AI: Apple's 'Stealthy' iPhone footprint in India. RTZ #637

...Apple's iPhone production going from 15% to 25%+ in India vs China

India has a long flowing cascade of opportunities in this AI Tech Wave over the next ten plus years, as I’ve written about for a while now. From chips to iphones, from software outsourcing to AI outsourcing. India’s AI challenges and opportunities run the gamut. Including lessons from its TikTok ban three years ago, and the lessons for the US with its own upcoming TikTok ban.

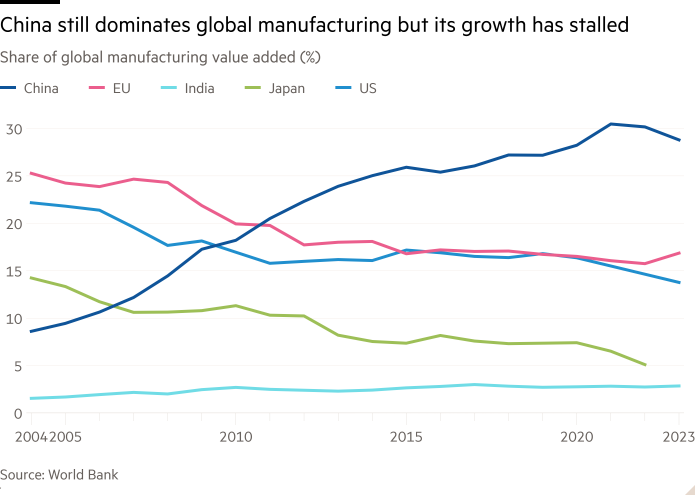

All in the shadow of the ongoing US/China ‘threading the needle’ geopolitical exercise. DeepSeek only being the latest example of opportunities and opportunity costs. All of which of course has accelerated US big tech partners investing in India amongst the ‘Mag 7s’, including AI stalwarts like Nvidia, and of course Apple.

The latter has been expanding its iPhone manufacturing footprint in India beyond China for years now. The current iPhone 16 has 15% of its production sourced in India.

The FT updates us on Apple’s challenges and opportunities in India with “Apple’s quiet pivot to India”:

“The iPhone maker wants to diversify its supply chain beyond China. Can the world’s largest democracy deliver?”

“As Donald Trump was preparing to take office for the first time in 2017, Priyank Kharge was busy making calls to Apple’s headquarters in Cupertino, California, from Bengaluru, the city known as India’s Silicon Valley.”

“With the US president threatening to unleash a wave of tariffs against China, Kharge, the information technology minister of the southern state of Karnataka, seized the opportunity to woo one of the world’s biggest companies. His mission was to convince Apple, whose manufacturing fortunes are prominently tied to China, to set up its first iPhone production plant in India.”

“The official touted Karnataka’s rich talent pool and sweeteners, such as tax breaks, that Apple could tap if it started making iPhones there. Other states, including Prime Minister Narendra Modi’s home state of Gujarat, were also courting the iPhone maker.”

“Eight years later, Apple’s Taiwanese supplier Foxconn and India’s Tata Electronics are now, or soon will be, manufacturing iPhones not only in Karnataka but also Tamil Nadu, India’s southernmost state.”

“Most significantly, Foxconn is producing Apple’s latest smartphone, the iPhone 16 Pro, an indication of how far its relationship with India has developed. For India, it is an important shift. Mobile phones have now surpassed diamonds as the country’s biggest product export.”

“And although only around 15 per cent of Apple’s iPhones are currently made in India, this is expected to increase to 25 per cent by 2027, according to JPMorgan and Bank of America analysts. Globally, the company shipped some 232mn iPhones in 2024, according to the International Data Corporation.”

“If you have an anchor firm like Apple coming in and placing . . . eggs in the India basket, that’s a positive sign,” says Konark Bhandari, a fellow with Carnegie India. “It’s a big signal to other companies that you can do business with some ease here — and also establishes a strong linkage with a downstream manufacturing firm, which wasn’t the case earlier.”

Secrecy abounds, due to the geopolitical and big business issues in the balance:

“For Apple’s chief executive Tim Cook, the geopolitics surrounding the shift are tricky. Apple — which is intensely secretive about its supply chain — needs to be wary of antagonising China, on which it still overwhelmingly depends.”

“Complicating matters further is the chilly relationship between Beijing and New Delhi. In a sign of the secrecy and political sensitivities, officials in Karnataka and Tamil Nadu refer to Apple even in private conversations as “the fruit company”.

“It’s very hard to build 35mn fewer phones in China and not be noticed — but they are doing it in the least public way possible,” says Wamsi Mohan, senior equity research analyst with Bank of America. Nevertheless, Apple’s growing business in India is viewed with suspicion in China. Beijing has recently hampered the movement of some Chinese technicians and capital goods into India, hitting Foxconn and other electronics producers, according to Indian and Chinese officials.”

And the recent political administration and congressional changes in the US matter as well, punctuated by the recent visit by Prime Minister Modi to Washington:

“The return of Trump to the White House, already firing salvos at China with a 10 per cent tariff on imports, underlines why Apple needs to diversify its supply chain and manufacturing, a business strategy known as China Plus One. The stakes of Apple’s relationship with India are also high for the Modi government, which is under pressure to create sorely needed jobs.”

“With unemployment hovering at about 10 per cent and millions of young people about to enter the labour force, the clock is ticking. Anger over the issue during last year’s election led to Modi’s Bharatiya Janata party being reduced to a minority for the first time in a decade and forced into a coalition. But if Apple is to put down deep roots in India, it will need a supply base there to rival its vast network in China.”

“The iPhones currently made in India are still largely assembled using flown-in parts. To become more ambitious and bolster Apple’s long-term presence, manufacturers of components will have to be lured to the country with similar revenue opportunities as those found in China. Other aspects of Apple’s success in China, notably a steady supply of mobile and trained female workers, is also proving challenging to replicate in India.”

“Apple does have keen and powerful partners: Tata, a leading flag-bearer of Indian business, is positioning itself as Apple’s first full-service supplier in India. But the 157-year-old group is a relative newcomer to electronics and will need to evolve quickly to make the partnership a success. Apple, Foxconn and Tata Electronics declined interview requests.”

“But the Financial Times spoke to current and former executives and employees at the company’s suppliers, Indian government officials, and analysts to piece together Apple’s growing footprint in India.”

“Apple will face a few key challenges, including finding suppliers with the expertise it needs and building the flexible workforce it has in China, with the ability to flex up and down by many tens and thousands of workers,” says Chris Miller, the author of Chip War.”

“It will also take time for relevant government authorities in India to figure out how Apple works and vice versa — and for both sides to develop the kind of conversations over regulatory issues that Apple has had in China.” From the moment it launched the iPhone in 2007, Apple bound itself to China. Henan province alone, the home of Apple’s largest iPhone manufacturing complex, exported around 53mn smartphones in 2024, according to Zhengzhou customs data.”

“That is roughly enough to supply America’s entire annual iPhone demand. But even before Trump’s return, the lucrative partnership was showing signs of stress. First came the Covid-19 pandemic, which disrupted logistics and put Apple’s supply chain in China under strain as the country maintained its “zero-Covid” policy. In April 2022, Apple warned it could lose up to $8bn in revenue for the quarter as China factories shut down.”

The whole piece is worth reading for the nuance of tactical and strategic difficulties of Apple putting down deeper manufacturing roots in India, diversifying away from China.

It’s happening relatively fast, but there are challenges to be scaled:

“But regardless of the progress made so far, India’s dream of getting more business from Apple still faces obstacles. Much of what Indians call iPhone production is still largely a screwdriver operation, involving the assembly of imported parts. Indian officials know that luring more suppliers is critical to Apple’s future in the country.”

“Some suppliers are starting to make the shift. Last year, US smartphone glassmaker Corning partnered with India’s Optiemus Infracom to build manufacturing facility Bharat Innovative Glass Technologies, known as BIG Tech, in Tamil Nadu, set to come online in the second half of this year. While Corning did not mention its future customers, officials in India tell the FT it will be supplying Apple.”

It took a long time, decades, to Apple to build its manufacturing footprint in China. It’ll take time for the transition to India. But for Apple, the opportunities in India are being looked at as the glass mostly to be filled, however long it takes:

“When asked about Apple’s plans for India on the company’s most recent earnings call, Cook simply noted that the business needed certain “economies of scale” to manufacture for both domestic and export markets. But he added that the Indian smartphone market showed ‘a lot of upside’.”

“On the ground, the signs of how far India has come are clear. Bank of America’s Mohan points specifically to the manufacturing of the iPhone 16 Pro: “The fact that India is now making Apple’s most advanced iPhone model is testament to the fact that they have been able to ramp successfully.”

And that is the big takeaway now in terms of India’s opportunity with US companies in this AI Tech Wave.

Making iPhones today is a global, multi-country task, as NYTimes’ Tom Friedman underlines citing useful sources like INET Oxford Executive Director Eric Beinhocker (a topic for another day).

But for now, making an iPhone at scale, a monumental task, is just getting started in India. And that is a process worth studying and watching. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)