AI: TSMC's 'long demand' for AI chips. RTZ #513

...semiconductors bifurcated between 'commodity' and AI related chips

Taiwan Semiconductor (TSMC), with its near trillion dollar market cap, has been discussed at length in these pages, as the critical base of this AI Tech Wave. It’s the single semiconductor factory (aka ‘Fabs’) that churn out over 70% of the chips that make our world run.

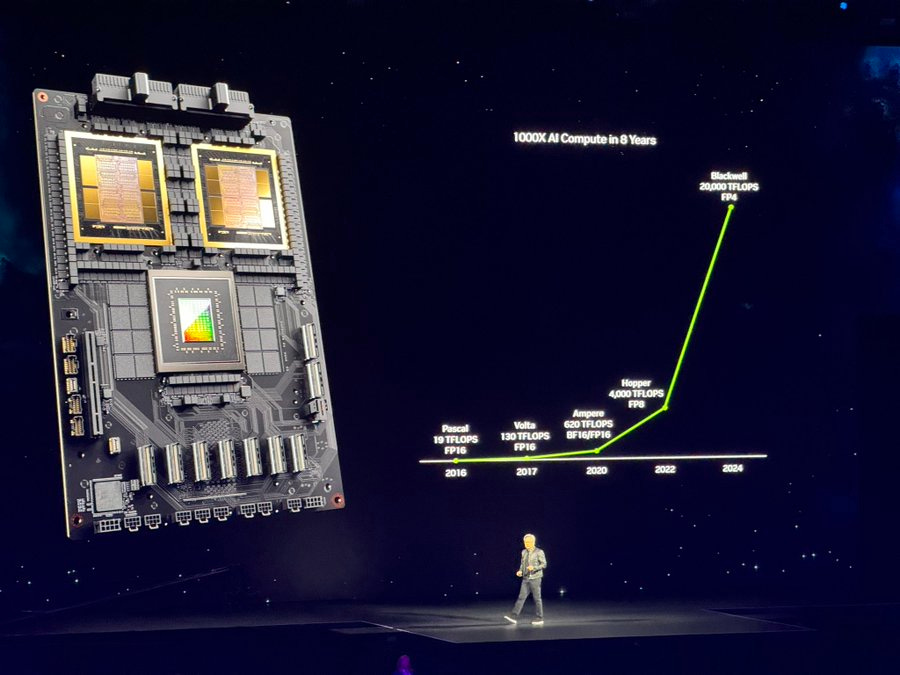

Including of course most the chips that go into our Apple and Google Android phones, and the ever critical AI GPU chips that make up the 80% share that Nvidia enjoys while cruising past $3 trillion in market value.

It’s the core company in Box 1 of the AI Tech Stack chart below.

And its location in Taiwan of course puts it at the center of the geopolitical tussle between the US and China. And their constant efforts to ‘thread the needle’ between national security and global trade via efficient supply chains, which are concurrently critical to both camps.

So it’s important to take note when TSM kicks off the earnings season going into the calendar fourth quarter, and take temperature of the ‘long demand’ for their products. As Bloomberg notes in “TSMC Hikes Revenue Outlook in Show of Confidence in AI Boom”:

“Taiwan Semiconductor Manufacturing Co. raised its target for 2024 revenue growth after quarterly results beat estimates, allaying concerns about global chip demand and the sustainability of an AI hardware boom.”

“The main chipmaker to Nvidia Corp. and Apple Inc. now expects sales to climb roughly 30% in US dollar terms this year, up from previous projections for about a mid-20% rise. That’s after TSMC reported better-than-predicted earnings for the September quarter. And it foresees capital expenditure rising in 2025 from roughly $30 billion this year.”

“TSMC’s outlook should help tamp down concerns that investors misjudged AI and semiconductor demand. Those fears crystallized after chip industry linchpin ASML Holding NV stunned markets by reporting about half the orders investors had expected. On Thursday, TSMC Chief Executive Officer C. C. Wei sought to dispel those doubts.”

Note that ASMl, the leading maker of chip making equipment in the Netherlands had weak results because of non-AI chip business dynamics, as Reuters explained:

“ASML closed 16% down after the Dutch company published results ahead of schedule in an apparent error, reporting weak bookings, lowering forecast, and indicating slower chip demand recovery outside the AI sector.”

“Despite the surge in demand for AI-related chips, the company reported that other segments of the semiconductor market remain weaker than expected, with logic chip makers delaying orders and memory chip makers only planning "limited" new capacity additions.”

Other chipmakers are seeins a similar AI vs non-AI chip demand mix issue as well:

“Samsung earlier this month warned its third-quarter profit would come in below market expectations, as it is struggling to capitalize on demand for artificial intelligence chips. In contrast, Samsung's rival, TSMC, which counts AI leader Nvidia as one of its major customers, is expected to report a 40% leap in third-quarter profit on Thursday.”

Which of course brings us back to TSMC’s solid quarterly results at the head of this piece.

The overall point of course is that the chip industry is of course bifurcated for now, with traditional ‘commodity’ dynamics in regular semiconductor segments, offset in places by the ‘long demand’ that is almost secular in nature for AI chips and infrastructure for the next 2-3 years at least.

And that of course is driving the multi-hundred billion dollar ‘AI Table Stakes’ capex investments I’ve written at length about, forging short-term supply issues in AI data centers, Power, and of course AI talent.

But it starts and ends with the chips. And for now, TSMC, Nvidia, and others continue to see secular AI chip tail winds for the intermediate term in this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)