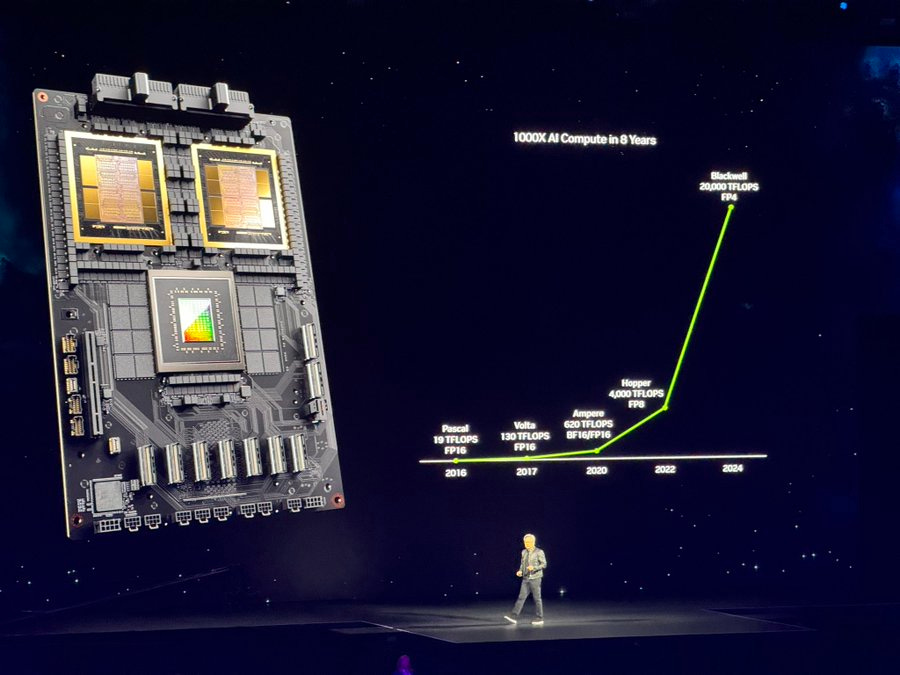

Well, Nvidia did as expected on their long-awaited tech results, and yes, they still reigns this AI Tech Wave as the supplier of over 90% of AI chip infrastructure. And they’re likely to have the secular demand for their AI GPU chips and data center infrastructure for at least next couple of years. If not longer as they execute on their ‘Accelerated Computing’, and build on their AI software moat as I outlined a few days ago. Founder/CEO Jensen Huang and team continue to execute.

First, let’s go through the highlights of their quarterly results. As the WSJ outlines in “Nvidia Reports Strong Quarter Amid Investor Jitters Over AI Boom’s Staying Power”

“AI chip giant gives bullish outlook despite recent challenges, though stock slips on complications with company’s newest product.”

“Nvidia’s sales and earnings more than doubled in the company’s most recent quarter, showcasing the momentum of the nearly two-year-old AI boom despite concern that investment has surged ahead too quickly.”

“The company also said Wednesday that gross profit margins narrowed in the quarter compared with the period that ended in April. Chief Financial Officer Colette Kress pinned the blame partly on production issues with Nvidia’s next-generation Blackwell chips that required a design tweak. The company, however, said that production will ramp up as expected and that demand is strong.”

“The overall results, while still robust, highlighted challenges from the increased complexity of Nvidia’s newest products, and showed its growth slowing from the supercharged clip over the past year.”

“Investors responded by sending the company’s shares down more than 6% in after-hours trading. Through Wednesday’s close, the shares had gained more than 150% this year alone, pushing Nvidia’s valuation above $3 trillion and making it the second-largest listed company in the world, behind Apple.”

The better than expected news in the quarter was the company apparently fixing the glitches in their next generation Blackwell AI chips and products:

“It recently informed customers of a monthslong delay in their rollout, although the company is still expecting to produce them in large quantities in the coming months.”

“Nvidia said Wednesday it made a change to Blackwell’s design to improve the quality of the chips’ manufacturing. The company booked provisions of $908 million in its latest quarter related primarily to the issues with Blackwell manufacturing, according to a securities filing”.

As expected, investors are now increasingly focused on how long the demand for Nvidia AI infrastructure will be sustained vs the AI applications and services could eventually pay the bills:

“Analysts on an earnings call peppered Nvidia executives with questions about the sustainability and returns of the tech industry’s massive investments in its chips and the other infrastructure that powers new generative artificial-intelligence systems.”

“Chief Executive Officer Jensen Huang tried to allay those jitters, pointing to new opportunities that generative AI is providing for large companies and startups. “There’s just so many different directions that generative AI is going, and so we’re actually seeing the momentum of generative AI accelerating,” he said.”

It’s a topic I’ve discussed at length, with the view that there is always a lag between capex investments in prior tech waves, vs the eventual plethora of applications and services that pay the bills.

The day to day volatility in the stock after 150% of appreciation this year is par for the course. The core message to take away for now with Nvidia ending this quarter’s big tech earning season, is that AI infrastructure roadmap momentum continues unabated as we move into the fall. Lot more AI developments ahead. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)