AI: A legal dent on the power of defaults. RTZ #440

...judicial ruling on Google/Apple search distribution deal, has 'ripple' implications for AI defaults and data

The series of regulatory actions on the ‘Magnificent 7’ big tech drew first blood, amid a day of broader market volatility. And it potentially has broader implications for the AI Tech Wave. Especially since the case establishes precedent in the ‘powers of default’, and the role of Data in today’s technology ecosystems.

As background to how we got here, Ben Thompson of Stratechery has a good piece on how antitrust laws in the US have evolved from the Sherman Antitrust Act of 1890 and its use against Standard Oil, to Google today. Worth a read on the ripples of American politics, commerce, and markets from there to here.

But first, the basics for today’s discussions. As Bloomberg reports, “Google loses Antitrust Suit over Search Deals on Phones”:

“A federal judge on Monday ruled that Google has illegally monopolized the search market, handing the government an epic win in its first major antitrust case against a tech giant in more than two decades.”

“Judge Amit Mehta in Washington said that the Alphabet Inc. unit’s $26 billion in payments to make its search engine the default option on smartphones and web browsers effectively blocked any other competitor from succeeding in the market.”

“Google’s distribution agreements foreclose a substantial portion of the general search services market and impair rivals’ opportunities to compete,” Mehta said in a 286-page ruling.”

“By monopolizing distribution on phones and browsers, Google has been able to consistently raise the prices of online advertising without consequences, Mehta said.”

“The trial evidence firmly established that Google’s monopoly power, maintained by the exclusive distribution agreements, has enabled Google to increase text ads prices without any meaningful competitive constraint,” he wrote.”

“Alphabet shares slipped 4.5% to $159.13 as of 3:50 p.m. in New York. Apple Inc., which depending on the remedy could stand to lose billions in payments Google makes to have its search engine be the default browser on iPhones, fell 5.8% to $207.14.”

“Antitrust enforcers alleged that Google has illegally maintained a monopoly over online search and related advertising. The government said that Google has paid Apple, Samsung Electronics Co. and others billions over decades for prime placement on smartphones and web browsers. This default position has allowed Google to build up the most-used search engine in the world, and fueled more than $300 billion in annual revenue largely generated by search ads.”

There was a ‘glass half full’ part of the ruling for Google, on the market for Search:

“Mehta found that Google doesn’t have a monopoly in the market for general search advertising, noting that competitors like Amazon.com Inc., Walmart Inc. and other retailers have begun to offer advertising related to searches on their own websites. But Google does have a monopoly over search text ads, which appear at the top of a search results page to draw users to websites, he said.”

“Mehta’s decision focuses solely on Google’s liability, nine months after the Justice Department and a group of states held a 10-week trial in federal court. He plans to hold a separate trial on what remedy to impose at a later date.”

“The Justice Department hasn’t yet said what changes it will seek, though it presented evidence that efforts by European regulators to require Google to offer users a choice of search engines led few to switch. The agency could demand the separation of Alphabet’s search business from other products, like Android or Chrome, which would mark the biggest forced breakup of a US company since AT&T was dismantled in 1984.”

“Antitrust enforcers separately sued Google for allegedly monopolizing the technology used to buy, sell and serve display advertising online. In that case, which is set for trial in Virginia federal court next month, the government is seeking to force Google to sell off some of its advertising technology products.”

Of course Alphabet/Google has appeals and this ruling will likely wind down a long road, with repercussions for both Google and Apple unclear for years. As WSJ outlines in its version of the ruling story:

“[The Judge] Mehta is now expected to consider what remedies to impose on Google to restore competition. That process could involve more court hearings over several months.”

“Google’s appeal could mean it will be years until the case is finally resolved, either via a settlement or a final judgment by the courts.”

“Google is expected to appeal, and additional years of litigation could be ahead.”

But the die has been cast on similar deals on the AI front, and particularly on the AI powered Search front for Google and others. This is a hotly contested new area as I’ve discussed already, with OpenAI releasing ‘SearchGPT’, and Google of course rolling out its Gemini AI powered Search Overviews.

Apple has already decided to go a different way with external LLM AI services as part of its ‘Apple Intelligence’ strategy, as I’ve discussed in an earlier piece. This potentially opens up a different pathway for Apple than the payment for Search default’ approach that has served it so well to date.

As the New York Times explains in its piece on the ruling, this case is really about the ‘power of defaults’, and the role of Data in past and future tech wave ecosystems:

“Nearly a quarter-century after Microsoft lost a similar case, a judge’s decision that Google abused a monopoly in internet search is likely to have major ripple effects.”

“Judge Mehta praised the company for its engineering skill and investment in search. “But Google,” he wrote, “has a major, largely unseen advantage over its rivals: default distribution.”

“Google’s multibillion-dollar default deals ensured that the company had a huge data advantage in search, the government claimed. It also presented studies in behavioral economics that concluded people rarely switched from the automatic settings, even if doing so was not a daunting technical task. Consumer behavior was not forced but strongly steered by the power of defaults.”

“In his ruling, Judge Mehta pointed to “the power of defaults.” He cited and agreed with an expert witness for the government, Antonio Rangel, a professor of neuroscience, behavioral biology and economics at Caltech, who testified that the “vast majority” of searches were done by habit.”

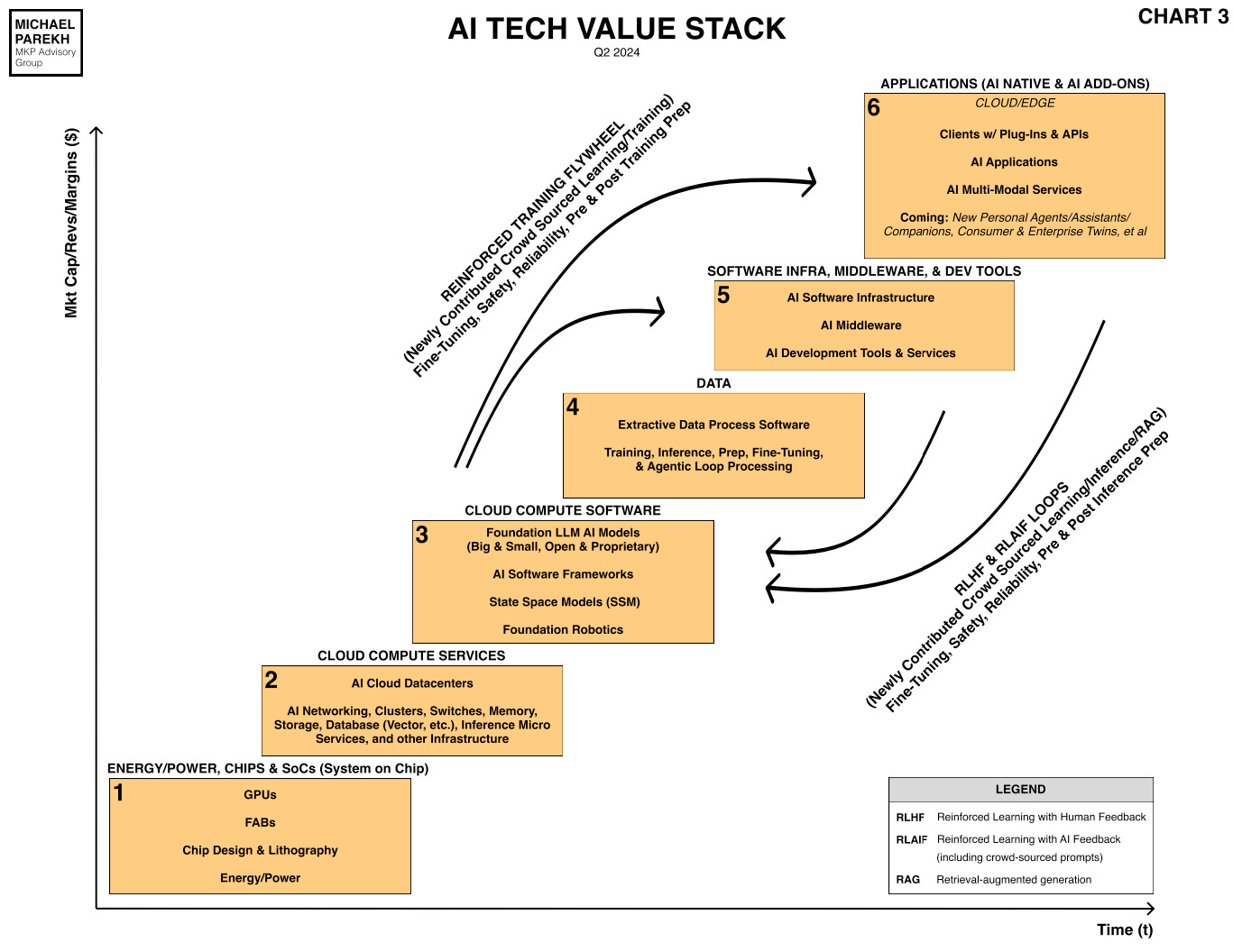

Besides default impacts on user habit, the other core differentiator is of course the role of Data, which is an even bigger driver of AI products and service results going forward. It’s something that I’ve discussed in detail, a key item in this AI Tech Wave’s Box 4 below.

Data played a key role in this ruling as well.

“In the Google case, data was described as a vital asset. The more user queries that flow through a search engine, the more data that is collected and then harnessed to improve search results, attracting still more users and generating more data.”

“At every stage of the search process,” Judge Mehta wrote, “user data is a critical input that directly improves quality.”

It’s fair to say that this AI Tech Wave is likely to see a different set of arrangements, and indeed different approaches to providing ‘defaults’ for AI products and services. But defaults and habits will play a key role here too as in the past, and legal precedents often have unexpected ripples going forward.

This ruling only nudges them in a somewhat different direction than prior waves. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)