AI: Masa Son bets on AI Power & Chips. RTZ #408

...Softbank leans in on tech wave infrastructure again

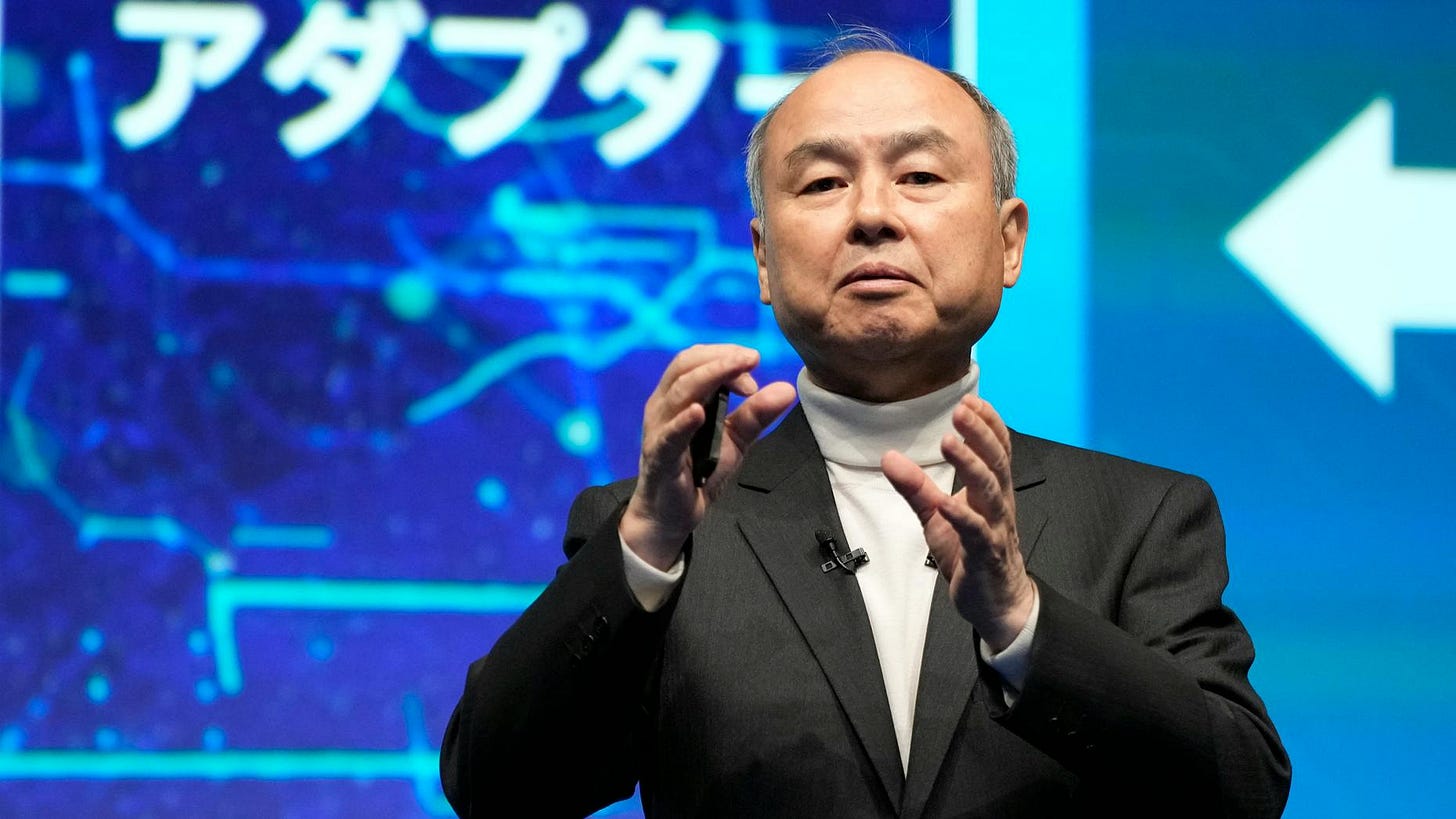

Softbank Founder/CEO Masayoshi Son is one of the iconic investors of previous technology waves, from the PC, to the Internet and beyond over the decades. Up, down and sideways, he has cast a long positive shadow over various technology and financial driven trends around tech investing. And now he’s learning into AI power and chips, an area recognized for a long-term need for investment.

I’ve had the opportunity to interact with Masa Son professionally on early internet companies back in the mid-1990s, and it’s been remarkable to watch his investment zig zags over the decades.

And I’ve noted his aspirations to ramp up in this current AI Tech Wave over the last couple of years since OpenAI’s ‘ChatGPT moment’ in November 2022.

He’s had strong tail winds from the IPO of ARM Holdings, a leading semiconductor company powering the AI platforms of companies like Apple, Qualcomm and many others. He owns 90% plus of that global company since it’s successful public debut last year. And that’s giving Masa Son additional resources for next steps in AI.

As the Information notes, “SoftBank’s $10 Billion-Plus Plan to Get Into the AI Race Centers on Power and Chips”:

“The next phase of SoftBank CEO Masayoshi Son’s plan to make the company a leader in artificial intelligence is coming into focus. And it is complicated—and potentially costly.”

“SoftBank has recently talked with banks about borrowing money to fund investment of up to $10 billion in energy-related projects, where AI is driving an enormous increase in demand, according to a person with direct knowledge of the discussions. SoftBank also is exploring ways to gain access to a large volume of Nvidia’s graphics processing units, which are critical for AI development, the person said.”

“Under one arrangement the company is considering, it would set up a special purpose company to buy the chips with money borrowed from banks. That company would in turn lease the chips to SoftBank, according to the person. Structuring a loan that way would ensure that SoftBank could keep the debt off its balance sheet.”

“Those previously unreported discussions show how SoftBank, one of the world’s largest tech investors, wants to increase its exposure to the infrastructure most critical for AI development.”

“Son is less focused on generative AI startup investments and has mostly sat out the wave of startup fundraisings in the past year or so.”

But Masa Son is focusing on the foundational parts of the AI Tech Wave stack I’ve discussed at length, especially Boxes 1 and 2 below, Power and Chips.

“SoftBank’s growing interest in energy, including potential breakthroughs in areas such as solar and nuclear technologies, reflects a growing view that securing enough power for data centers is becoming just as difficult as getting enough AI chips. LLM processing uses immense amounts of power, prompting tech companies to look far afield at new sources of energy, including nuclear power plants.”

“While the progress in chips and data centers accelerates advancements in AI, “one of the biggest bottlenecks will be power,” Son said during the company’s shareholder meeting last month in Tokyo. He added that innovations in areas such as renewable energy and nuclear fusion could offer new sources of power.”

Nuclear power for AI data centers is a subject I discussed just yesterday, and is a foundational block for AI data centers in the US, Europe, Asia, and especially China.

Masa Son has long focused on the foundational infrastructure reinventions of previous tech waves. His early investment in the broadband wired and wireless networks in Japan via Vodaphone, was an illustrative case in point.

So it’s logical that he would focus on the same part of the AI Tech Wave stack this time around. True long-term investing in its toughest form. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)