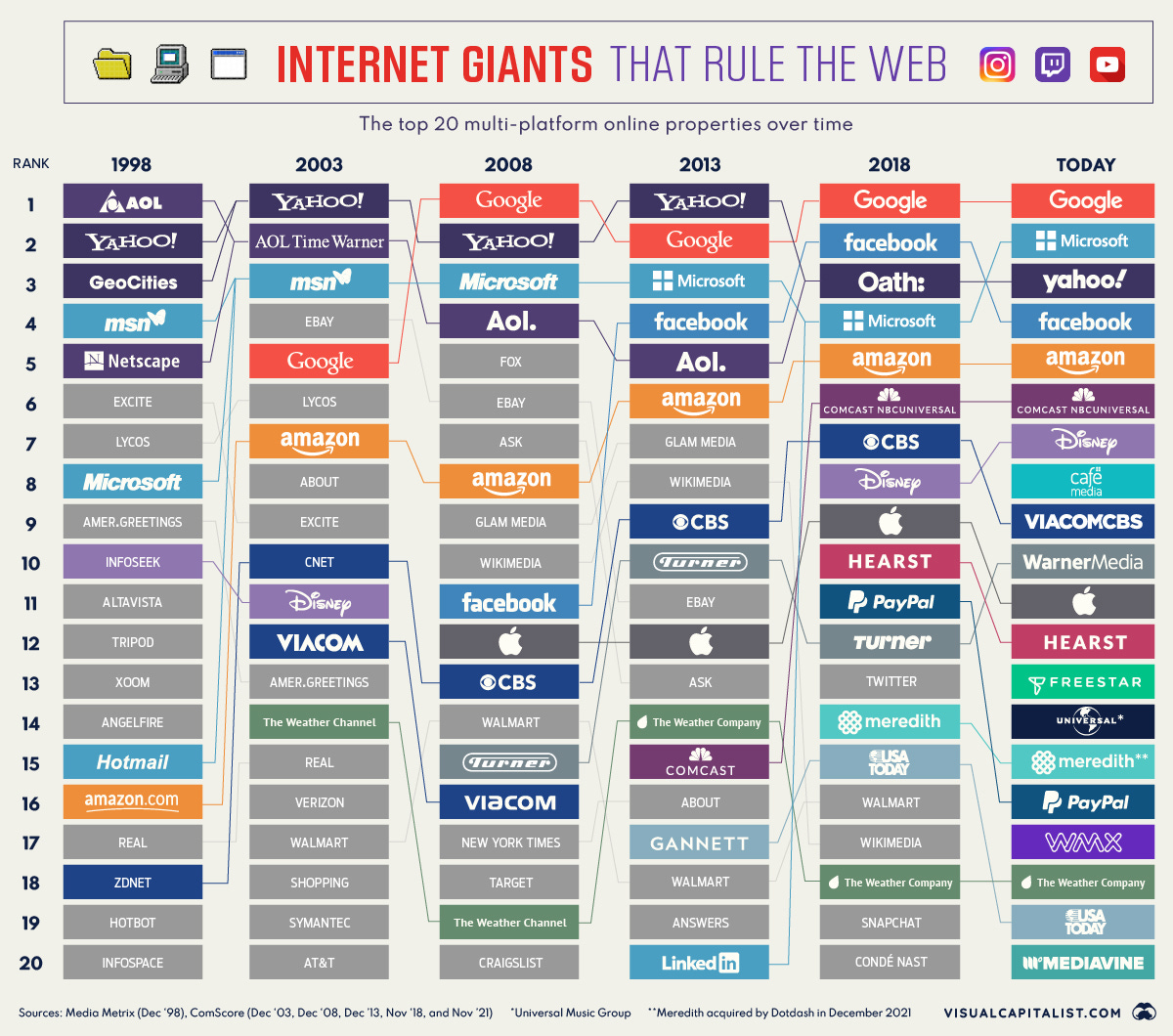

In the past three decades, the companies that led the way were primarily from the US, as illustrated in this chart by Visual Capitalist:

Names like Microsoft, Google, Amazon, Apple, Meta and Nvidia of late across blaze across the decades as ‘Internet Treasures’, with some of them soon to be long-term ‘AI Treasures’ for the world.

In the last big tech cycles, we of course saw global execution by founders outside the US. Key examples include Skype, Spotify and Minecraft from Europe, Alibaba, Tencent and Baidu from China, Infosys, Wipro and Tata from India in back office IT, among of course many more from other countries.

And this time, we’ve already seen the ‘insanely great’ execution by Chinese companies at scale globally, leveraging opportunities in mobile and increasingly AI driven technologies.

I’m talking of course about the global success of TikTok, a Bytedance subsidiary, and the additional success of Chinese companies like Shein and Temu of late in the US in the ecommerce realm. Those three companies’ apps, along with Capcut, another Bytedance subsidiary, and a maker of mobile online tools, have been among the most popular apps globally on App stores from ‘Everything App’ Apple and others.

While these companies and their services may be familiar, what’s of note is the incredible hard work their founders and executives put in at scale over a long time to get to this point of success. Despite the intense political headwinds of late. If of interest, I’d recommend this TikTok ‘origin story’ series by tech guru Eugene Wei in particular to understand the execution hurdles managed at scale. Similarly impressive is Shein’s origin story, along with this other piece provides some insight into what Shein has done of late. Not to forget of course Bytedance itself. Everyone deserving its own motion picture.

The point of these tales is that building businesses of any size is hard. Doing it with technology at scale, and then achieving success across borders is harder still. Then taking them through the decades of private and public incarnations, while traversing cyclical volatility in the media, politics and financial markets are daily gauntlets. When it ultimately happens at the scale of their businesses turning into a global verb or noun, it’s a miracle.

For in their wake were hundreds if not thousands of other failures. Founders, entrepreneurs, and employees leaving it all on the field when things didn’t work out. With of course financial losses by investors public and private. Generally forgotten.

But in countries like the US, and increasingly in places beyond, they have the chance to try anew, sometimes transcending their failures with success.

That’s the bottom up framework we should always be thinking about, while we gaze top-down the national pyramids led by our leaders and spot-lit daily by our media. Pyramids stand tall bottom up across the ages, built by entrepreneurial minions employing the technologies of the day. With of course aspirational capital by investors public and private. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)