Enterprise AI’s ‘Success Theater’: The week saw commentary by enterprise CEOs on their trials and deployment of LLM AIs and Agents in their various divisions, with the phrase ‘Success Theater’ emerging as a resonant theme. AI critics like Gary Marcus and others had further thoughts here of course. The road to both enterprise and consumer AI applications and services is likely to be slow but steady. And ongoing updates, positive and negative, are par for the course. In the meantime, Salesforce for example, is expanding its Compute Infrastructure investments for its Agentforce AI applications. The overall takeaway though is that corporate focus on AI applications and experimentations remains a large and growing one, More here.

Apple’s iPhone diversification to India from China: Apple launched its least expensive iPhone SE this week, filling out its product range. The wider story continues to be the company’s ongoing diversification of its iPhone production of over 230 million units annually from China to India. Already 15% of iPhones are assembled in India, with a target rate of 25% or more. The challenge remains scaling production in India with its partner Foxconn, as well as maintaining its relationships in China in as ‘stealthy’ a manager as possible. These moves are also notable for other companies trying to figure out their supply chain diversifications in light of ongoing US/China geopolitical negotiations. More here.

Google’s internal AI headwinds: Despite Google’s opportunities around AI, there remain internal organizational headwinds on Google’s execution around AI opportunities, according to recent reports. This despite AI Cloud success stories like Google Cloud (GCP) under CEO Tom Kuria I’ve discussed earlier and of course YouTube. Consequences include departures of innovative Google product leaders like its Notebook LM effort, for startup entrepreneurial efforts outside the company. The company remains focused on its Gemini AI efforts across its divisions like Sir Demis Hassabis led DeepMind, Google Search et al. But the coordination of these efforts around Alphabet/Google’s decades’ long culture, remains a headwind. More here.

OpenAI’s Software Coding implications for AI Reasoning: OpenAI continued to push ahead on its AI Reasoning and Agentic offerings like Deep Research and Operator, with an AI Software Coding product. The technical innovations driving that efforts are a useful template to understand for OpenAI’s overall roadmap to AGI. And its efforts to compete with open source global alternatives like DeepSeek. The innovations are around reinforcement learning (RL) techniques developed around sparse, ‘test time compute’ inference driven unsupervised learning, often using other, larger models (closed or open) for ‘distillation’ purposes to drive better, more relevant and accurate results. This continues to be a close innovation race with peers in the space. More here.

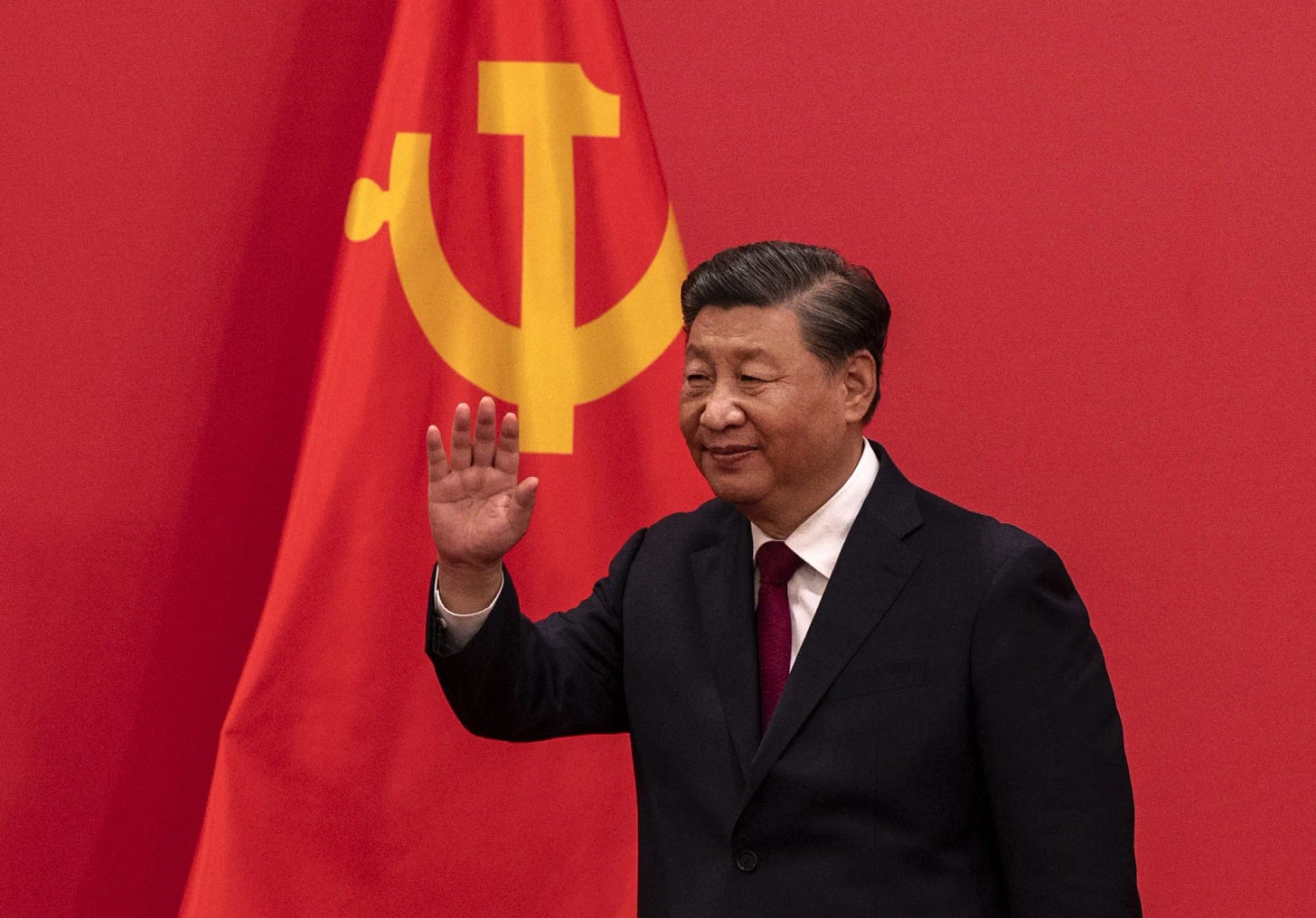

China’s Xi welcomes back China Tech: China’s Xi Jinping held a tech symposium in China significant for inviting a wide and deep range of China’s tech entrepreneurs, ranging from veteran Alibaba founder Jack Ma to DeepSeek founder Liang Wenfeng. WIth the founder of its leading auto/EV company BYD in the mix. The event was a notable softening of China’s top down clamp down on its globally successful tech companies and entrepreneurs, particularly given the resurgent focus by President Trump in the US to clear the path of US tech companies worldwide. So now both of the world’s top two economies are focused top down on lowering the headwinds for its tech companies, in light ot the AI space race underway. More here.

Other AI Readings for weekend:

Microsoft’s Majorana 1 ‘Quantum Computing’ milestone and AI implications. More here.

Alibaba of China commits to AGI race. More here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)