AI: Google executing better than expected in 'AI race'. RTZ #526

...not as behind and 'challenged' by AI as assumed

I’ve been arguing for some time now in this AI Tech Wave, that Google Gemini’s ‘AI powered Search’ will more than prevail vs ‘AI Search’ competitors like OpenAI, Perplexity, and more recently Meta and others.

Powered in particular by Google’s Cloud business, which has been ramping up its AI Compute capabilities vs bigger rivals like Amazon AWS, Microsoft Azure and others.

Well, as the Q4 earnings season kicks off this week with Google leading the pack. Google seems to be more than holding its own on these fronts. Bloomberg explains in “Alphabet’s Pricey AI Bet Pays Off With Cloud, Search Growth”:

“Google has reduced the cost of AI answers in search queries. AI expertise is helping draw cloud customers, CEO Pichai says”

“Google parent Alphabet Inc. is showing an expensive foray into artificial intelligence is starting to pay off, delivering better-than-expected sales for its cloud-computing business and driving more usage of its flagship search engine.”

“Revenue, excluding partner payouts, jumped 16% to $74.6 billion from a year ago, the company said in a statement Tuesday, surpassing analysts’ estimates. Third-quarter net income of $2.12 per share also far exceeded projections.”

Most importantly, the company seems to be addressing the principal concern of investors ever since OpenAI kicked off the AI Infrastructure ‘Gold Rush’ almost two years ago: that AI Search will dent Google Search, for the long-term.

“The strong beats worked to allay investor concerns that the company had squandered an early lead in AI and that its massive investments to catch up to the likes of Microsoft Corp. and OpenAI may fail to deliver.”

Even as the positive results were being couched grudgingly:

“As its main search business matures, Google is betting on growth from its cloud division, which supplies computing power, software and services to other companies. Google is drawing more cloud customers using its AI expertise to gain ground on larger rivals Amazon.com Inc. and Microsoft, making inroads by signing on fast-growing AI startups — some of which were founded by former Googlers — as clients.”

“In cloud, our AI solutions are helping drive deeper product adoption with existing customers, attract new customers and win larger deals,” Alphabet Chief Executive Officer Sundar Pichai said in the statement.”

The markets for now reacted positively:

“Alphabet shares rose 6.9% as the markets opened in New York on Wednesday, the most since April. The stock had gained 21% this year through Tuesday’s close.”

In particular, the company addressed investor concerns around AI head-on:

“Google is making progress in addressing investor concerns about the billions it spends on AI infrastructure and research. Pichai said on a conference call with investors after the report that Google reduced the cost of producing AI answers in search queries by over 90% in 18 months, “through hardware, engineering, and technical breakthroughs,” while doubling the size of Gemini, the generative artificial intelligence model powering the answers.”

And explained how it was committed in the AI data center and AI power race vs Microsoft, Amazon and others, as I’ve discussed before:

“The company is also investing heavily in new forms of power, including nuclear, to handle the future load of AI’s progress, Pichai said. And it’s leaning on the technology to help it work more efficiently: More than a quarter of Alphabet’s new computer code is written by AI, Pichai said.”

All this goes on of course against the regulatory headwinds in front of Google:

“While Google builds its prominence in the AI industry, the US government is evaluating its major successes — search and digital advertising — for antitrust harm. In August, a US judge declared Google’s search business an illegal monopoly. The Justice Department and a group of states also allege that Google has monopolized the market for advertising technology tools used by websites and advertisers to buy and sell online display ads.”

“On the earnings call with investors, Pichai warned that the US government’s resolution of the antitrust cases could have “unintended consequences” for US leadership in tech.”

The one startling AI metric cited by Google CEO Sundar Pichai was the following:

“Today, more than a quarter of all new code at Google is generated by AI, then reviewed and accepted by engineers."

— Google CEO Sundar Pichai, speaking on Tuesday's earnings conference call.”

It doesn’t mean Google and other companies will need fewer programmers necessarily. But that AI is fundamentally boosting the productivity with those engineers. And it shows across Google’s businesses.

And of course it’s a trend also being focused on by peers like Microsoft and others around AI tools for engineers and developers.

There are some other useful analyses of Google’s results and prospects I’d recommend to those looking for more context. Including deeper dives into important Google businesses like YouTube.

As Stratechtery explains, Alphabet/Google CEO Sundar Pichai provided some details about the scope of YouTube’s business:

“Moving now to YouTube. For the first time ever, YouTube’s combined ad and subscription revenue over the past four quarters has surpassed $50 billion. Together, YouTube TV, NFL Sunday Ticket and YouTube Music Premium are driving subscription growth for the platform. And we are leaning into the living room experience with multi-view and a new option for creators to organize content into episodes and seasons, similar to traditional TV. At Made on YouTube, we announced that Google DeepMind’s most capable model for video generation VO is coming to YouTube Shorts to help creators later this year.”

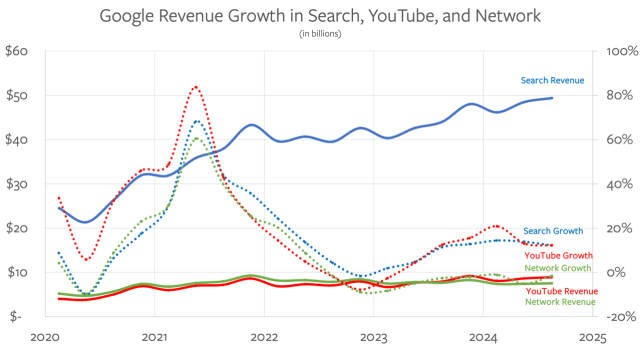

“That noted, now that we have that $50 billion number, it’s pretty interesting. First, YouTube ad revenue over the past 4 quarters was $34.9 billion; that means YouTube subscription revenue was $15.1 billion. Second, the last time Google disclosed total YouTube revenue was Q2 2023 when the service hit $40 billion total revenue; at that time ad revenue was $29.1 billion, and subscription revenue was $10.9 billion. That means that subscriptions are growing faster than ads; this chart is from MoffettNathanson:”

“Just to put these numbers in context, Netflix revenue over the last 12 months is $37.6 billion. That means that not only does YouTube have 33% more revenue than Netflix, but it has nearly half as much subscription revenue as well.”

So a business bigger than Netflix fits into Alphabet/Google in the YouTube bucket. And YouTube video as I’ve noted before, is a big source of training and other AI data/content for Google’s next generations of Gemini AI models.

But the broader picture is that Google in this AI Tech Wave, is truly in AI with proactive plans to more than hold its own. To build AI powered Search, Cloud, and a whole range of other businesses.

And we haven’t even gone into in depth how Google can use AI to boost its industry leading Ads business, just as Meta is laser-focused on doing as the industry #2 in online ad businesses.

With Nobel prize winner Sir Demis Hassabis leading the company’s AI research and commercialization efforts.

It’s early days in the AI Tech Wave, and there are many, many quarters to go. But as I said in my Google call last August:

“It’s worth repeating that Google isn’t coasting on the flywheel of their incumbency. They’re hard at work on new stuff.”

Google is not resting on its laurels. Even as worth competitors like OpenAI, Perplexity and others are innovating around AI in impressive ways. Google for now is moving faster for the AI opportunities, despite their perceived ‘late start’. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)