AI: Enterprise Search, the other 'AI Search' Opportunity. RTZ #540

...Glean with an early lead vs industry leaders

Since OpenAI’s ChatGPT moment two years ago this November 30th, investors have been laser-focused on the implications of AI for Google’s world-leading consumer search business. And I’ve outlined my reasoning why Google with Gemini AI LLM technologies, should be able to hold its own as a Search leader.

Despite strong efforts by OpenAI, Microsoft, Perplexity, Meta, xAI and many others to compete in the all important Search market. But the other area where Search is also important is the Enterprise. And AI also has a role to play there in this AI Tech Wave, both via incumbents and AI startups.

The Information has a timely piece on this segment with “The Enterprise Search App That Got Google and OpenAI’s Attention”:

“ChatGPT changed how people search for information online, sparking a battle among tech giants. Now Glean, a five-year-old startup led by a former Google search engineer, is attracting big rivals in a related market: search chatbots for businesses.”

“These products, which are powered by the same technology that’s behind ChatGPT, help employees find information within their company to fix software bugs, improve sales pitches and analyze financial performance, among other tasks.”

“In the budding market for business-search chatbots, Glean has gotten the attention of ChatGPT creator OpenAI, Google, Snowflake and Cohere—and is inspiring them to launch rival products.”

A TALE OF TWO ‘ARVINDS’:

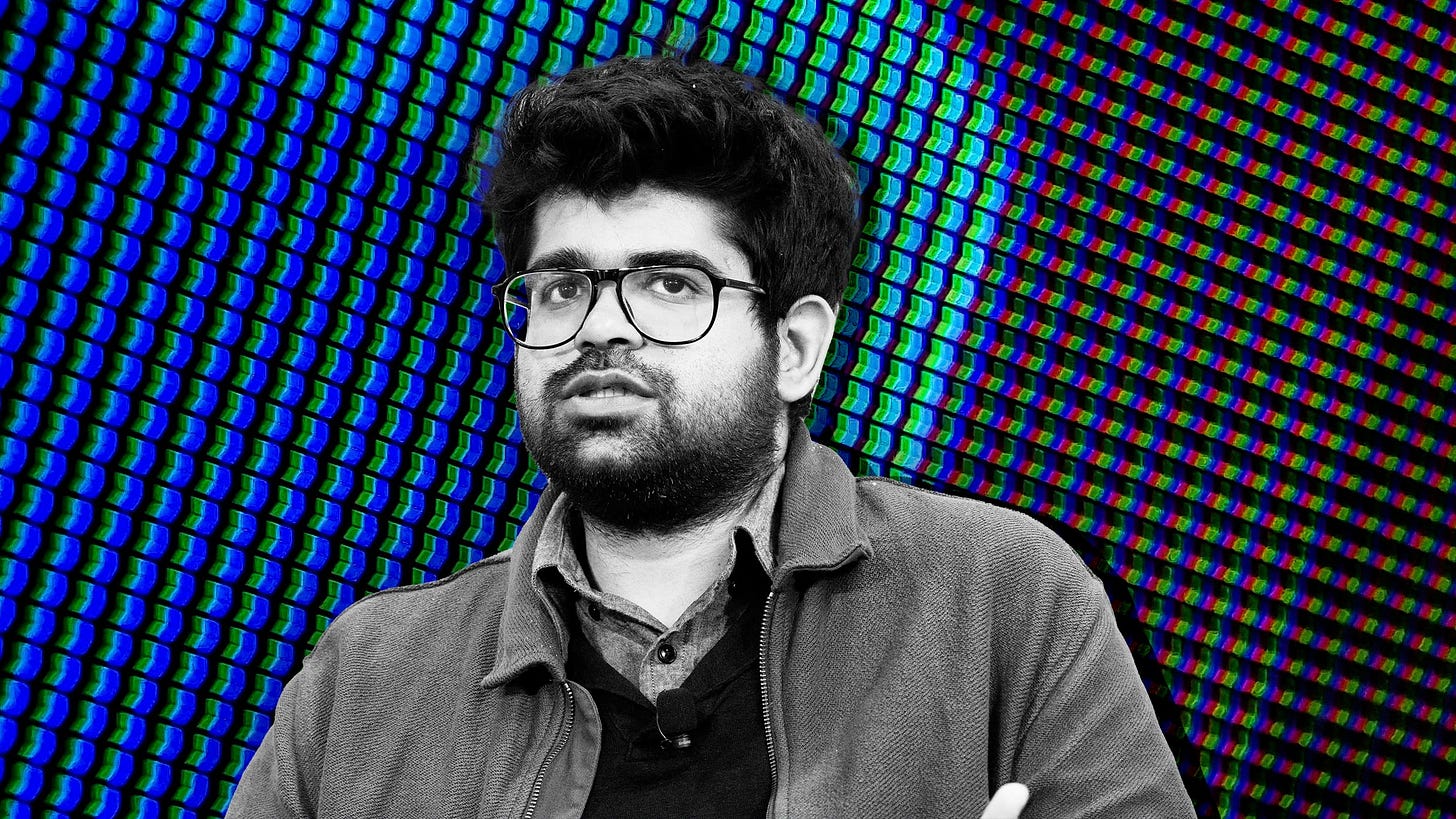

Just like Perplexity has done on the consumer AI Search side with founder/CEO Aravind Srinivas (also an ex-Googler), Glean under founder/CEO Arvind Jain has done something similar in the enterprise space. Similar first names of course an utter coincidence.

“Arvind Jain, Glean’s CEO and one of its co-founders, said he was inspired to launch the startup because as a Google engineer, and later as a co-founder at data management firm Rubrik, he found it difficult to search for internal documents or get answers to questions such as which employees were working on a particular project and which customers needed a specific product feature.”

“The key to Glean’s product is connectors, a type of software the startup popularized, which collects and organizes a corporate customer’s data from the dozens or hundreds of applications and databases in which the information is stored. Connectors also analyze the relative importance of data or documents based on how often they are accessed. The idea is similar to how Google’s search engine crawls, indexes and ranks websites so people can quickly find authoritative information or links to sites.”

And competitors are noticing:

“Google, for instance, is preparing to launch a new version of the enterprise search service it sells to cloud customers that will be similar to Glean’s, according to two people who have used a preview of the software.”

“Employees at OpenAI—whose AI models businesses are using to develop their own search tools—have been working on technology that could help ChatGPT compete more directly with Glean, said a person with knowledge of the situation. And Cohere, another generative AI firm, is also developing a Glean-like search product, according to an employee with knowledge of it.”

“Enterprise software firms Snowflake and Dropbox also each recently launched products that resemble Glean’s. Spokespeople for Google, OpenAI and Cohere didn’t have a comment on their upcoming products, which haven’t previously been reported.”

The whole piece is worth reading for the details on how this market for AI driven Enterprise Search is evolving, in particular with Glean’s focus on enterprise priorities with their own Data:

“Glean’s growth suggests that business-search chatbots are becoming an important application of generative AI.”

“And Glean’s connector technology also has been key to its popularity, he said, because it is compatible with more than 100 different apps and databases many businesses use. Businesses that develop search tools with OpenAI models have to do more work to achieve the same result, he said.”

“Glean’s business started to take off in the summer of 2023 as more companies began adopting LLMs, said a person who worked there at the time. Around that time, Glean incorporated RAG, which helps chatbots answer questions about specific data or documents that weren’t part of the data on which they were trained.”

“Glean’s customers now include technology firms Databricks, Confluent, Pinterest and Instacart.”

Glean is yet another example of how opportunities abound up and down the AI Tech Stack above, especially in the all important Box 6. Early mover advantages count for a lot in tech, and Glean for now has it along with the attention of its peers. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)

how does this effect companies like elastic?

Where does data liquidity fit in your puzzle across the market? For example, for some the value may not be in the models they can build for others or themselves, but the data they can provide to the market to build better models. Is data an underutilized/undermonetized/undervalued asset sitting on the "balance sheets" of companies?