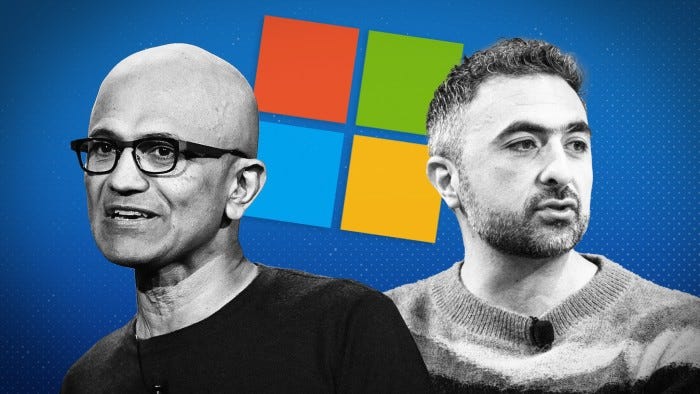

AI: OpenAI and Microsoft's 'friendly competition'. RTZ #401

...aligning rapidly shifting interests while scaling AI

Just a little friendly competition, is likely the best way to describe the competitive dance between OpenAI and Microsoft. Almost a year ago, in a piece titled “Takes two to Tango…OpenAI and Microsoft’s AI Dance”, I highlighted:

“The unusual deal between OpenAI and Microsoft is not without its growing pains, and continuing efforts to find alignments”.

While both sides have benefited tremendously from their partnership, these challenges of working together across two large organizations, and in many cases go after the same large consumer and enterprise markets, is going to find varying degrees of success in areas where there is a competitive overlap.

This was highlighted by the Information today in a piece titled “In a surprise, OpenAI is selling more of its AI models than Microsoft”:

“When Microsoft formed an alliance in 2019 with OpenAI to resell the startup’s artificial intelligence, it brought the reputation, connections and sales muscle to the table that seemed key for winning deals with large customers. Turns out OpenAI itself has gotten pretty good at cutting those deals.”

“The revenue that the startup—best known for its ChatGPT chatbot—makes from selling access to AI models such as GPT-4 now exceeds what Microsoft makes from an equivalent business. It’s a remarkable achievement for OpenAI, which barely had a salesforce until the middle of last year and seemed to be at a serious sales disadvantage to Microsoft, the world’s biggest seller of enterprise and cloud software.”

“OpenAI pulled off the feat with simple tactics: promising customers early access to new versions of conversational AI, and helping its largest customers tailor the software to their needs. That’s helped it counter Microsoft’s powerful discounts for customers that bundle services.”

I’ve described Microsoft’s formidable institutional advantages in bundling its various software offerings, now with Copilot AI powered services.

“As of March, OpenAI was generating around $1 billion in annualized revenue from selling access to its models, according to someone who viewed internal figures related to the business. The annualized revenue rate refers to the prior month’s revenue multiplied by 12. In contrast, Microsoft’s comparable offering, Azure OpenAI Service, only recently hit $1 billion in ARR, OpenAI CEO Sam Altman told his staff this month.”

“Friendly Rivalry”

“The new revenue figures also show how the unusual partnership between the two companies could be tested by the rising competition. For now, the rivalry appears to be mostly friendly, and the two have been planning giant supercomputers that are years away.”

“Microsoft’s stock has nearly doubled based on expectations of growth from products like the Azure OpenAI service and Copilot, a suite of AI features for software coders and Office 365 customers that relies on OpenAI technology. But OpenAI is now a formidable competitor in both product categories.”

“In the long run, though, Microsoft stands to gain from OpenAI’s success in other ways. Microsoft can use OpenAI’s technology in perpetuity for its own products. And after OpenAI pays back its first investors, Microsoft will get 75% of OpenAI’s profits until its principal investment—$13 billion—is paid back, and 49% after that until it hits a theoretical cap. The cap could soon rise, too.”

As the Information highlights in a separate piece by Stephanie Palazzolo:

“We repeatedly heard two questions following our report on OpenAI’s staggering revenue growth earlier this month: What percentage of revenue comes from ChatGPT subscriptions versus OpenAI’s application programming interface, through which app developers can access its models? And what are OpenAI’s computing costs?”

“This morning’s in-depth piece from Aaron brings us closer to answering both.”

“Subscriptions to ChatGPT are the majority of OpenAI’s revenue by quite a margin—but its API business seems to be catching on fast. As of March, OpenAI’s annualized revenue from its API had reached $1 billion, triple from where it was in mid-2023, a significant chunk of OpenAI’s $3.4 billion overall annualized revenue.”

“That growth was fast enough, in fact, that the business appears to have surpassed Microsoft’s competing API, Azure OpenAI Service, which only recently hit $1 billion in annualized revenue. Despite all the distribution advantages Microsoft enjoys, OpenAI is showing that it can hold its own with potential customers by promising ease-of-use and early access to new models.”

“(In case you’re wondering why both companies sell the same OpenAI models to developers, the piece explains that too.)”

The two narratives above highlight the ongoing concurrent trends of close partnership AND cut-throat competitiveness by two of the iconic partners in this AI Tech Wave. Microsoft’s integration of AI company Inflection, and launching its own LLM AI models large and small, is a case in point.

It’s something that is par for the course when the largest companies are engaged in unprecedented levels of ‘Frenemy’ driven interactions.

Nvidia competing with its core customers long term, while short term, they account for almost half of its stratospheric revenues and financial growth over the last year and into the next two at least, is another case in point.

For now there is room both for alignment and mis-alignment, while the AI markets grow from a very nascent base.

Schrodinger’s cat both alive and dead, depending on when and where one looks.

A little friendly competition. We’ve seen this before in prior cycles, but the scale of this perplexing reality at this time of AI Scaling in this AI Tech Wave is truly unprecedented. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

It would be interesting to know revenue attribution for both Open AI’s API business and Azure’s AI services. I would expect more tech savvy businesses to directly use Open AI apis unless they hit the Product market fit and are looking to Scale up their services. At that time, Seamless integration will be the key and Cloud providers will see a meteoric rise in their AI service revenues as more & more business enterprises ( usually less Tech savvy ), of all sizes from small to fortune 100, starts integrating these LLMs in their BAUs